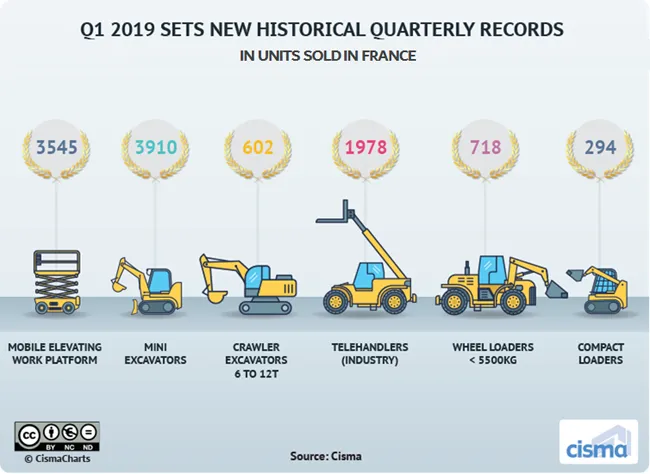

In the first quarter of 2019 six new records were set.

Compared with Q1 2018, the market is up 10%. This performance can be explained by the rise in sales to rental companies of nearly 13%, notes CISMA.

The mobile elevating work platform sales reached a peak of 3,545 units in the quarter – highest ever, beating the previously best years of 2000-2001 and 2007-2008.

Sales of compact earthmoving equipment increased by 14% overall compared to the same period a year ago. This performance can be explained by the strength of sales to rental companies (+32%) but also by the good performance of sales to other businesses, excluding rental – this was up 4%.

The mini crawler excavators rose by just over 10% with 3,910 units sold. Sales of crawler excavators from 6-12tonnes saw a significant growth of 18%. Wheel loaders of 5500kg and under rose by 23%. Sales of compact loaders jumped by 59% in Q1 this year compared to Q1 2018.

Sales of telehandlers sales for construction and industry grew overall by 42% compared to the first quarter of 2018. Sales to rental companies rose sharply.

Reasons for the rise appear to be the continually improving French civil engineering sector is still improving with the Greater Paris project among the work that is boosting the market. Activity is driven by local government investment spending, private investment and ongoing infrastructure projects. Among these are the French high-speed broadband plan and the French motorway plan.

The current activity in the building sector remains also strong. The level of order bookings is high, and is currently estimated to be at around six and a half months.

Above all, renters remain very active and explain a significant part of the performance observed in the first quarter.

However, it should be noted that the “fiscal measure of exceptional deduction” whereby companies can claim exceptional depreciation of capital goods (asserts) against taxes to be paid ended in April.

CISMA is a Paris-based trade association for companies in France that produce and sell equipment for construction as well as the steel industry and handling sector. It also includes component suppliers. CISMA represents the interests of its 200 members - SME, SMI and subsidiaries of international groups - that employ around 31,000 people in France. These businesses export 58% of their production and generate nearly €9 billion in annual revenue.