After a sluggish performance over the past couple of years, Poland’s construction is recovering strongly, according to a new report by Timetric’s Construction Intelligence Centre. Construction activity in Poland was weak during the report’s review period, 2011–2015, because of a deteriorating business environment, weak economic conditions, currency depreciation and a lack of foreign capital investment. The report, ‘Construction in Poland – Key Trends and Opportunities to 2020’, noted that the construction s

March 23, 2016

Read time: 2 mins

After a sluggish performance over the past couple of years, Poland’s construction is recovering strongly, according to a new report by 7472 Timetric’s Construction Intelligence Centre.

Construction activity in Poland was weak during the report’s review period, 2011–2015, because of a deteriorating business environment, weak economic conditions, currency depreciation and a lack of foreign capital investment.

The report, ‘Construction in Poland – Key Trends and Opportunities to 2020’, noted that the construction sector posted a compound annual growth rate (CAGR) of 0.12% in real terms during the review period. Output fell from US$110.3 billion in 2011 to $109.7 billion in 2015.

However, Timetric expects the future to be brighter in the next five years. In real terms, the Polish construction industry is expected to accelerate at a CAGR of 4.17%.

Consequently, the industry’s value is expected to increase from nearly $110 billion in 2015 to $134.6 billion in 2020, measured at a constant 2010 US dollar exchange rate. Growth will be driven by the government investments in infrastructure, energy and housing projects.

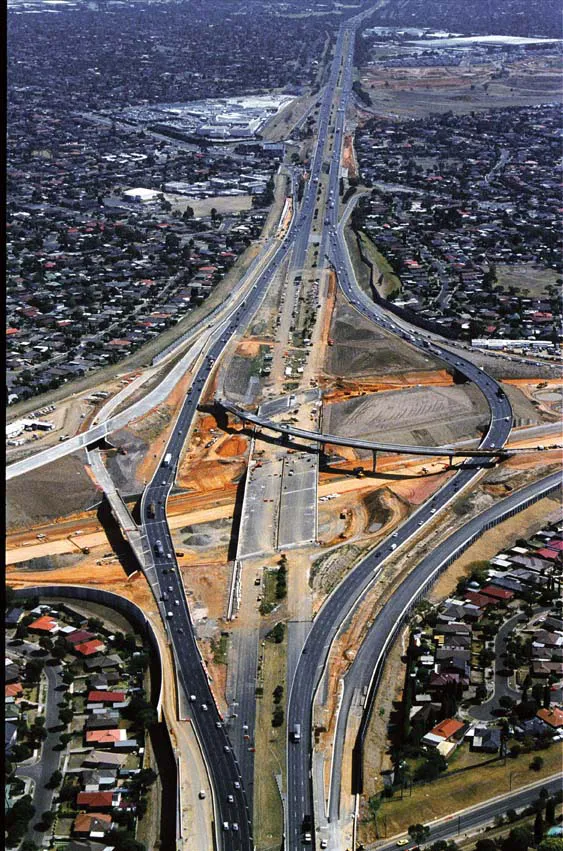

Infrastructure development is forecast to be a crucial driver behind the future construction growth in the country and is expected to remain the largest market in the industry over the next five years. It is expected to post a forecast-period CAGR of 8.25% in nominal terms, to value $47.3 billion in 2020.

The government is increasing its investment in public transport infrastructure through public-private partnership deals.

Construction activity in Poland was weak during the report’s review period, 2011–2015, because of a deteriorating business environment, weak economic conditions, currency depreciation and a lack of foreign capital investment.

The report, ‘Construction in Poland – Key Trends and Opportunities to 2020’, noted that the construction sector posted a compound annual growth rate (CAGR) of 0.12% in real terms during the review period. Output fell from US$110.3 billion in 2011 to $109.7 billion in 2015.

However, Timetric expects the future to be brighter in the next five years. In real terms, the Polish construction industry is expected to accelerate at a CAGR of 4.17%.

Consequently, the industry’s value is expected to increase from nearly $110 billion in 2015 to $134.6 billion in 2020, measured at a constant 2010 US dollar exchange rate. Growth will be driven by the government investments in infrastructure, energy and housing projects.

Infrastructure development is forecast to be a crucial driver behind the future construction growth in the country and is expected to remain the largest market in the industry over the next five years. It is expected to post a forecast-period CAGR of 8.25% in nominal terms, to value $47.3 billion in 2020.

The government is increasing its investment in public transport infrastructure through public-private partnership deals.