Webuild has reported double-digit growth in both revenues and margins in the first half of 2025.

The Italy-based construction group's board of directors says the consolidated half-year financial report to June 30, 2025 reaffirms its trajectory of excellent performance, despite the uncertain macroeconomic scenario.

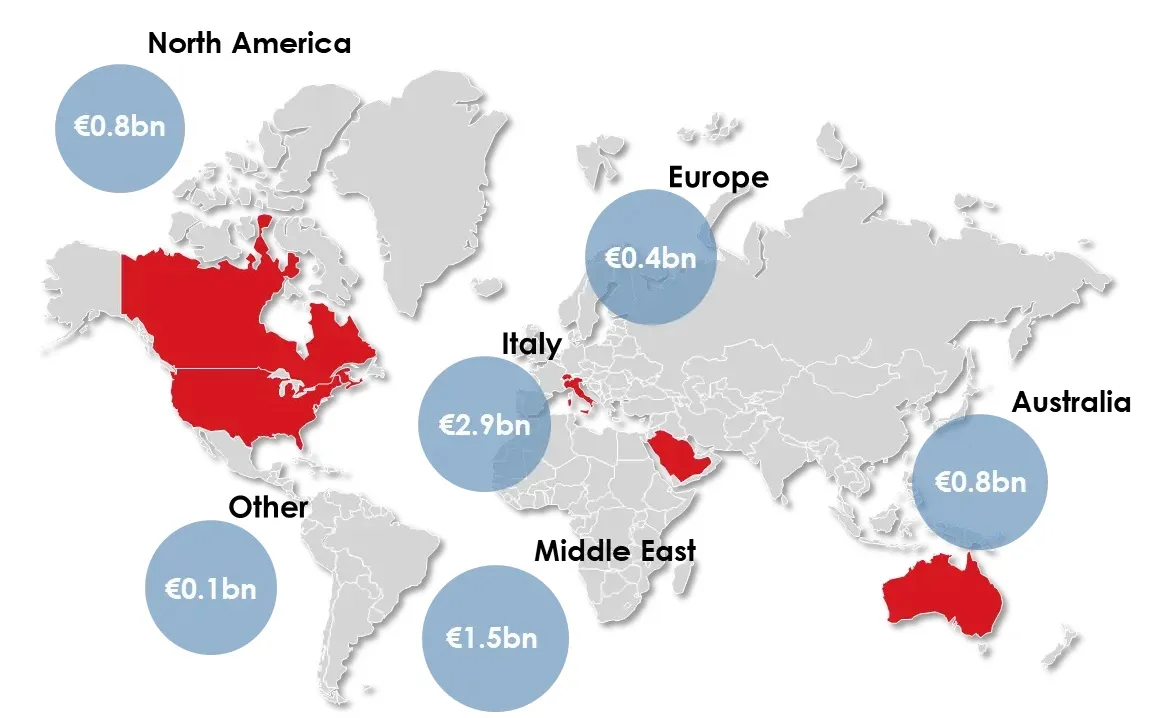

Revenues reached €6.7bn, up 22% compared to the first half of 2024, while EBITDA rose significantly by 38% year-on-year to €564m. EBITDA margin stood at 8.4%, an improvement of 100 basis points compared to the first half of 2024. Net cash position stood at €275m, remaining positive for the sixth consecutive semester.

Financial leverage further improved to 2.6 times, down from 3.0 times as of December 31, 2024, which Webuild says reflects the continued strengthening of the group's financial structure and credit standing.

New orders acquired since the beginning of the year amount to €6.5bn, exceeding 50% of the full-year target. Orders include strategic infrastructure such as the Women and Babies Hospital in Perth, a new centre of excellence for the care of women and children in Australia; the extension of Line C of the Rome Metro, an important urban mobility infrastructure; the construction of a cultural and commercial hub in Diriyah, Saudi Arabia, which includes more than 70 buildings and public spaces; and the extension and modernisation of Interstate 85 in North Carolina in the United States.

The order backlog exceeds €58bn, of which approximately €50bn refers to construction activities, providing strong visibility on future revenues and a solid foundation for the next business plan. The commercial pipeline, totaling around €85bn, is supported by significant investments in strategic infrastructure for the transition to a low-carbon economy, energy security, population growth, and urbanisation. With solid expertise, established delivery capacity and investment in people and innovation, Webuild is confirmed as a major player in the industry, committed to improving people's quality of life and contributing to the security of the countries in which it operates.

Operational activities continued at a sustained pace across projects, with significant progress both in Italy and abroad. Key milestones include the completion of excavation works on the first lot of the Verona–Vicenza high-speed/high-capacity rail line; the laying of the first tracks on the Naples–Cancello section of the Naples-Bari high-speed rail line; the placement of the eleventh caisson of the Genoa breakwater; the completion of the I-275 highway segment in Florida; the excavation of the first section of the North East Link in Melbourne, Australia; and the activation of the second lot of the Riachuelo system in Buenos Aires, the largest wastewater treatment facility in the region.

In Europe, infrastructure investments are expected to benefit from NATO’s new military spending target of 5% of GDP by 2035, with up to 1.5% potentially allocated to strategic infrastructure. This is in addition to the €500bn plan launched by the German government to modernise transportation, education, water resources, and existing infrastructure. There is also future reconstruction efforts in Ukraine, where investment needs are estimated at US$500bn by 2033.

In Italy, infrastructure development is focused on two main areas that go beyond the resources allocated under the National Recovery and Resilience Plan (PNRR). The first is transportation, with strategic projects such as high-speed rail lines (Salerno-Reggio Calabria) and metro line expansions. The second area is water and energy networks, the renovation of hydroelectric plants, and the construction of hospitals and stadiums. In addition, under NATO’s military spending objectives, up to 1.5% of GDP could be allocated to dual-use infrastructure, representing a potential of approximately €30bn in annual investments.

In Australia, where the Group ranks among the country’s top five contractors, Webuild says it is well-positioned to seize opportunities in a rapidly growing market. Investments are expected to be driven by the energy and mining sectors, with large-scale projects in hydropower, water infrastructure, energy storage, and power grids. Infrastructure demand will also be supported by major federal and local investment plans in public transport, schools, hospitals, and social housing. The sector will further benefit from the development of the Brisbane area - including potential stadiums and rail projects - in view of the 2032 Olympic and Paralympic Games, as well as from growing trade flows in the Asia-Pacific region, supporting investments in port infrastructure.

In the United States, the government’s strategy promotes greater private sector involvement in infrastructure development, creating opportunities for public-private partnerships (PPPs), with a focus on civil infrastructure, especially roads and bridges. The recently approved “One Big Beautiful Bill” is expected to stimulate activity in the construction sector, particularly in the manufacturing and energy sectors, as well as in the construction of defense infrastructure. In Canada, ambitious investment plans have been launched or proposed in several provinces, including Ontario and Québec, for the development of transportation infrastructure, healthcare facilities, schools, hydroelectric plants, and power infrastructure, such as transmission and distribution networks.

In the Middle East — particularly Saudi Arabia — investment in large-scale infrastructure projects is expected to remain strong, supported by the “Saudi Vision 2030” plan and upcoming international events such as the FIFA World Cup 2034 and Expo 2030. Key priorities include metro systems, high-speed railways, stadiums, airports, and other strategic infrastructure.

Webuild commented: "The operational and financial results achieved in the first half of the year, combined with a market environment rich in opportunities and the strength and quality of the order backlog, allow Webuild to confirm the financial guidance for 2025: a book-to-bill ratio greater than 1.0 times and a further improvement of results with revenues exceeding €12.5bn and EBITDA greater than €1.1bn. The Group remains focused on cash generation, maintaining a solid net cash position, which is expected to exceed €700m."