Volvo CE said strong sales, particularly in North America, helped the company record a 15% rise in equipment sales in Q2 of 2012 – bucking a worldwide reduction in the size of the global equipment sales market. The company’s operating income also rose in Q2 2012 to 35%, with operating margin up 13.3% on the same period of 2011. Volvo CE strengthened its market position in wheeled loader and excavator sales in China, taking a 14.7% share of the vital market.

July 31, 2012

Read time: 2 mins

RSS359 Volvo CE said strong sales, particularly in North America, helped the company record a 15% rise in equipment sales in Q2 of 2012 – bucking a worldwide reduction in the size of the global equipment sales market.

The company’s operating income also rose in Q2 2012 to 35%, with operating margin up 13.3% on the same period of 2011. Volvo CE strengthened its market position in wheeled loader and excavator sales in China, taking a 14.7% share of the vital market.

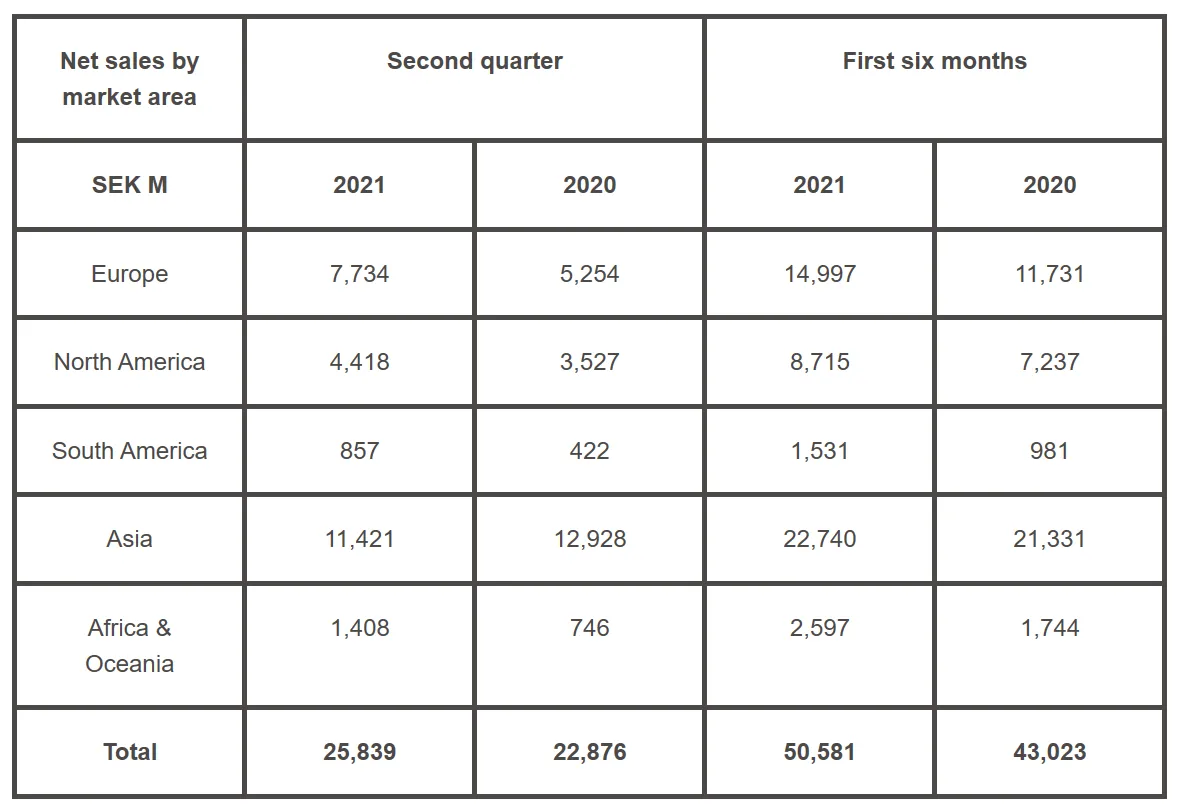

The 15% Volvo CE sales rise in Q2 2012 amounts to €2.34 billion (SEK 19,715 million) (€2.03 billion/SEK 17,153 million in Q2 2011). Operating income, meanwhile, increased by 35% and amounted to €312.5 million (SEK 2,629 million), up from €231.2 million (SEK 1,945 million) in 2011.

The value of Volvo CE’s order book at the end of the second quarter was also higher, up 14% compared to the same date in 2011.

Commenting on the Q2 2012 results Pat Olney, president of Volvo CE, said: “Sales growth continued to be robust during the quarter, most notably in North America where sales were up 89% compared to the same period last year. In Asia we managed to offset a sharp decline in the overall market in China by continuing to gain market share, while demand in Southeast Asia remained strong.”

Due to the global economic crisis, Volvo CE said its full 2012 sales year in Europe is anticipated to be flat, having previously forecast a 10-20% rise, while expectations regarding North America remain unchanged at growth of 15-20%. Meanwhile, South American sales are predicted to grow by 0-10%, and sales in Asia, excluding China, are forecast to increase by up to 10%. As previously forecast, Volvo CE expects China sales to decline by 15-25%.

The company’s operating income also rose in Q2 2012 to 35%, with operating margin up 13.3% on the same period of 2011. Volvo CE strengthened its market position in wheeled loader and excavator sales in China, taking a 14.7% share of the vital market.

The 15% Volvo CE sales rise in Q2 2012 amounts to €2.34 billion (SEK 19,715 million) (€2.03 billion/SEK 17,153 million in Q2 2011). Operating income, meanwhile, increased by 35% and amounted to €312.5 million (SEK 2,629 million), up from €231.2 million (SEK 1,945 million) in 2011.

The value of Volvo CE’s order book at the end of the second quarter was also higher, up 14% compared to the same date in 2011.

Commenting on the Q2 2012 results Pat Olney, president of Volvo CE, said: “Sales growth continued to be robust during the quarter, most notably in North America where sales were up 89% compared to the same period last year. In Asia we managed to offset a sharp decline in the overall market in China by continuing to gain market share, while demand in Southeast Asia remained strong.”

Due to the global economic crisis, Volvo CE said its full 2012 sales year in Europe is anticipated to be flat, having previously forecast a 10-20% rise, while expectations regarding North America remain unchanged at growth of 15-20%. Meanwhile, South American sales are predicted to grow by 0-10%, and sales in Asia, excluding China, are forecast to increase by up to 10%. As previously forecast, Volvo CE expects China sales to decline by 15-25%.