The European road building market is forecast to grow strongly in real terms from now to the end of 2019, as a strengthening economy boosts construction, creating investment and jobs.

Road building growth is led by the UK, Norway and Poland with these three showing increases of 39%, 38% and 35% respectively in 2019 compared with 2016.

The road building market as a whole is predicted to grow by 16% over the same period. All of the forecasts are in euros at 2016 prices.

In the UK, the market is being buoyed by a number of major projects coming on stream, such as the A14 upgrade between Cambridge and Huntingdon, the M4 motorway upgrade and the A9 Perth to Inverness dualling project in Scotland.

This upbeat picture was revealed at a recent conference of specialist economists in Amsterdam organised by Euroconstruct, a body that brings together construction market consultants and forecasting organisations from 19 European countries.

The latest Euroconstruct forecasts for the whole European construction sector represent a marked uplift on their last figures published in November.

They now predict that total European construction output in all 19 states will have risen by 7.5% in 2019 over 2016, up from 6.5% previously.

The market in Hungary is predicted to grow by a staggering 52% in the same period, Poland by 17% and Ireland by 25%.

But with Hungary and Ireland coming from a very low base – in Ireland’s case off the back of a savage recession - Euroconstruct argues that health of a country’s construction market can better be judged “by a combination of current performance relative to historic growth levels and future growth prospects”.

Taking those factors into account, the three star performing countries are Poland, Norway and Sweden.

By sector, the two markets driving the recovery are civil engineering and housing, with the civils market boosted by road, rail and telecoms work.

Last year, the European civil engineering market was still in decline mainly due to sharp falls in Euroconstruct’s four Eastern European members – the Czech Republic, Hungary, Poland and Slovakia.

This had been caused by the delays in many infrastructure projects, especially in Poland, and the end of the last European Union funding cycle, but now they will be boosted by the start of a new funding cycle.

In the UK, the picture for the entire civil engineering is very positive. Apart the major road upgrades, upcoming projects include the Hinkley Point C nuclear power station, the enabling works at the Wylfa nuclear plant, the HS2 high speed rail link, the Thames Tideway Tunnel and the huge Hornsea Wind Farm in the North Sea off the Yorkshire coast.

Euroconstruct economists acknowledged that in the wake of the 2008 crash, some countries are coming from a low base.

But they argued that consumer confidence, European Union funding and continuing loose monetary policy will combine to boost construction across almost all markets.

“Construction went through some very tough years after the financial crisis, but now the market is recovering again,” said Oebele Vries, deputy director of the Dutch Economic Institute for Construction and Housing, and the conference host.

“And the European market is much more stable now than in 2007, before the crash.”

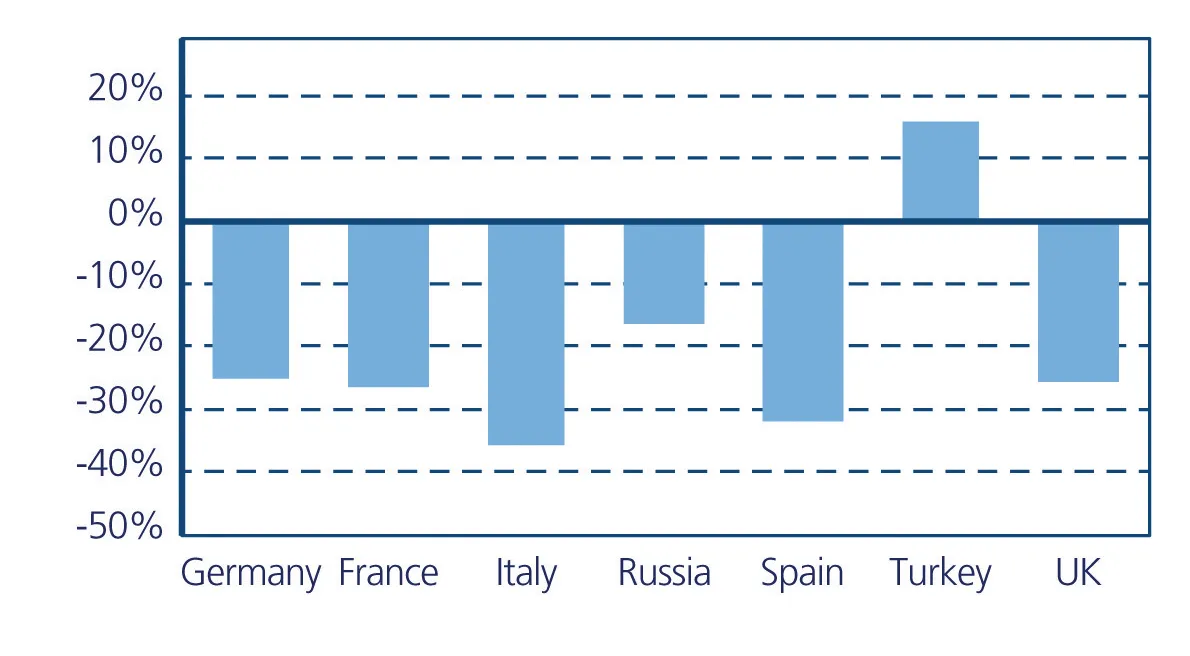

Vries added: “When we look at the whole construction market in all 19 countries the level is still 15% below 2007 before the crash, but when we exclude Spain there is a big change - for the remaining 18 countries we can see that the market has recovered from the crisis.”

“And if we exclude Italy, we can see that in the remaining 17 countries the amount of construction activity exceeds pre-crisis levels.”

However, there were words of caution from some experts. Germany, Europe’s biggest construction market, is stagnating with growth near flat in 2018 and 2019. And prospects for the UK, are uncertain due to Brexit and political upheavals.

Dutch MEP Paul Tang, warned that Europe risked seeing another cycle of “boom-bust” without a planned programme of investment, including a commitment to long-term infrastructure spending.

“It is good we are seeing an economic recovery in the Eurozone, which is a bit of a surprise, given the uncertainties,” said Tang, who is a leading member of the European Parliament’s Economic and Monetary Affairs Committee.

“But if we want steady growth, we need a new investment agenda to help us make the transition to a more sustainable economy. Without action, we will remain a boom bust economy.”

* Euroconstruct is the main network for construction forecasting in Europe and has members in 19 European countries, 15 in western Europe plus the Czech Republic, Poland, Hungary and Slovakia in eastern Europe. It meets twice a year and provides short- and medium-term forecasts for the main European construction market sectors.

Road sector drives European construction’s recovery

The European road building market is forecast to grow strongly in real terms from now to the end of 2019, as a strengthening economy boosts construction, creating investment and jobs.

June 27, 2017

Read time: 4 mins