Volvo CE is reporting an improving financial position.

By MJ Woof

October 19, 2020

Read time: 2 mins

Volvo CE says that business activity has improved for the third quarter of 2020. According to the company, customer demand has picked up in the wake of the COVID-19 pandemic. As a result, orders for construction equipment and services recovered strongly in the third quarter of 2020, particularly in China.

This helped Volvo CE post improvements in sales, orders and machine deliveries in the period. While net sales in the third quarter decreased by 2% to SEK 17.6 billion (compared with SEK 17.9 billion for the same period in 2019), when adjusted for currency movements they were up 6% in the period. Adjusted operating income was also slightly down, at SEK 1.963 billion, compared to SEK 2.18 billion in the corresponding period in 2019. This equated to an operating margin of 11.1% (12.2%).

Net order intake in the third quarter increased by 40% compared with the same quarter in 2019. Deliveries increased by 20%, to 19,774 machines, in the third quarter, mainly driven by higher sales in China.

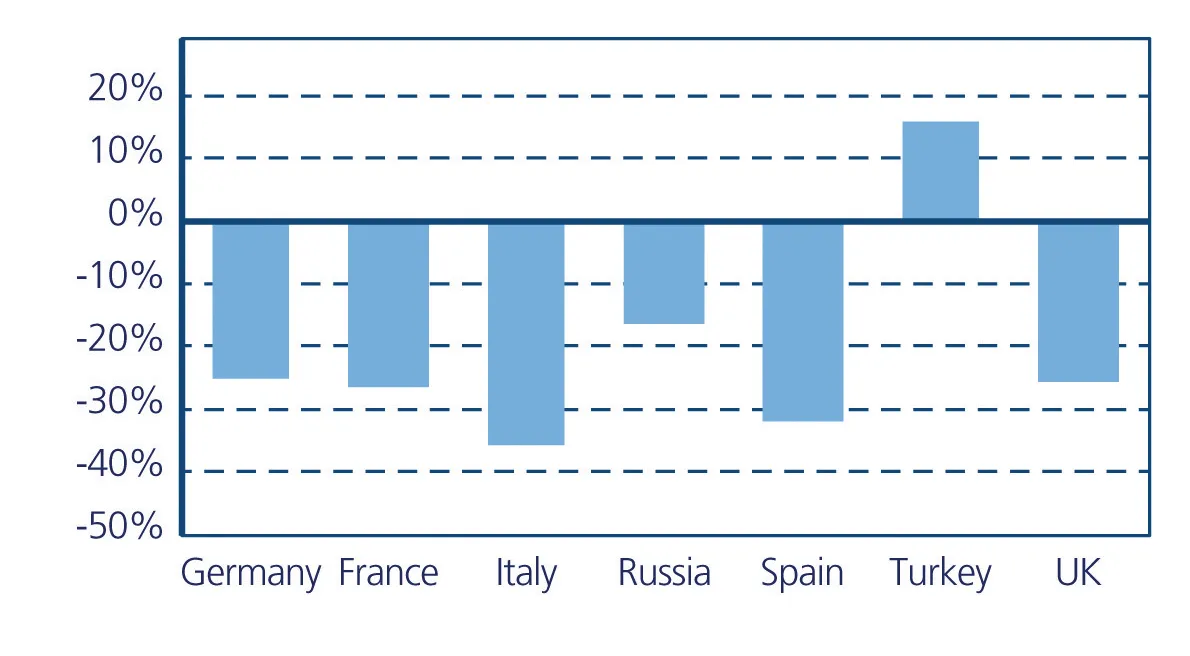

The firm says that most markets recovered well from the effects of the Covid-19 pandemic in the third quarter, with machine utilisation at the end of the period at almost 2019 levels. That said, the ongoing uncertainty created by the pandemic weighed on the European market, which up to the end of August was down by 19%.

The North American market was also down by 19%, while South America was up 11%, albeit from very low levels in 2019. In Asia (excluding China), the total market was down 13%. The Chinese market recovered strongly from the impact of the pandemic, driven by government stimulus measures, prompting an increase in demand of 22% in the period.

“After the sharp Covid-19 triggered downturn of Q2 we saw construction activity gradually improve across most markets in the third quarter,” commented Melker Jernberg, President of Volvo CE. “Demand was particularly strong in China, the world’s biggest market, and here we continued to grow our market share. With continuing uncertainty due to the ongoing spread of the pandemic, we will maintain a tight focus on cost control, and prioritize the health and safety of colleagues, customers and business partners.”

In line with the company’s policy of concentrating on core product groups, Volvo CE divested its North American Blaw-Knox paver range during the third quarter. It also announced that the first deliveries of its all-electric compact machines would begin in UK, France and Germany in the coming weeks.