Volvo CE reports that its operating margin has recovered in the second quarter of 2013, although the firm has been hit by weaker sales, especially in the mining industry. This situation reflects the continued slowdown in the size of the total market for construction equipment and the company’s sales were down 19% during the period. However the firm said that behind the headline figures there were underlying positives, not least a good order intake and improving trends in China, Europe and the Middle East, a

July 24, 2013

Read time: 2 mins

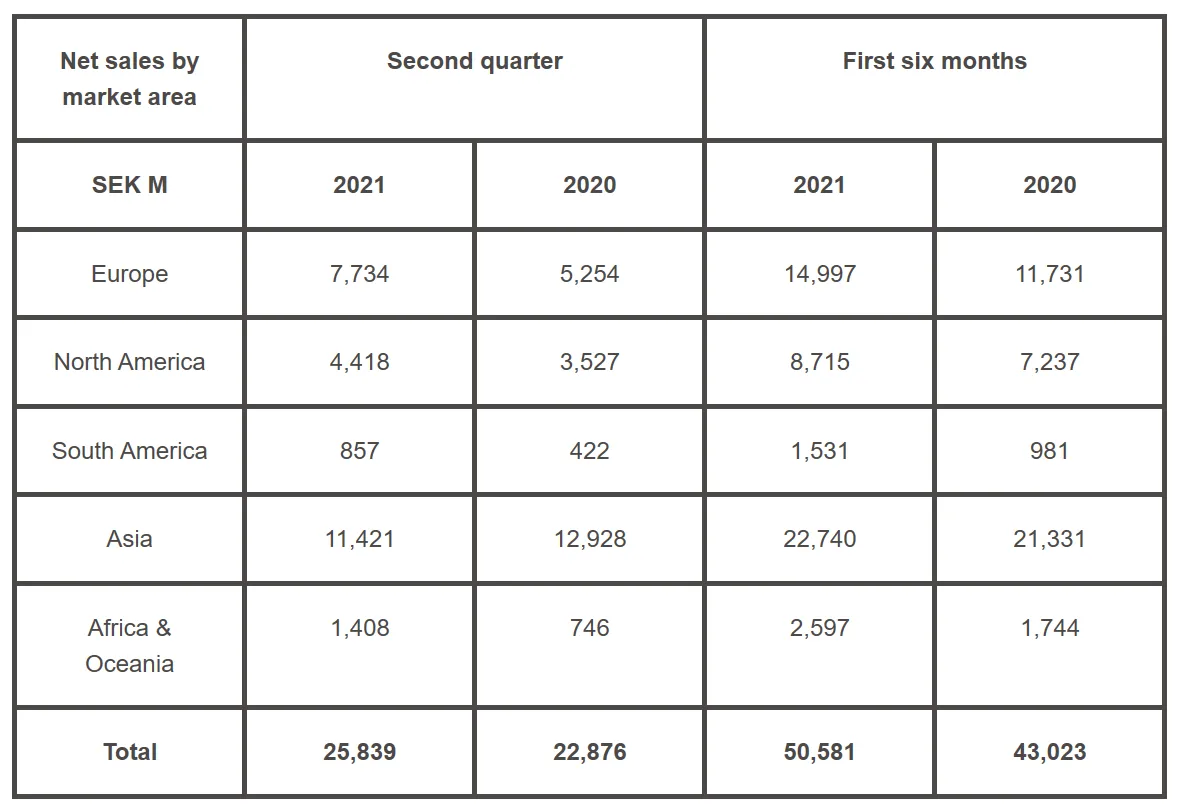

Net sales in the second quarter fell 19% to US$2.47 billion, compared with $3.04 billion for the same period in the previous year, though adjusted for currency movements, net sales decreased by 14%. Operating income also decreased to $203.9 million compared with $422.3 million in the same period during 2012. Operating margin, at 8.3%, although down compared to the 13.9% achieved in same period last year, more than doubled versus the first quarter of 2013. This effect was due to lower sales in the higher margin mining sector according to the company. A positive note though is that despite the weaker market conditions, the value of Volvo CE’s order book at the end of the second quarter was nearly the same as for the same period in 2012.

The company is cautious about its performance for this year and said that measured in units, Europe is anticipated to decline by 5-15%, while expectations regarding North America, South America, China and the rest of Asia are all expected to be in the range of minus 5% to plus 5%.