The VDMA is the German equipment manufacturing association and says it is optimistic with regard to machine demand. The VDMA’s latest forecast for the construction equipment business segment in 2015 suggests market growth of 4%. According to the VDMA, the bauma 2016 construction equipment event in Munich in spring 2016 will also provide strong impetus for machine sales.

German construction equipment manufacturers are more optimistic at the middle of the year than they were at the beginning – "even though u

July 16, 2015

Read time: 3 mins

The 1331 VDMA is the German equipment manufacturing association and says it is optimistic with regard to machine demand. The VDMA’s latest forecast for the construction equipment business segment in 2015 suggests market growth of 4%. According to the VDMA, the 688 bauma 2016 construction equipment event in Munich in spring 2016 will also provide strong impetus for machine sales.

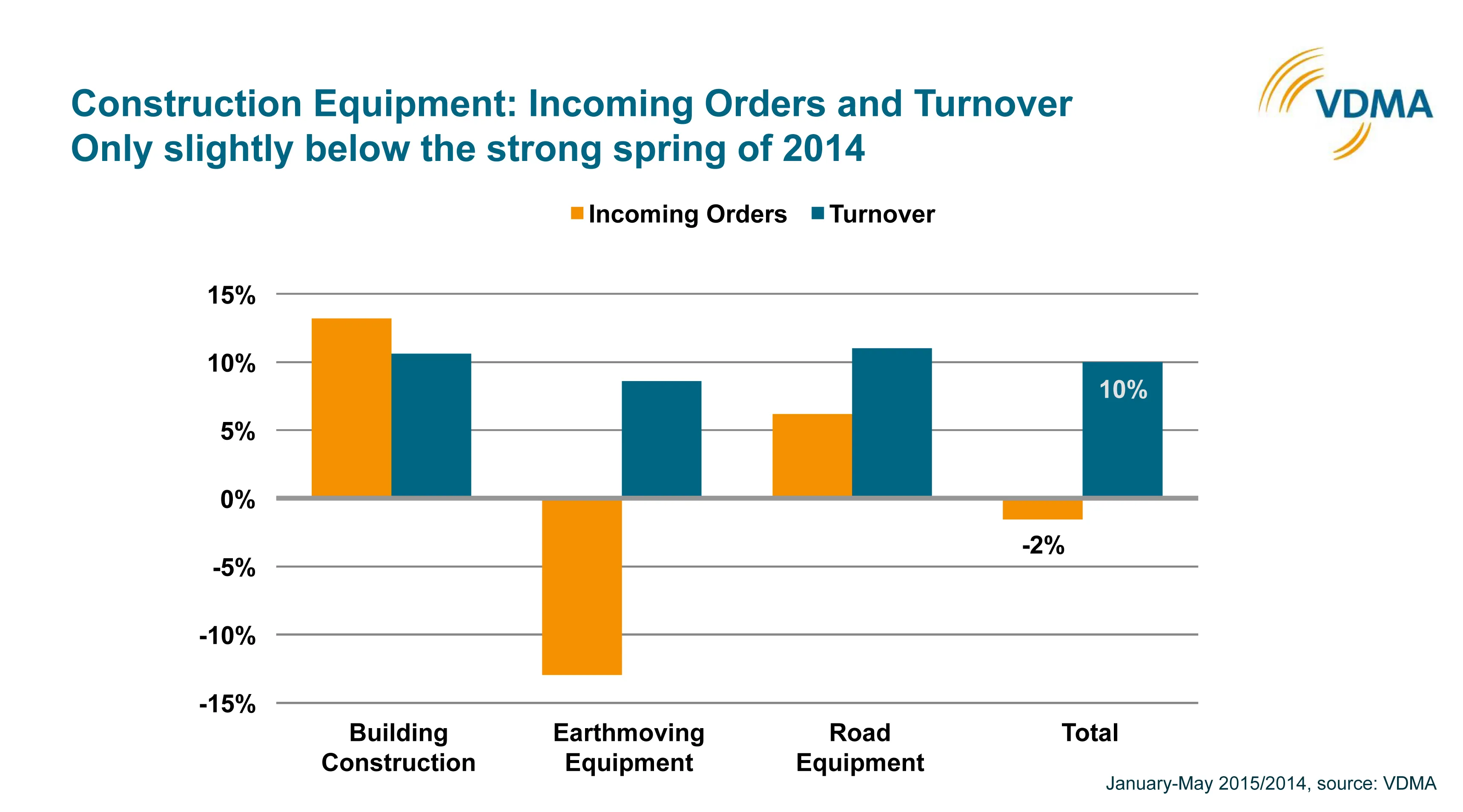

German construction equipment manufacturers are more optimistic at the middle of the year than they were at the beginning – "even though uncertainty is the largest obstacle for us at present," according to Johann Sailer, chairman of the VDMA Association for Construction Equipment and Building Material Machines. The VDMA says that there has been double-digit growth in turnover by member companies throughout the sector in the first five months. Despite a damper in May, construction equipment manufacturers are correcting their forecast upwards for 2015. An increase in turnover of 4% to €8.7 billion seems achievable.

Construction equipment sales in Europe and North America have grown significantly in the first five months of the year, despite the fact that the Russian market has recorded a drop of around 70%. France too, once the second largest construction equipment market in Europe, is suffering a pronounced downturn with an above-average decline of 19% compared with the previous year. The drivers of business are the UK, Scandinavia and Germany. This year, manufacturers are expecting new momentum from Poland, too. Southern Europe is slowly catching up. Nonetheless, Europe still has to recover. “This is of central importance to us construction equipment manufacturers," Sailer said.

The North American construction equipment market is doing well and has already reached the pre-crisis level of 2006. The sector expects development next year to be rather flat. Good growth is coming from Saudi Arabia and the Emirates. China, India, Southeast Asia and Latin America, in particular, are falling short of expectations. When categorised by product group, there are significant differences in development. Demand for earthmoving machinery is disappointing and heavy machinery in particular has few customers due to the global mining crisis. But the trend is continuing upwards in concrete technology. The current situation is still good in road construction machinery, too. After a strong start to the year, incoming orders throughout the sector are currently at minus 2% compared with the previous year. And turnover is positive.

Companies today are looking forward to 2016 with optimism. bauma will take place in Munich from 11 to 17 April. Every three years, the world's leading trade fair for the industry is considered a driver of new investments from customers worldwide.

German construction equipment manufacturers are more optimistic at the middle of the year than they were at the beginning – "even though uncertainty is the largest obstacle for us at present," according to Johann Sailer, chairman of the VDMA Association for Construction Equipment and Building Material Machines. The VDMA says that there has been double-digit growth in turnover by member companies throughout the sector in the first five months. Despite a damper in May, construction equipment manufacturers are correcting their forecast upwards for 2015. An increase in turnover of 4% to €8.7 billion seems achievable.

Construction equipment sales in Europe and North America have grown significantly in the first five months of the year, despite the fact that the Russian market has recorded a drop of around 70%. France too, once the second largest construction equipment market in Europe, is suffering a pronounced downturn with an above-average decline of 19% compared with the previous year. The drivers of business are the UK, Scandinavia and Germany. This year, manufacturers are expecting new momentum from Poland, too. Southern Europe is slowly catching up. Nonetheless, Europe still has to recover. “This is of central importance to us construction equipment manufacturers," Sailer said.

The North American construction equipment market is doing well and has already reached the pre-crisis level of 2006. The sector expects development next year to be rather flat. Good growth is coming from Saudi Arabia and the Emirates. China, India, Southeast Asia and Latin America, in particular, are falling short of expectations. When categorised by product group, there are significant differences in development. Demand for earthmoving machinery is disappointing and heavy machinery in particular has few customers due to the global mining crisis. But the trend is continuing upwards in concrete technology. The current situation is still good in road construction machinery, too. After a strong start to the year, incoming orders throughout the sector are currently at minus 2% compared with the previous year. And turnover is positive.

Companies today are looking forward to 2016 with optimism. bauma will take place in Munich from 11 to 17 April. Every three years, the world's leading trade fair for the industry is considered a driver of new investments from customers worldwide.