UK output from companies involved in manufacturing equipment and parts turned down in June, according to the latest data from the

Output in June was 4.3% lower than May, but was still 3.3% higher than June 2016 levels.

Output in June was the lowest for the past seven months - since November 2016 - and has resulted in the six-month moving average flattening out for the first time this year.

Output in the second quarter of 2017 was 1% down on the first quarter, but was still 4.1% above Q2 2016. This suggests a stabilisation in output, after a rising trend since the beginning of 2016. Overall output in the first half of 2017 was still 5.8% above the first half of 2016.

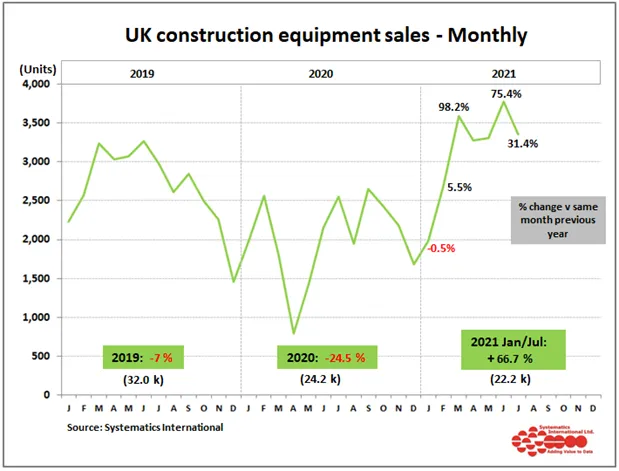

The latest output figures are consistent with estimates of single figure growth in equipment sales to the UK market in the first half of the year, compared with 2016. They are also consistent with increasing levels of exports of construction equipment, which showed a 13% increase in Q1 2017 compared with Q4 2016, measured in monetary value.

Analysis of the data from the ONS on an annual basis shows that industries included within the Machinery & Equipment NEC category include construction, earthmoving, mining and lifting equipment and parts. ONS output data is based on company turnover and collected monthly.

Comparison of this data on an annual basis with construction equipment production data from research organisation

Information for this report came from the