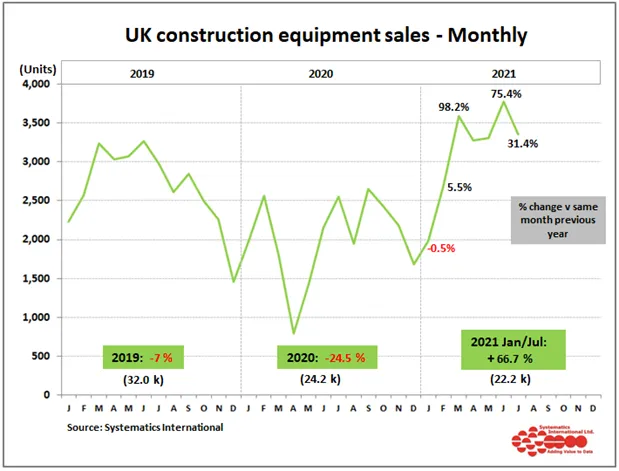

UK retail sales of construction and earthmoving equipment remained strong in July, according to figures from the construction equipment statistics exchange.

The exchange, operated by Systematics International in partnership with the UK Construction Equipment Association, found that sales were 31 per cent above the levels seen in the same month last year, when the sector was still recovering from the impact of the first lockdown.

As a result, sales in the first seven months of this year were 66 per cent up on 2020 levels, reaching over 22,000 units. Sales are still remaining ahead of 2019 levels so far this year, illustrating the underlying strength of the market, despite ongoing concerns about supply chain constraints for components and parts.

The pattern of sales for the major equipment types in the first seven months of the year to July is similar to the preceding months.

The figures show that telehandlers (for the construction industry) are seeing the strongest growth, with sales more than double last year’s levels at this stage. Road rollers are also very strong, at double last year’s levels. The weakest sales are still being seen from mini/midi excavators (up to 10 tonnes), with the rate of increase easing back to 49% this year, after being the strongest growing product type last year.

The construction equipment statistics exchange covers sales on a regional basis in the UK and N Ireland. Sales have been strongest in Scotland and the North West of England, at more than double last year’s levels so far. In contrast, weaker sales are still being experienced in the West Midlands and Wales, at 28 per cent to 35 per cent above last year’s levels.

Sales in the Republic of Ireland are also recorded in the statistics scheme. This shows the rate of growth easing back in July at only 7 per cent above 2020 levels. However, sales in the first seven months of 2021 are still 50 per cent above the same period last year.