UK retail sales of construction equipment showed further strong growth in June, rising 75% ahead of the levels seen in the same month in 2020.

Sales in the second quarter of the year, Q2, were more than double seen last year and reached over 10,000 units during the quarter.

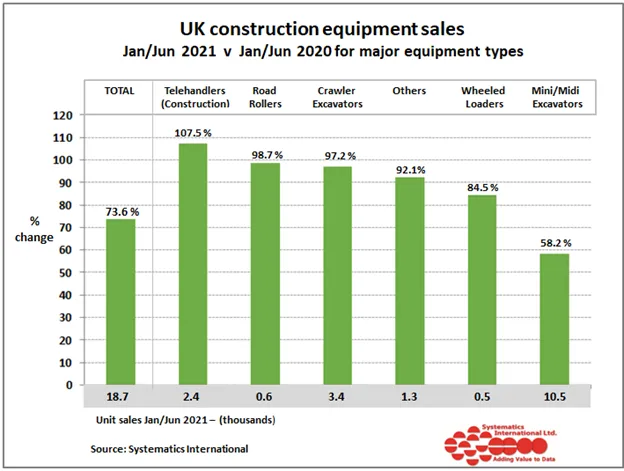

For the first half of the year, sales were over 18,000 units and are 73 per cent ahead of the levels seen in the first half of last year.

Comparisons with sales in earlier years indicate how buoyant the market has been in 2021, with sales are ahead of both 2018 (by 4 per cent) and 2019 (+7 per cent) in the first half of the year.

However, like many other industries, the sector is still experiencing supply chain shortages and price rises for many products and materials. High levels of equipment sales in the face of this demonstrate the underlying strength of current demand in the construction market, according to the UK trade association Construction Equipment Association (CEA), which completes the reports in partnership with Systematics International.

In the first half of the year, the strongest growth in sales has been experienced by telehandlers (for the construction industry), with sales more than double last year’s levels in the first six months. This is a welcome bounce back after showing the weakest performance amongst the major equipment types in 2020 when sales were over 40 per cent below 2019 levels.

Mini/midi excavators, up to 10 tonnes, have had the opposite experience after being the strongest performing product last year. In the first six months of this year, sales have shown 58 per cent growth compared with last year and lag behind all the other major equipment types in percentage growth terms. However, Mini/midi excavators remain the most popular equipment type by a significant margin.

Sales by region have been strongest in the North West of England and in Scotland - more than double the levels seen in the first half of 2020.

In contrast, weaker sales have been experienced in the West Midlands and Wales, where sales have been less than 35 per cent above last year’s levels for the same period.

Sales in the Republic of Ireland, like those in the UK, showed further strong growth in June. As a result, sales in Q2 were more than double last year’s levels and in the first half of the year are 56 per cent above sales in the same period last year.

This article first appeared in Aggregates Business Europe, a sister publication of World Highways.