UK construction machine sales have seen a drop for 2020 compared with 2019.

By MJ Woof

October 29, 2020

Read time: 2 mins

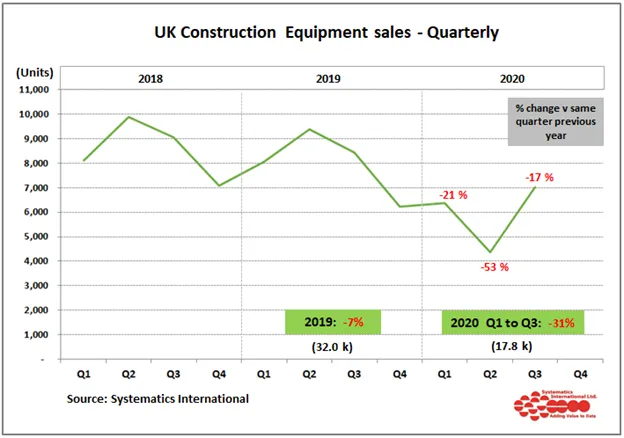

A new report from the UK’s Construction Equipment Association (CEA) reveals a drop in machinery sales of 17% for the third quarter of 2020, compared with the same period for 2019.

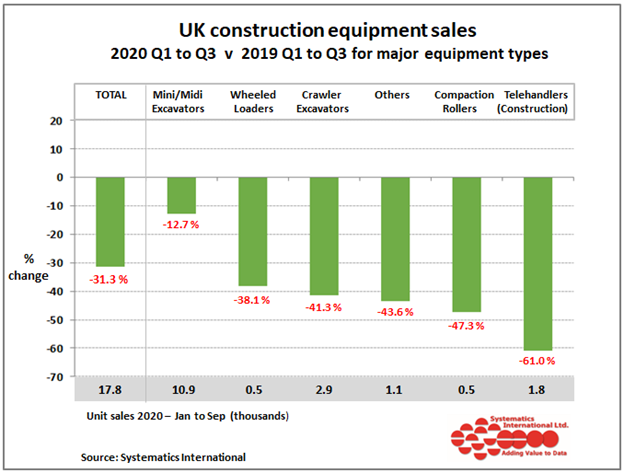

According to the report, construction machinery sales in the first three quarters of 2020 were 31% below those for the same time period in 2019. However, sales for the third quarter have shown an improvement on the position at the end of the previous quarter, when sales were 38% below 2019 levels.

The improvement in construction machinery sales in September 2020 have helped to reduce the deficit compared with 2019. At over 2,600 units in September, they were only 7% below 2019 levels and can be considered the first month to see sales return to near normal levels since February 2020, before the COVID-19 pandemic hit.

Sales in previous months since May 2020 have been on an improving trend, but were still showing major reductions compared with sales in the same month in 2019. The expectation now is that equipment sales for the full year might be in the range of 25% to 30% below the levels for 2019, if modest recovery continues in the fourth quarter, which is traditionally the quietest quarter of the year.

The construction equipment statistics exchange also covers retail sales of equipment in the Republic of Ireland. In the third quarter, sales matched 2019 levels, and have reduced the shortfall in the first three quarters of the year to 19% below last year’s levels.