According to a new report by Timetric’s Construction Intelligence Centre, 15 of the major economies in Europe are investing over US$1.43 trillion in road and rail construction projects in the coming years. Russia leads with investment of $433 billion, followed by the UK and France with $263 billion and $167 billion, respectively.

The railways sector has the highest value at $804 billion, followed by the roads sector at $301 billion. Tunnels and bridges is valued at $227 billion and the trams and metros se

April 13, 2015

Read time: 2 mins

According to a new report by 7472 Timetric’s Construction Intelligence Centre, 15 of the major economies in Europe are investing over US$1.43 trillion in road and rail construction projects in the coming years. Russia leads with investment of $433 billion, followed by the UK and France with $263 billion and $167 billion, respectively.

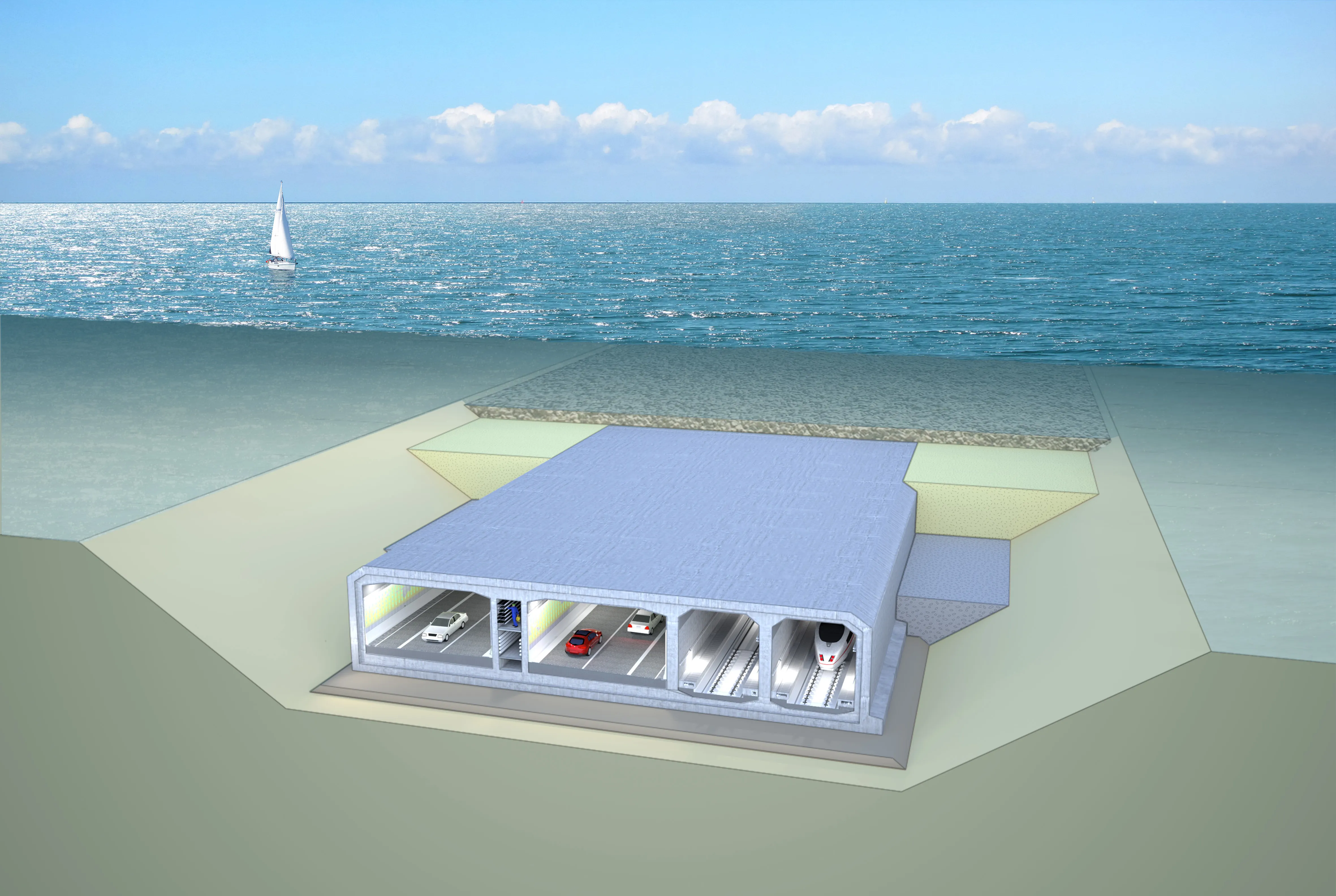

The railways sector has the highest value at $804 billion, followed by the roads sector at $301 billion. Tunnels and bridges is valued at $227 billion and the trams and metros sector has a value of $96 billion. Russia leads in investment in railways, roads and tunnels and bridges.

Despite being the leading economy in Europe, Germany is in seventh place among the 15 countries studied with investment of $51 billion. This comparatively low investment could act as a brake on the economy domestically and in the wider Eurozone. The UK is investing heavily in infrastructure projects, which it is hoped will help drive the economy. Large UK projects include Crossrail 1 and 2, the HS2 rail link and various London-based road and tunnel projects mooted to relieve congestion in the capital, such as the Inner Orbital Route.

The developing economies of Eastern Europe are expecting high growth up to 2017, outpacing most western European countries. Investment in cross border road and rail projects as well as those in the major population areas will help to sustain this growth. The 15 European countries studied have over 73% of the projects which are worth $1.05 trillion at the pre-construction stage.

“Infrastructure investment in the road and rail sector is likely to be the driving force for the European economies in the coming years as transport links between east and west are strengthened. Apart from the massive rail projects such as the UK’s Crossrail, HS2 and Russia’s Moscow to Ekaterinburg HS Rail Link, large metro developments in Spain, Russia, Poland, Denmark, Romania and Turkey are also improving the transport infrastructure in these countries' capitals,” said Neil Martin, manager at Timetric CIC.

The railways sector has the highest value at $804 billion, followed by the roads sector at $301 billion. Tunnels and bridges is valued at $227 billion and the trams and metros sector has a value of $96 billion. Russia leads in investment in railways, roads and tunnels and bridges.

Despite being the leading economy in Europe, Germany is in seventh place among the 15 countries studied with investment of $51 billion. This comparatively low investment could act as a brake on the economy domestically and in the wider Eurozone. The UK is investing heavily in infrastructure projects, which it is hoped will help drive the economy. Large UK projects include Crossrail 1 and 2, the HS2 rail link and various London-based road and tunnel projects mooted to relieve congestion in the capital, such as the Inner Orbital Route.

The developing economies of Eastern Europe are expecting high growth up to 2017, outpacing most western European countries. Investment in cross border road and rail projects as well as those in the major population areas will help to sustain this growth. The 15 European countries studied have over 73% of the projects which are worth $1.05 trillion at the pre-construction stage.

“Infrastructure investment in the road and rail sector is likely to be the driving force for the European economies in the coming years as transport links between east and west are strengthened. Apart from the massive rail projects such as the UK’s Crossrail, HS2 and Russia’s Moscow to Ekaterinburg HS Rail Link, large metro developments in Spain, Russia, Poland, Denmark, Romania and Turkey are also improving the transport infrastructure in these countries' capitals,” said Neil Martin, manager at Timetric CIC.