The Rolls-Royce Power Systems Business Unit reports strong financial performance for the first half of 2023. The firm saw revenue increase by 24% for the period compared with 2022, which was helped by a transformation of its operations.

Rolls-Royce Group says that this reflects end-market growth, with a robust order intake as demand for mtu products and solutions remains strong. The underlying sales for the Power Systems business unit increased to £1.8 billion (€2 billion) in the first half of 2023. The order cover for 2023 and 2024 is at record levels. "This significant sales growth in the often not so strong first half of the year is a success of our efforts to leverage existing potential and improve the performance of our business," said Dr Jörg Stratmann, CEO of Rolls-Royce Power Systems. Operating profit remained roughly the same at £125 million (€143 million).

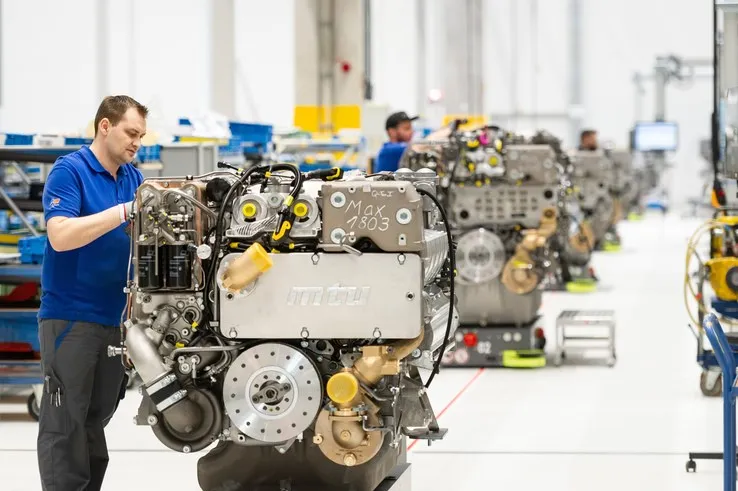

Services revenues were up 10% reflecting increased end market activity. OE revenue grew by 33%, driven by strong order execution for stationary power generating equipment and continued strong sales of mobile power solutions. Operating profit was £125 million (€143 million) with a 7.0% margin. For the remainder of the year as a whole, the Power Systems business anticipates a positive development with an improvement in the operating margin due to the impact of pricing actions, cost efficiencies and seasonally higher volumes.

"We are pursuing our chosen path of profitable growth - with initial successes already. We have successfully initiated and implemented numerous measures. We reliably support our customers worldwide in their goals with our products and solutions - for example, with our mtu engines, which have been approved for operation with alternative fuels such as HVO. In this way, we are making an important contribution to the energy transition in various industries," emphasised Dr Stratmann.