The French construction market could grow by up to 5% in 2019, up from 3.1% last year, according to a recent report.

Major infrastructure projects will continue to boost activity, including the country’s motorway building programme, the Greater Paris project of improved roads and other amenities and the French ultra-high-speed broadband plan.

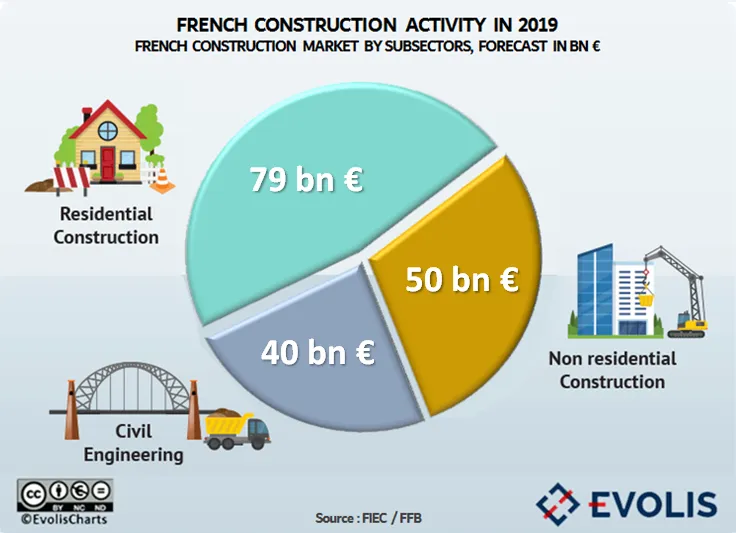

Activity in the French public works sector in general is expected to continue to rise at a rate of 10% in 2019, noted the report by Evolis, the French construction sector organisation. Local government spending, which accounts for 41% of overall public output, will be one of the main growth drivers.

However, growth is uneven and is varied according to many industry sector segments.

Housing construction activity overall is expected to remain more or less stable with a possible change of 0.2%. Repair and maintenance activity is forecasted to remain positive and showing a 0.3% increase.

Non-residential activity growth is expected to accelerate, with an increase of 6.4%.

The impact of growing e-commerce is changing the retail sector, which saw permits fall by 22.5% in 2018 and the construction of retail stores is expected to decline by 9.5% in 2019.

Administrative building projects will probably also remain in a slump. Other market segments should remain strong in 2019. Industrial buildings should see a rise in 2019 of almost 20%, while the warehouses and the offices should increase by additional 35% and 1% respectively.