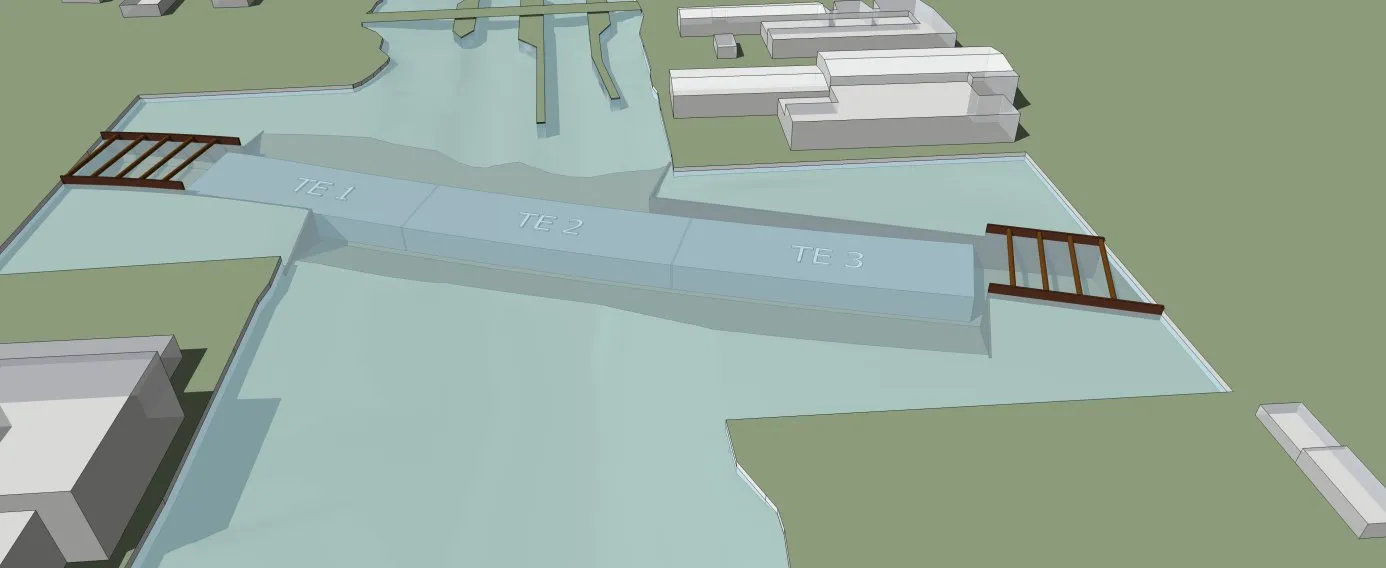

The refinancing package for Germany’s A8 Autobahn has now been formalised. The section of the A8 runs between Ulm and Augsburg in the south of Germany and is operated by concession firm Pansuevia, a 50:50 partnership between HOCHTIEF and STRABAG. The 58 km section of the A8 between Ulm and Augsburg was opened to traffic on schedule in September 2015 after four years of construction. PANSUEVIA designed, financed, and carried out the widening of the section to six lanes and took over maintenance and operation

June 27, 2016

Read time: 2 mins

The refinancing package for Germany’s A8 Autobahn has now been formalised. The section of the A8 runs between Ulm and Augsburg in the south of Germany and is operated by concession firm Pansuevia, a 50:50 partnership between 981 HOCHTIEF and 945 STRABAG. The 58 km section of the A8 between Ulm and Augsburg was opened to traffic on schedule in September 2015 after four years of construction. PANSUEVIA designed, financed, and carried out the widening of the section to six lanes and took over maintenance and operation of the section for a period of 30 years. Construction was carried out by a joint venture consisting of STRABAG Großprojekte, HOCHTIEF Infrastruktur and Ed Züblin.

The refinancing replaces the original financing from May 2011 for the public-private partnership (PPP) motorway widening project between Ulm and Augsburg. The financial close has been achieved following an agreement with the banks KfW Ipex-Bank, Nord LB, SEB and Société Générale, the institutional investors MEAG and LBPAM (La Banque Postale Asset Management) and the European Investment Bank (EIB). The EIB will stay on board as creditor and has also made use for the first time of its new financing instrument, Senior Debt Credit Enhancement (SDCE). As a subordinated debt instrument, SDCE is designed to improve the risk position of the preferential creditors. The aim is to implement an important goal of the European Community, to provide easier access for private capital to investments in transport infrastructures.

The refinancing replaces the original financing from May 2011 for the public-private partnership (PPP) motorway widening project between Ulm and Augsburg. The financial close has been achieved following an agreement with the banks KfW Ipex-Bank, Nord LB, SEB and Société Générale, the institutional investors MEAG and LBPAM (La Banque Postale Asset Management) and the European Investment Bank (EIB). The EIB will stay on board as creditor and has also made use for the first time of its new financing instrument, Senior Debt Credit Enhancement (SDCE). As a subordinated debt instrument, SDCE is designed to improve the risk position of the preferential creditors. The aim is to implement an important goal of the European Community, to provide easier access for private capital to investments in transport infrastructures.