Cummins reports strong results for the first quarter of 2023. The first quarter revenues of US$8.5 billion increased 32% from the same quarter in 2022. Sales in North America increased 39% and international revenues increased 24% due to the addition of Meritor and strong demand across all key global markets.

“The company achieved record revenues, EBITDA and EPS in the first quarter of 2023, with demand for our products remaining strong across most of our key markets and regions,” said Jennifer Rumsey, president and CEO. “We are delivering cycle-over-cycle improvement in financial performance despite persistent supply chain constraints, and we continue to invest in sustainable solutions that will protect our planet for future generations and support the success of our customers.”

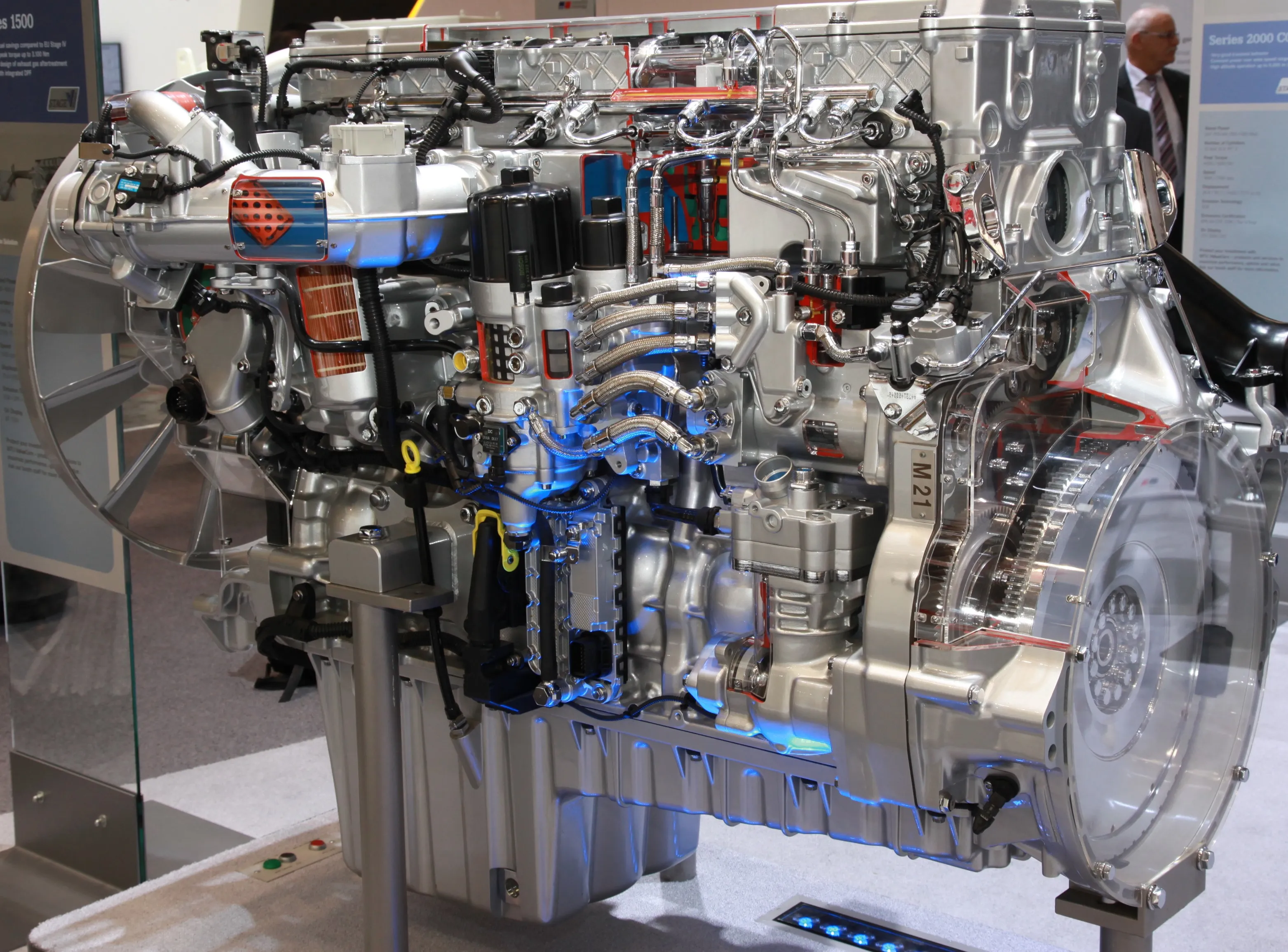

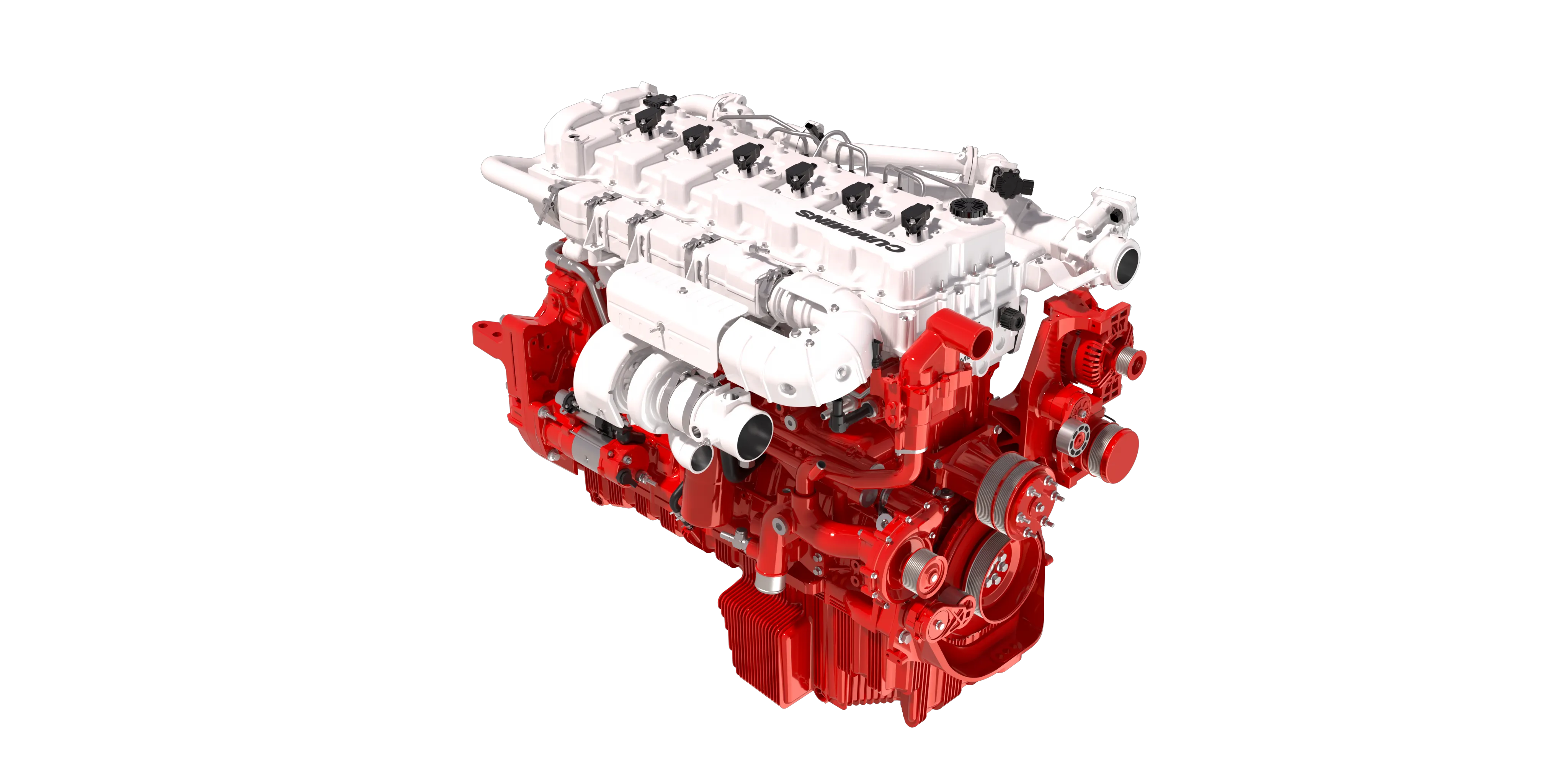

Technology such as the new fuel agnostic engine platform, hydrogen fuel cells, electric drives and batteries continue to transform the firm's product offering.

Net income attributable to Cummins in the first quarter was $790 million, or $5.55/diluted share compared to $418 million, or $2.92/diluted share, in 2022, which included $158 million, or $1.03/diluted share, of costs related to the indefinite suspension of operations in Russia. Results included costs associated with the separation of the Filtration business of $18 million, or $0.10/diluted share, in the first quarter of 2023, and $17 million, or $0.09/diluted share, in the first quarter of 2022. The tax rate in the first quarter was 21.7% including $3 million, or $0.02/diluted share, of favourable discrete tax items.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) in the first quarter were $1.4 billion, or 16.1% of sales, compared to $755 million, or 11.8% of sales, a year ago. EBITDA for the first quarter of 2023 included the costs related to the separation of the Filtration business and the first quarter 2022 EBITDA included the costs related to the indefinite suspension of operations in Russia and costs related to the separation of the Filtration business as noted above.

The company plans to continue to generate strong operating cash flow and returns for shareholders and is committed to our long-term strategic goal of returning 50% of operating cash flow back to shareholders. In the near term, we will focus on reinvesting for profitable growth, dividends and reducing debt.

“We have raised our guidance on revenue and profitability for 2023 due to continued demand for Cummins’ products and services. We will continue monitoring global economic indicators closely to ensure we are prepared should economic momentum slow,” said Rumsey. “Cummins is in a strong position to keep investing in future growth, bringing new technologies to customers and returning cash to shareholders.”

Based on its current forecast, Cummins is raising its full year 2023 revenue guidance to be up 15-20%, an increase from prior projections of up 12-17%, due to stronger demand across most markets. Meanwhile, EBITDA is expected to be in the range of 15-15.7%, an increase from the prior range of 14.5-15.2% of sales.