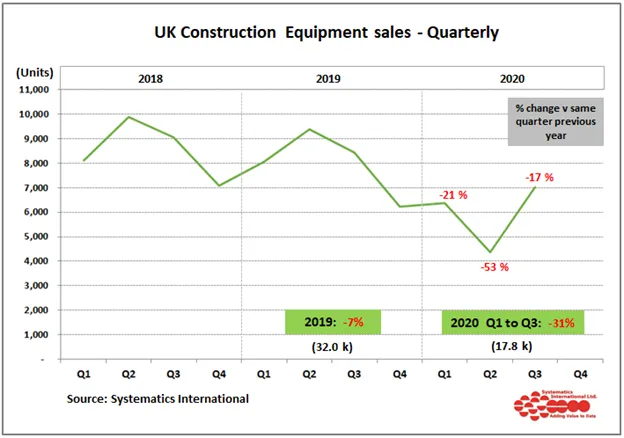

Retail sales of construction and earthmoving equipment in the UK market grew by 2% in 2018, despite a drop in the last quarter.

Prior to the 8% reduction in sales in Q4 (compared with Q4 2017), the trend over the previous two years had been to show steady, but slowing growth each quarter (see graph).

Retail sales in the UK market reached nearly 31,000 units, according to the

Among the most popular machine types, crawler excavators over 10 tonnes showed the strongest growth, at more than 16% ahead of 2017 levels. This pushed mini/midi excavators - under 10 tonnes - into second place at 4% growth year-on-year.

Weakest performance was shown by telehandlers, but only to the construction industry. After weak sales in the second half of the year, total sales in 2018 were 10% below 2017 levels.

The map below shows percentage changes in equipment sales on a regional basis in 2018 compared with 2017. This shows some quite significant differences compared with the national total of 2% growth (see map). The strongest sales were to London and Yorkshire, while the weakest sales of equipment were in the North East of England and in Wales.

Construction output in the UK in 2018 showed only 0.7% growth, according to the latest figures from the UK government’s

This was the lowest level of year-on-year growth for the construction industry for five years. Against this background, 2% growth in sales of construction equipment can be considered positive for the year, with sustained demand from the rental sector a key factor.

In contrast with domestic sales, UK exports of construction and earthmoving equipment showed very strong growth in 2018, according to official customs data from HMRC, the UK government tax agency. This shows that exports reached £3,473 million (€4,026 million), an increase of 19% on 2017 levels. This reflects strong demand in many of the major overseas markets, and is significant for UK equipment manufacturers, as exports of equipment are estimated to account for over 60% of UK machine production.

Imports of equipment also increased in 2018 to £1,633 million (€1,927 million), which was 11% higher than 2017 - consistent with domestic demand for equipment remaining strong. The overall trade surplus for construction equipment showed a 28% increase in 2018, reaching £1,839 million (€2,131 million).