UK-based contractor Balfour Beatty has exited from Balfour Beatty Infrastructure Partners (BBIP) which has rebranded as Basalt Infrastructure Partners.

Basalt is now an independent fund management business that is 100% owned by the partners of the firm - Rob Gregor, Steven Lowry and Jeff Neil.

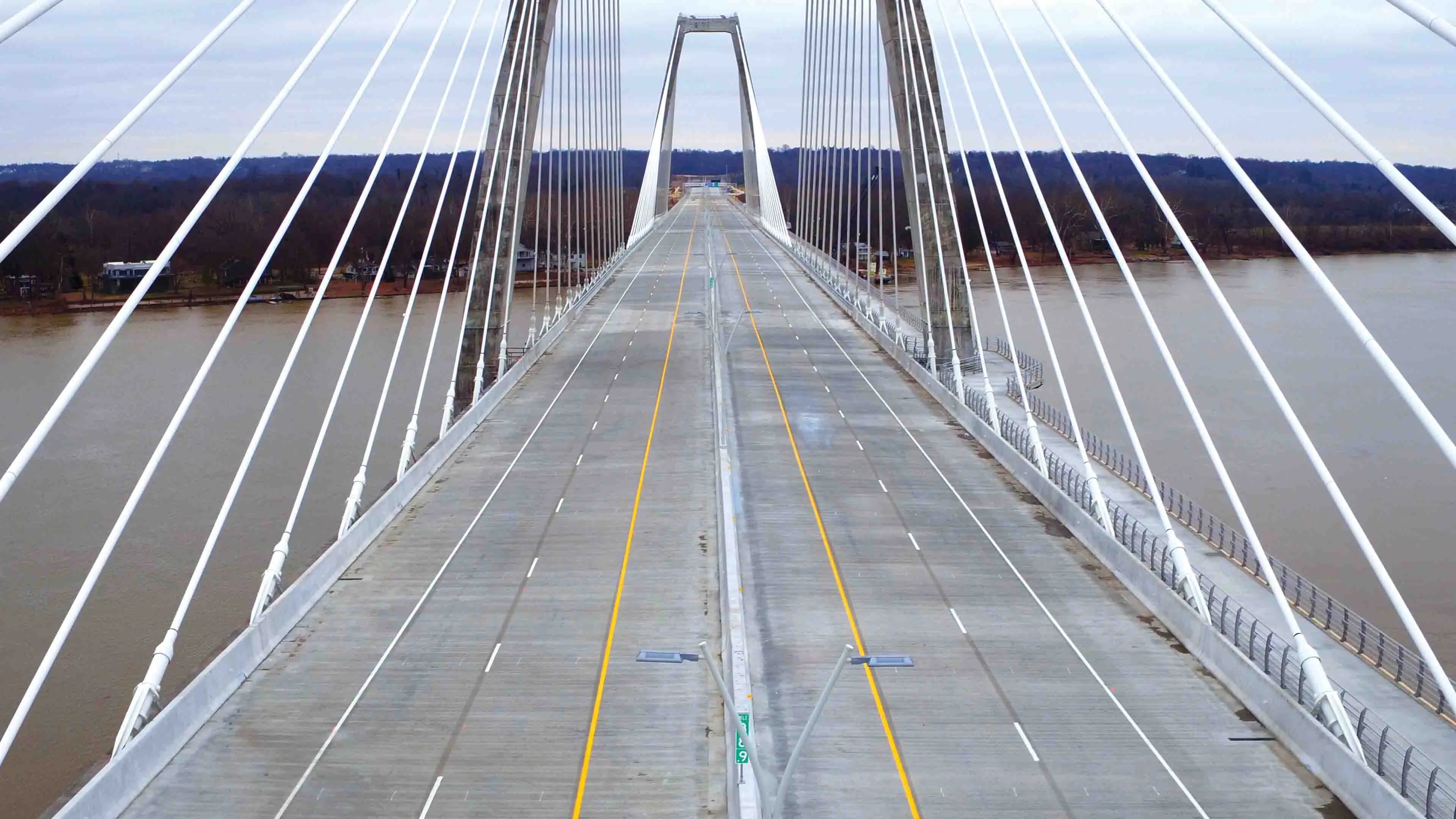

“Basalt’s investment strategy will continue to focus on mid-market infrastructure assets in the energy, transport and utilities sectors in Western Europe and North America,” according to a Basalt statement.

July 6, 2016

Read time: 2 mins

UK-based contractor 1146 Balfour Beatty has exited from Balfour Beatty Infrastructure Partners (BBIP) which has rebranded as Basalt Infrastructure Partners.

Basalt is now an independent fund management business that is 100% owned by the partners of the firm - Rob Gregor, Steven Lowry and Jeff Neil.

“Basalt’s investment strategy will continue to focus on mid-market infrastructure assets in the energy, transport and utilities sectors in Western Europe and North America,” according to a Basalt statement.

Basalt investments include McEwan Power, Wightlink Ferries, Alkane Energy, Upper Peninsula Power Company, Texas Microgrid and a Spanish transportation deal. Basalt has offices in London, Munich and New York.

BBIP was set up in November 2010 as an independently managed infrastructure management business focusing on secondary opportunities and is run at arm’s length to Balfour Beatty’s Investments portfolio.

In addition, Balfour Beatty has disposed of its entire interest in Balfour Beatty Infrastructure Partners LP, the infrastructure fund advised by BBIP.

It said its interest had been sold to businesses controlled by investment management firm Wafra Investment Advisory Group for US$64.4 million. The proceeds of the transaction will be retained within the Balfour Beatty Group.

“Our exit from BBIP and sale of the Fund interest further simplifies the Group and maintains our existing balance sheet strength,” said Balfour Beatty chief executive Leo Quinn. “Exiting the infrastructure fund management market will allow our core infrastructure investments business to focus entirely on its highly successful primary investments portfolio which also offers further downstream opportunities for the Balfour Beatty Group”.

Basalt is now an independent fund management business that is 100% owned by the partners of the firm - Rob Gregor, Steven Lowry and Jeff Neil.

“Basalt’s investment strategy will continue to focus on mid-market infrastructure assets in the energy, transport and utilities sectors in Western Europe and North America,” according to a Basalt statement.

Basalt investments include McEwan Power, Wightlink Ferries, Alkane Energy, Upper Peninsula Power Company, Texas Microgrid and a Spanish transportation deal. Basalt has offices in London, Munich and New York.

BBIP was set up in November 2010 as an independently managed infrastructure management business focusing on secondary opportunities and is run at arm’s length to Balfour Beatty’s Investments portfolio.

In addition, Balfour Beatty has disposed of its entire interest in Balfour Beatty Infrastructure Partners LP, the infrastructure fund advised by BBIP.

It said its interest had been sold to businesses controlled by investment management firm Wafra Investment Advisory Group for US$64.4 million. The proceeds of the transaction will be retained within the Balfour Beatty Group.

“Our exit from BBIP and sale of the Fund interest further simplifies the Group and maintains our existing balance sheet strength,” said Balfour Beatty chief executive Leo Quinn. “Exiting the infrastructure fund management market will allow our core infrastructure investments business to focus entirely on its highly successful primary investments portfolio which also offers further downstream opportunities for the Balfour Beatty Group”.