Cummins is benefiting from strong results in Q3.

By MJ Woof

November 5, 2021

Read time: 2 mins

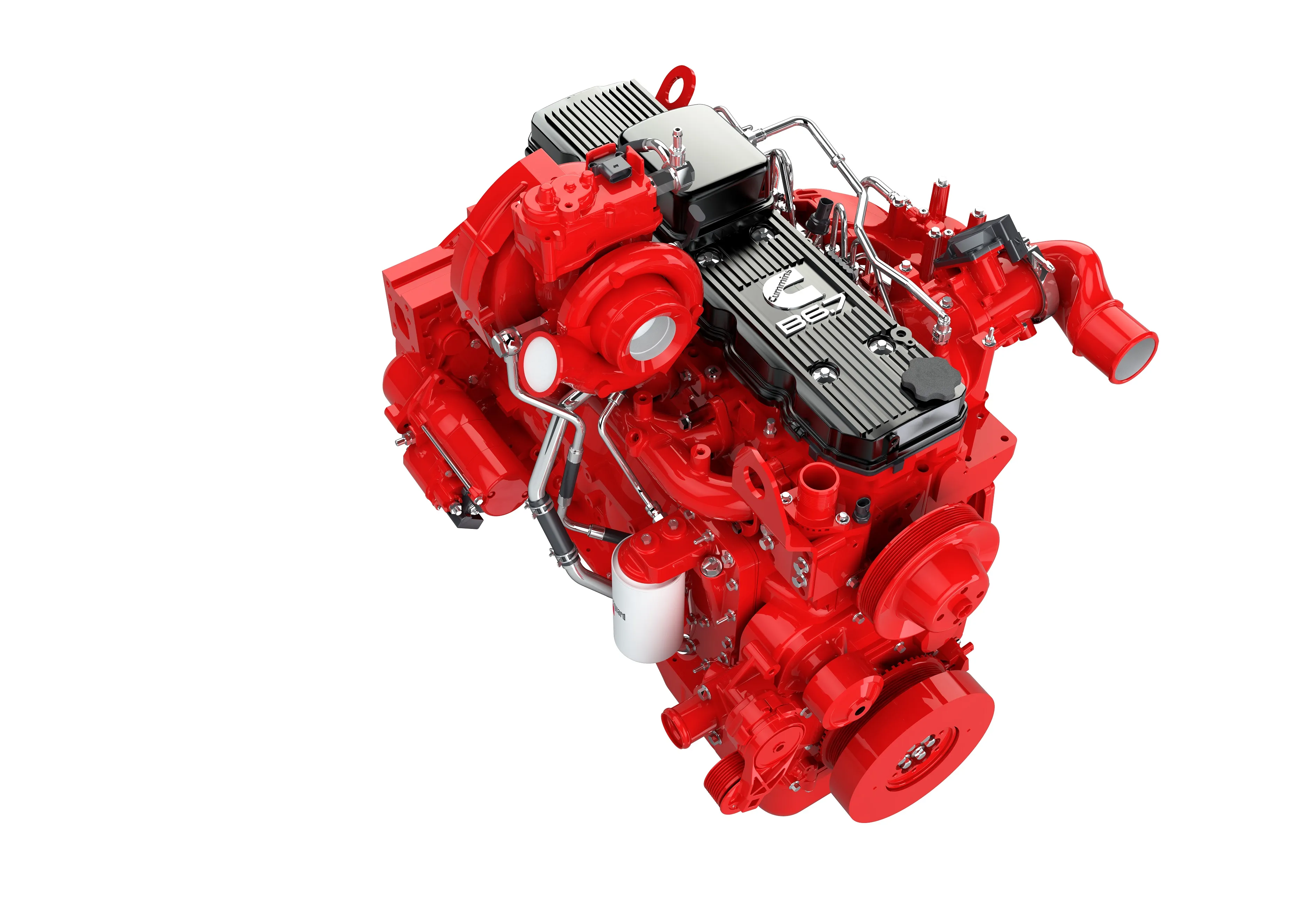

Engine manufacturer Cummins reports strong third quarter revenues of US$6 billion, an increase of 17% from the same quarter in 2020. Sales in North America increased 13% while international revenues increased 22%. This was driven by strong demand across all global markets, outside of China, when compared to the same quarter in 2020.

“Demand remained strong in the third quarter as the global economy continued to improve, driving strong sales growth across most businesses and regions outside of China, which is moderating in line with expectations,” said chairman and CEO Tom Linebarger.

“Economic trends such as order activity, freight rates, and used equipment prices remain robust across a number of our key end markets which points to strong demand extending into 2022 and beyond. Cummins is well positioned to benefit as these markets gain momentum as we continue to see orders for our products outpace our competition. Despite this strong demand, supply chain constraints continue to impact our business as well as our customers’, resulting in rising material costs, elevated logistics expenses, and other manufacturing inefficiencies and capping revenue below our expectations three months ago."

Earnings before interest, taxes, depreciation and amortisation (EBITDA) in the third quarter was $862 million (14.4% of sales), compared to $876 million (17.1% of sales) a year ago. Net income attributable to Cummins in the third quarter was $534 million ($3.69/diluted share) compared to $501 million ($3.36/diluted share) in 2020.

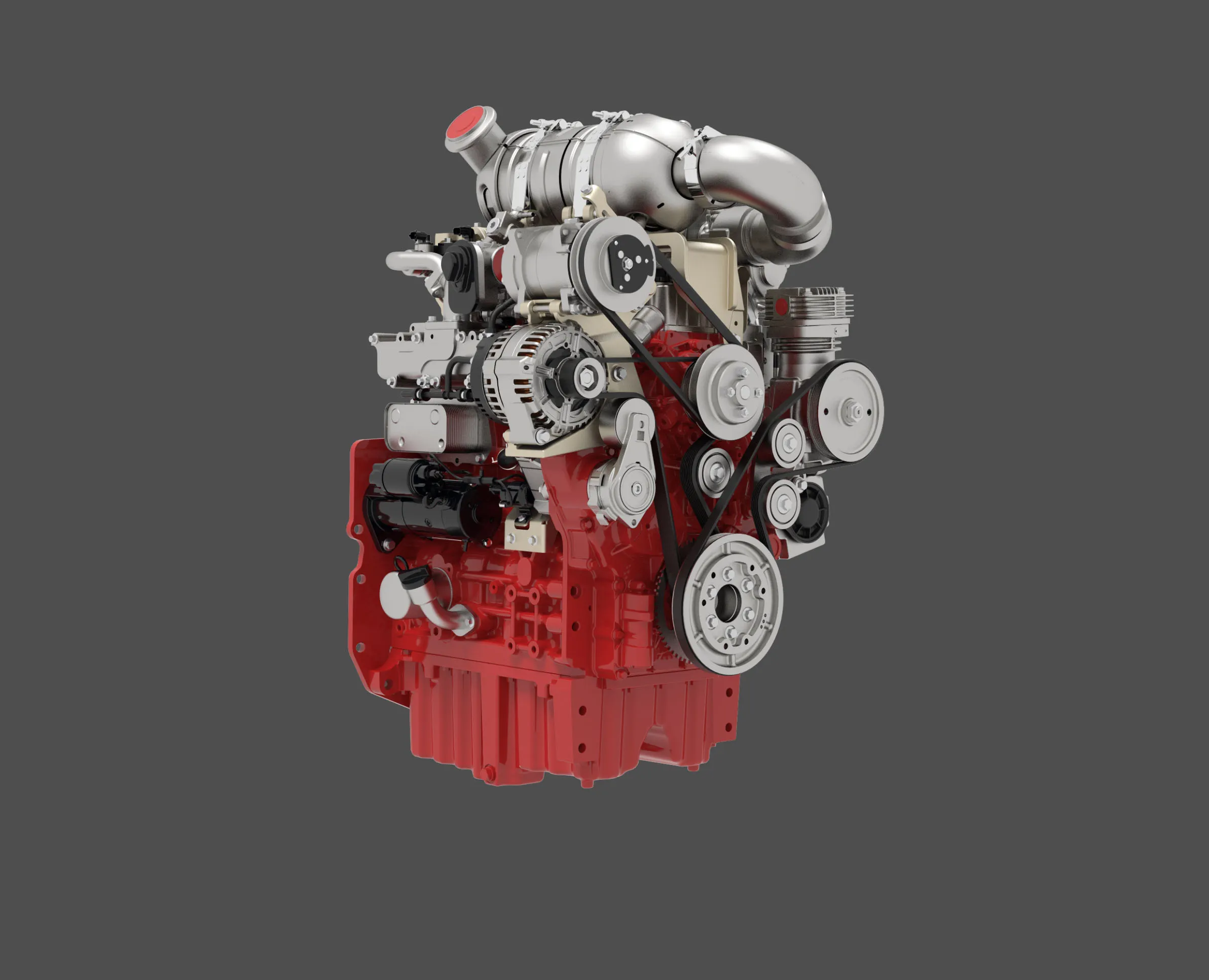

The firm has made some key announcements in the third quarter, such as the plans to market a 15litre natural gas engine for heavy-duty trucks. The natural gas engine is an important part of the firm’s strategy for its path to zero emissions. The strategy focuses on new powertrains including advanced diesel, natural gas, hydrogen engines, hybrids, battery electric, and fuel cells along with an increased use of low carbon fuels and renewable electricity and related infrastructure.

The company also announced that it will launch a set of software features to integrate its powertrains with Automated Driving System (ADS) technologies. With these new software features, Cummins will extend these core capabilities into the ADS space as well. Cummins is actively testing more than 100 vehicles in coordination with ADS technology companies to ensure seamless powertrain integration as ADS solutions enter commercial vehicle markets globally.

Cummins received two awards, totalling nearly $7 million, from the US Department of Energy for continued work on enhancing the economic viability of fuel cell powertrain solutions for heavy-duty applications. The programme will drive the scale and investment needed to allow for faster adoption of hydrogen fuel cell technologies.