Dr Joerg Stratmann, CEO of Rolls-Royce Power Systems said: “This deal follows the realignment of our strategy to focus on the supply and maintenance of engines and systems primarily from our own production. We are handing over a good business, an excellent customer base and a strong team.”

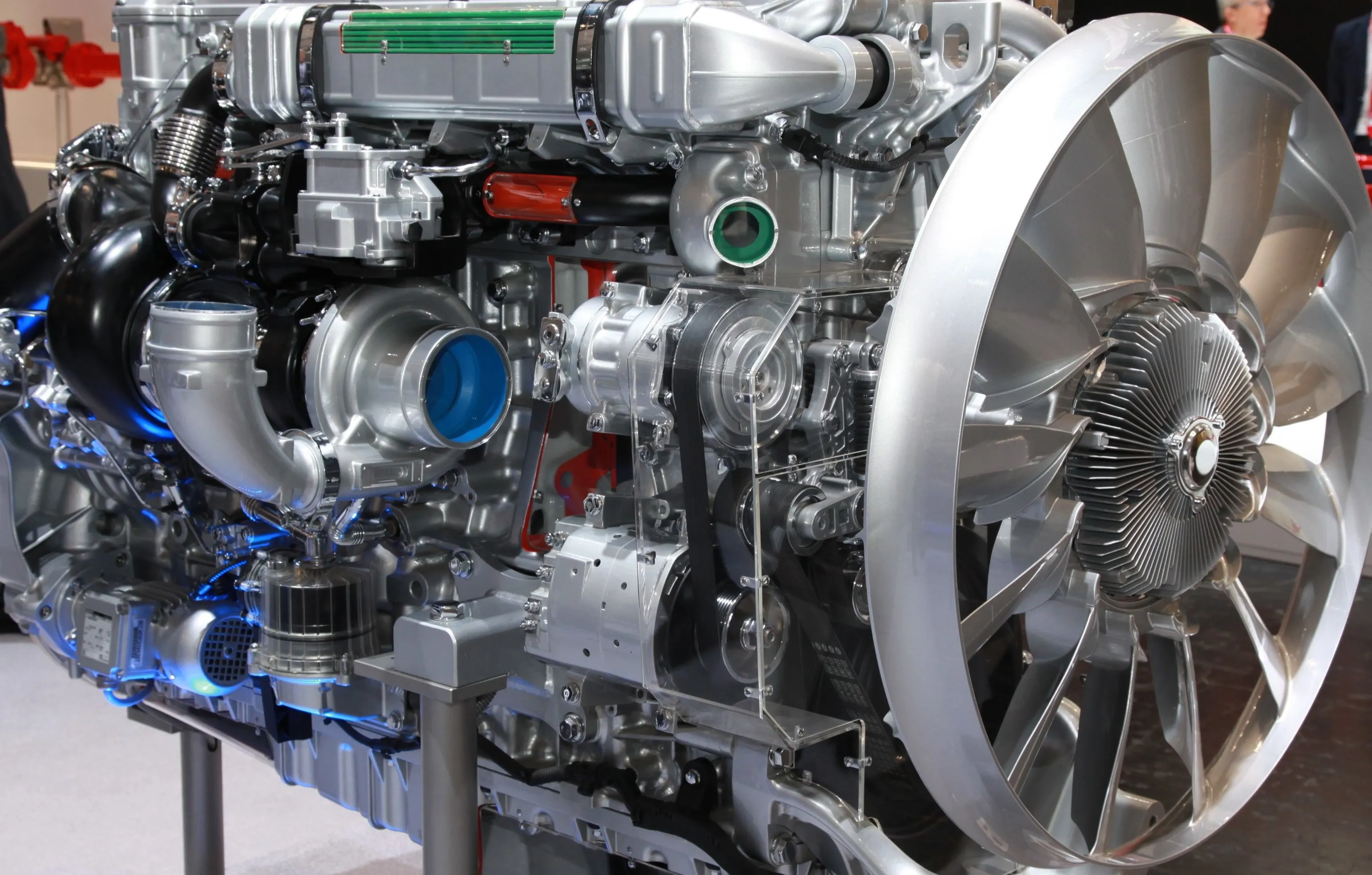

As a result of the transaction, Deutz will take over the distribution of the mtu Classic series in the lower power range and the mtu engine series 1000 to 1500, which are based on three Daimler Truck engine platforms. These engines are in the 5-16litre displacement class with an output of up to 480kW and used in a variety of off-highway applications.

Meanwhile, Rolls-Royce Power Systems increased its operating results, sales and order intake in the first half of 2024. This was driven in particular by business activities in the power generation segment, with strong demand for data centre equipment, growing governmental business and effective efficiency measures.

Dr Stratmann said: "The strength of our new strategy presented in autumn 2023, with its focus on profitable growth, and the intensive commitment of teams throughout the company is reflected in these positive business figures. This half-year result confirms our strategic course. At the same time, we are creating the financial basis to position ourselves for the future: for the first time in 20 years, we are developing a new mtu engine platform. The triple-digit million euro amount that we will be investing in this over the coming years, underlines our confidence in this technology and its contribution to a successful energy transition. We are convinced that we will create clear added value for our customers with the new mtu engine platform and set new standards in our industry."

Order intake was €2.8bn* (£2.4bn*), 26% up versus the prior period, with a book-to-bill ratio of 1.3x. Underlying revenue was €2.2bn (£1.8bn), an increase of 6% versus the prior period. Underlying operating profit grew by 56% to €222m (£189m), underlying operating margin rose by 3.3pts to 10.3% (H1 2023: 7.0%). The increase in underlying operating profit reflects continued commercial optimisation benefits, across all categories, notably in Power Generation, and cost efficiencies. A higher underlying operating profit margin in H2 2024, reflecting the typical seasonality of the business is expected.

Trading cash flow was €142m (£121m) with a conversion ratio of 64% versus €24m (£22m) and 18% last year. The increase in trading cash flow was mainly due to increased operating profit.