The first engines built in the Chinese joint venture facility established by Cummins and LiuGong are now rolling off the production line. The factory, located in Liuzhou in Guangxi Province, is part of a 50:50 partnership between the two companies called Guangxi Cummins Engine Company. The facility is now making L9.3 engines to meet the demand of both LiuGong and other Chinese equipment manufacturers. The engine is available in multiple versions to meet various off-road emissions standards and has been deve

March 18, 2013

Read time: 2 mins

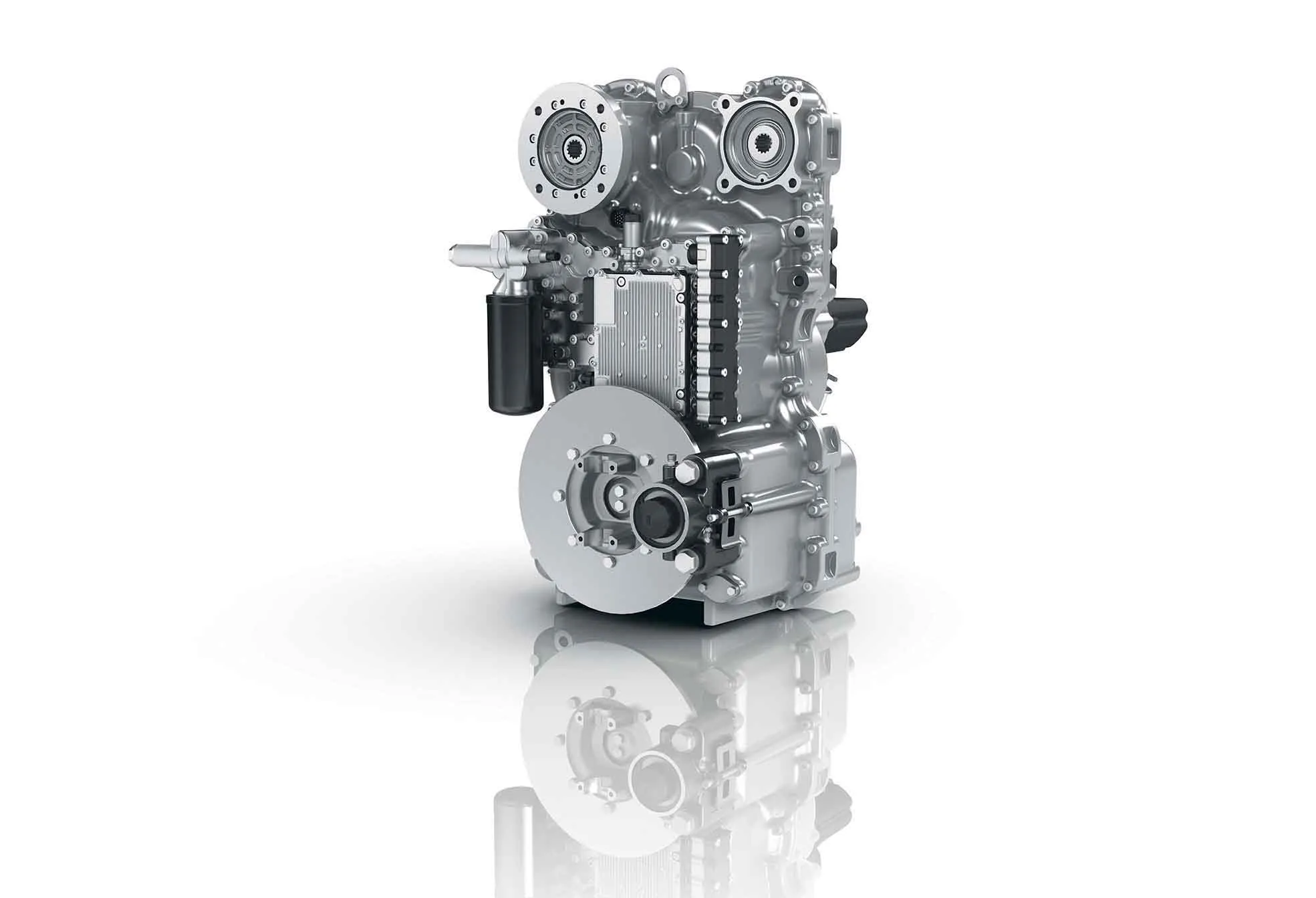

The first engines built in the Chinese joint venture facility established by 196 Cummins and 269 LiuGong are now rolling off the production line. The factory, located in Liuzhou in Guangxi Province, is part of a 50:50 partnership between the two companies called Guangxi Cummins Engine Company. The facility is now making L9.3 engines to meet the demand of both LiuGong and other Chinese equipment manufacturers. The engine is available in multiple versions to meet various off-road emissions standards and has been developed in China from the existing Cummins L8.9 diesel. With a power rating of 162kW, this engine is said to deliver good low-end torque for wheel-loader applications with a 5tonne bucket load. Its performance has been specially designed for wheeled loaders, with strong power delivery, fast response and operational efficiency. The optimised components and engine features are said to be engineered to deliver high reliability, improved fuel efficiency and performance for off-highway customers.

Guangxi Cummins is the first Cummins manufacturing facility in China dedicated to providing power for the construction machinery market. It is also one of the largest production facilities for off-highway diesel engines in China. The total investment on the company exceeds US$160 million. Covering an area of 200,000m2, the initial production capacity is expected to reach 50,000 units/year, with the ability to increase the volume when market demands increase.

Guangxi Cummins is the first Cummins manufacturing facility in China dedicated to providing power for the construction machinery market. It is also one of the largest production facilities for off-highway diesel engines in China. The total investment on the company exceeds US$160 million. Covering an area of 200,000m2, the initial production capacity is expected to reach 50,000 units/year, with the ability to increase the volume when market demands increase.