The deal, pending regulatory approval, is expected to be completed by the end of the first quarter 2019 at the latest.

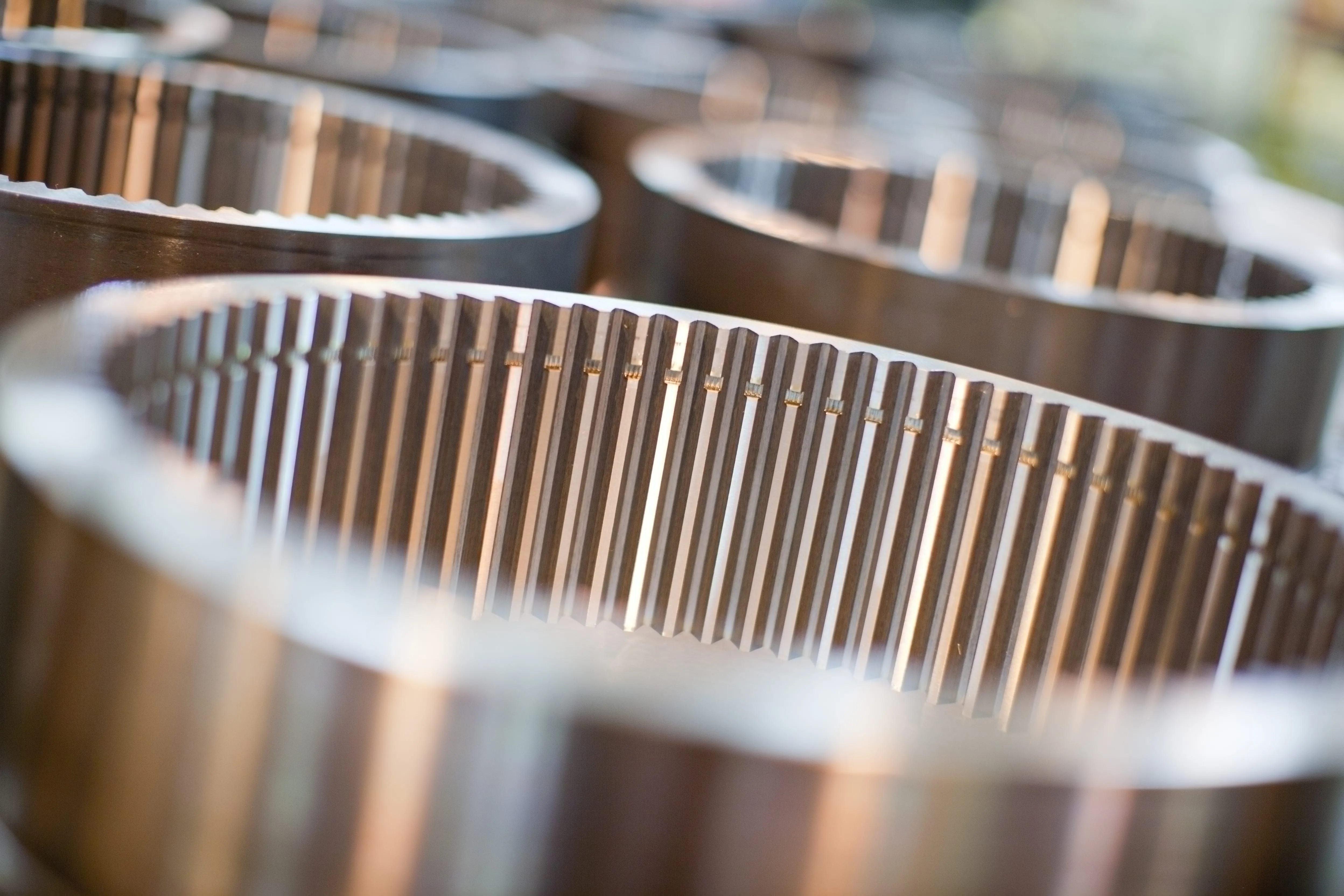

Oerlikon’s drive systems business makes high-precision gears, planetary hub drives for tracked vehicles and products, controls and software that support vehicle electrification across the mobility industry.

Dana is an American worldwide supplier of drivetrain, sealing and thermal-management technologies. The company said in a written statement that the deal “complements and extends Dana’s current technology portfolio, especially with respect to high-precision helical gears for the light- and commercial-vehicle markets and planetary hub drives for tracked vehicles in the off-highway market”.

The purchase also “provides products, controls, and software that support vehicle electrification in each of Dana’s end markets – light vehicle, commercial vehicle and off-highway”.

The addition of the Oerlikon’s drive business - with its brands Oerlikon Graziano and Oerlikon Fairfield - to the Dana portfolio brings growth opportunities especially in China and India, as well as the US. It also adds five research and development facilities to Dana’s network of technology centres.

Importantly, the deal “will deliver significant long-term value by accelerating our commitment to vehicle electrification… while further expanding and balancing the manufacturing presence of our off-highway business in key geographical markets”, said Jim Kamsickas, chief executive of Dana.

Dana is based in Maumee, in the US state of Ohio, and reported sales of $7.2 billion in 2017.