World events are driving the new focus on fuel economy for diesel engine development Spiralling fuel prices have put a new spin on technological developments in the engine and driveline sector. Recent legislation has been pushing manufacturers to develop cleaner running engines that are quieter and offer drastic reductions in exhaust emissions. For the engine and driveline manufacturers, research and development aimed at reducing engine fuel consumption is in hand but the market conditions have placed fresh

July 20, 2012

Read time: 4 mins

World events are driving the new focus on fuel economy for diesel engine development

Spiralling fuel prices have put a new spin on technological developments in the engine and driveline sector. Recent legislation has been pushing manufacturers to develop cleaner running engines that are quieter and offer drastic reductions in exhaust emissions.For the engine and driveline manufacturers, research and development aimed at reducing engine fuel consumption is in hand but the market conditions have placed fresh emphasis on this work.

The coming Tier 4 emissions legislation due in the 130-560kW powerband for 2011 is pushing a huge swathe of technological development and in terms of equipment design, it will have major implications. Continued development of these same technologies will be employed for Tier 4 Final in 2014, when NOx will need to reduce to near-zero levels.

Tighter legislation on engine emissions will result in a need for exhaust after-treatment technology as well as engines that run hotter and require more cooling. How this will be achieved varies depending on the specific technologies the firms are adopting. The current generation of machines have compact engine housings providing good visibility, but manufacturers will have to allow for the potentially bulky after-treatment technology as well as increased cooling equipment.

An important focus for all of the engine suppliers is the need to minimise installation issues. Keeping the engines as compact as possible will reduce the problems faced by equipment manufacturers when trying to slot the power units into existing chassis. Standardised engine, after-treatment and air intake packages will help to cut installation times.

Because

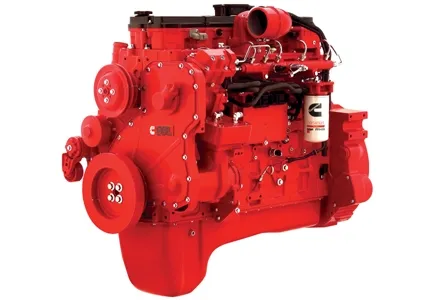

Technical solutions are well in hand with regard to exhaust emission and noise reduction and Cummins has already exhibited a concept diesel designed to meet the Tier 4 requirements. The company has said it will use a combination of particulate filters and cooled exhaust gas recirculation (EGR) to meet the Tier 4/Stage IIIB emissions legislation. The core technology will be a particulate filter and the EGR system, providing an integrated solution extending from air intake to exhaust after-treatment. The firm is also planning its sophisticated variable geometry turbochargers, advanced electronic controls and the latest high pressure, common rail fuel systems. Much of the Tier 4/Stage IIIB emissions technology used on the mid-range QSB to the heavy-duty QSX engines will be broadly similar. Notably, the improved product range will maintain or increase power outputs in comparison with the current Tier 3/Stage IIIB engines while fuel efficiency will increase by up to 5%, depending on the application.

Because the firm has already used many of these technologies in the on-highway sector, Cummins believes its off-highway diesels will provide all the performance requirements needed by the legislation. A package of engine combustion solutions will be used with the

after-treatment filter to reduce particulate matter (PM) emissions levels by 90%, while cooled EGR means the required 45% reduction in oxides of nitrogen (NOx) can be reached.

Part of the Caterpillar group,

increasing the power and range for Tier 4 Interim/EU Stage IIIB and EPA Tier 4 Interim engines. The revised Perkins range will offer an array of power solutions for individual customer needs and the firm says that customers will be able to select compact diesels that deliver greater power density to suit specific requirements. The top-of-the-range will be the all-new 1200 Series, which will extend Perkins Interim Tier 4 power offering up to 243kW. The first engines planned for launch in 2010 will have a 7litre capacity, followed in 2011 by 6.6litre and 4.4litre units.

These engines have been developed through intensive collaborative design programmes with customers.

However, Perkins is working to provide OEMs with a tailored emissions solution through a combination of technologies which will change depending on power band. The company says that for Tier 4 it will offer a compact product range that will deliver increased power density, improved flexibility and better fuel efficiency.