Infrastructure services contractor FM Conway has signed a deal to supply Nynas, a UK provider of bitumen binder, with bitumen from its recently rebuilt Imperial Wharf terminal.

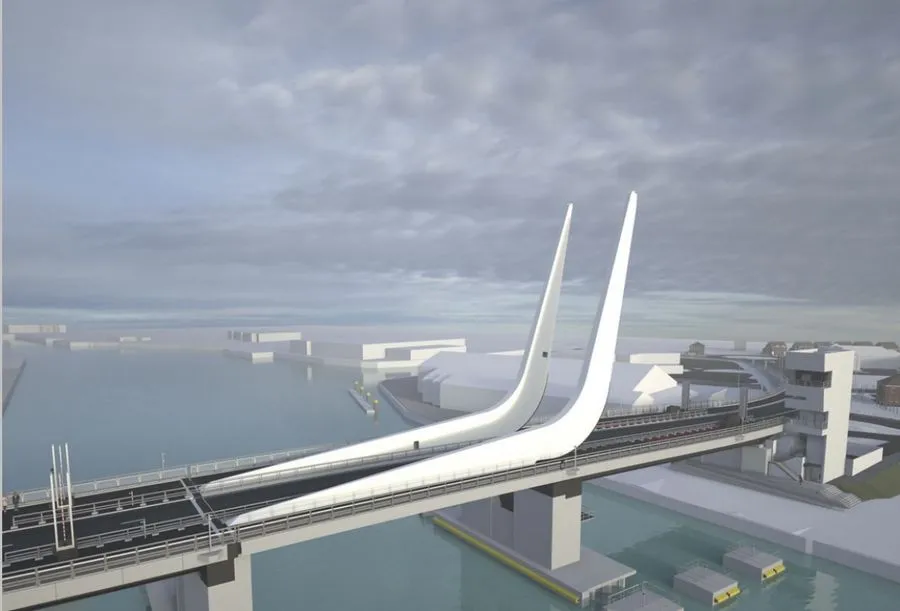

The facility is on the River Thames in the town of Gravesend, near the mouth of the river and down river from London.

FM Conway invested around €3.5 million to refurbish the terminal which was finished last September. The terminal has the capacity to dock and store up to 7,500tonnes of bitumen.

Under the deal, Nynas will bas

April 15, 2015

Read time: 3 mins

Infrastructure services contractor FM 2329 Conway has signed a deal to supply 294 Nynas, a UK provider of bitumen binder, with bitumen from its recently rebuilt Imperial Wharf terminal.

The facility is on the River Thames in the town of Gravesend, near the mouth of the river and down river from London.

FM Conway invested around €3.5 million to refurbish the terminal which was finished last September. The terminal has the capacity to dock and store up to 7,500tonnes of bitumen.

Under the deal, Nynas will base bitumen tankers permanently at the terminal for delivery to key locations in London and across the south of England.

Conway said the deal gives Nynas “a secure, cost-effective source of bitumen” in the south east of the UK, complementing its existing facilities in the Wirral, Dundee and Teesside.

FM Conway, established more than 50 years ago, has its own recycling facility at Dartford and an asphalt plant in Erith, both towns upstream from the renovated Imperial Wharf terminal facility.

David Smith, development director at FM Conway, said: “Achieving cost and carbon-efficiency when supplying projects in the south of England has always been challenging for our industry, with many sources of key materials located in the Midlands or the north.”

“This new supply point means we can respond more rapidly to our clients’ needs, in particular in urgent and emergency situations,” said Keith Sherlock, commercial director at Nynas. “It also makes the transport of bitumen to southern England sites far more cost-effective and environmentally friendly, which is crucial for us in the long term.”

Nynas manufactures its products at refineries in Europe as well as North and South America. Three of their facilities – Nynäshamn and Gothenburg in Sweden and Harburg in Germany – are owned by Nynas. The refinery in Eastham, in the UK, is a joint venture with Shell.

In January 2014, Nynas took over a base oil plant in Harburg with an annual production of specialty oils up to 355,000tonnes. This represents a 40% increase in the company's supply capability of naphthenic specialty oils.

Other Nynas production plants, such as in Antwerp in Belgium, are linked to the company through cooperation agreements. Nynas also has access to refining capacity in the Netherlands Antilles.

The facility is on the River Thames in the town of Gravesend, near the mouth of the river and down river from London.

FM Conway invested around €3.5 million to refurbish the terminal which was finished last September. The terminal has the capacity to dock and store up to 7,500tonnes of bitumen.

Under the deal, Nynas will base bitumen tankers permanently at the terminal for delivery to key locations in London and across the south of England.

Conway said the deal gives Nynas “a secure, cost-effective source of bitumen” in the south east of the UK, complementing its existing facilities in the Wirral, Dundee and Teesside.

FM Conway, established more than 50 years ago, has its own recycling facility at Dartford and an asphalt plant in Erith, both towns upstream from the renovated Imperial Wharf terminal facility.

David Smith, development director at FM Conway, said: “Achieving cost and carbon-efficiency when supplying projects in the south of England has always been challenging for our industry, with many sources of key materials located in the Midlands or the north.”

“This new supply point means we can respond more rapidly to our clients’ needs, in particular in urgent and emergency situations,” said Keith Sherlock, commercial director at Nynas. “It also makes the transport of bitumen to southern England sites far more cost-effective and environmentally friendly, which is crucial for us in the long term.”

Nynas manufactures its products at refineries in Europe as well as North and South America. Three of their facilities – Nynäshamn and Gothenburg in Sweden and Harburg in Germany – are owned by Nynas. The refinery in Eastham, in the UK, is a joint venture with Shell.

In January 2014, Nynas took over a base oil plant in Harburg with an annual production of specialty oils up to 355,000tonnes. This represents a 40% increase in the company's supply capability of naphthenic specialty oils.

Other Nynas production plants, such as in Antwerp in Belgium, are linked to the company through cooperation agreements. Nynas also has access to refining capacity in the Netherlands Antilles.