MWV Specialty Chemicals is being renamed Ingevity. The MWV Specialty Chemicals division of WestRock Company is being renamed in the run up to being spun off as an independent, publicly-traded company around the end of the year.

“Ingevity is a unique expression of our purpose – to turn our customers’ complex challenges into powerful possibilities,” said Ed Rose, president, MWV Specialty Chemicals. “Our announcement is the first step in a comprehensive plan to launch our brand, and define our future as a

July 20, 2015

Read time: 2 mins

“Ingevity is a unique expression of our purpose – to turn our customers’ complex challenges into powerful possibilities,” said Ed Rose, president, MWV Specialty Chemicals. “Our announcement is the first step in a comprehensive plan to launch our brand, and define our future as a separate and independent company that will be better positioned to profitably grow in our targeted markets.”

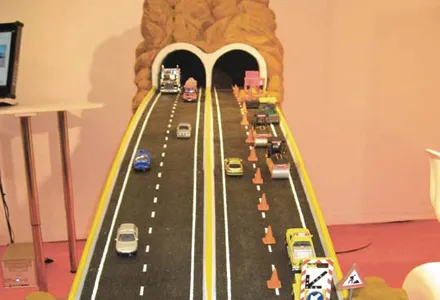

The Specialty Chemicals division develops and delivers high performance chemicals and materials that make a real difference in the real world – enabling oil to flow better, colours to shine brighter, roads to last longer and air to breathe cleaner. With a history of innovation spanning over 100 years, the division generates industry leading returns by exceeding the performance expectations of its customers across the mega-trend aligned markets of energy, infrastructure and transportation.

The separation is expected to be executed by means of a tax-free spinoff of the Specialty Chemicals business to shareholders of WestRock Company, resulting in two independent, publicly traded companies. The spinoff is expected to be completed around the end of the calendar year, subject to customary conditions.