From the beginning of this year, a new law to limit sulphur emissions from ships came into force, courtesy of the International Maritime Organisation (IMO). The allowable sulphur content of fuel oil is now 0.5%, down from 3.5%.

Some ships have complied by installing scrubbers on their exhausts which allow them to continue using high sulphur fuel oil (HSFO). But this accounts for a very small proportion of the global shipping fleet. Commodity price reporting agency Argus estimates just 3% of the world’s 45,000 vessels have scrubbers. The rest will have to switch to low sulphur fuel oil.

The impacts for the bitumen market are two-fold. Pricing will change and supply patterns will change.

“Bitumen has always been priced against 3.5% HSFO, but because HSFO prices are sinking, the bitumen prices are dislocating,” says Jonathan Weston, editor of Argus’ bitumen report (see graph).

Uncertainty over how bitumen prices will move creates difficulties for those buying and tendering for highways contracts. Road contractors will be unwilling to commit to prices for projects that are scheduled in the future or which will stretch over several years.

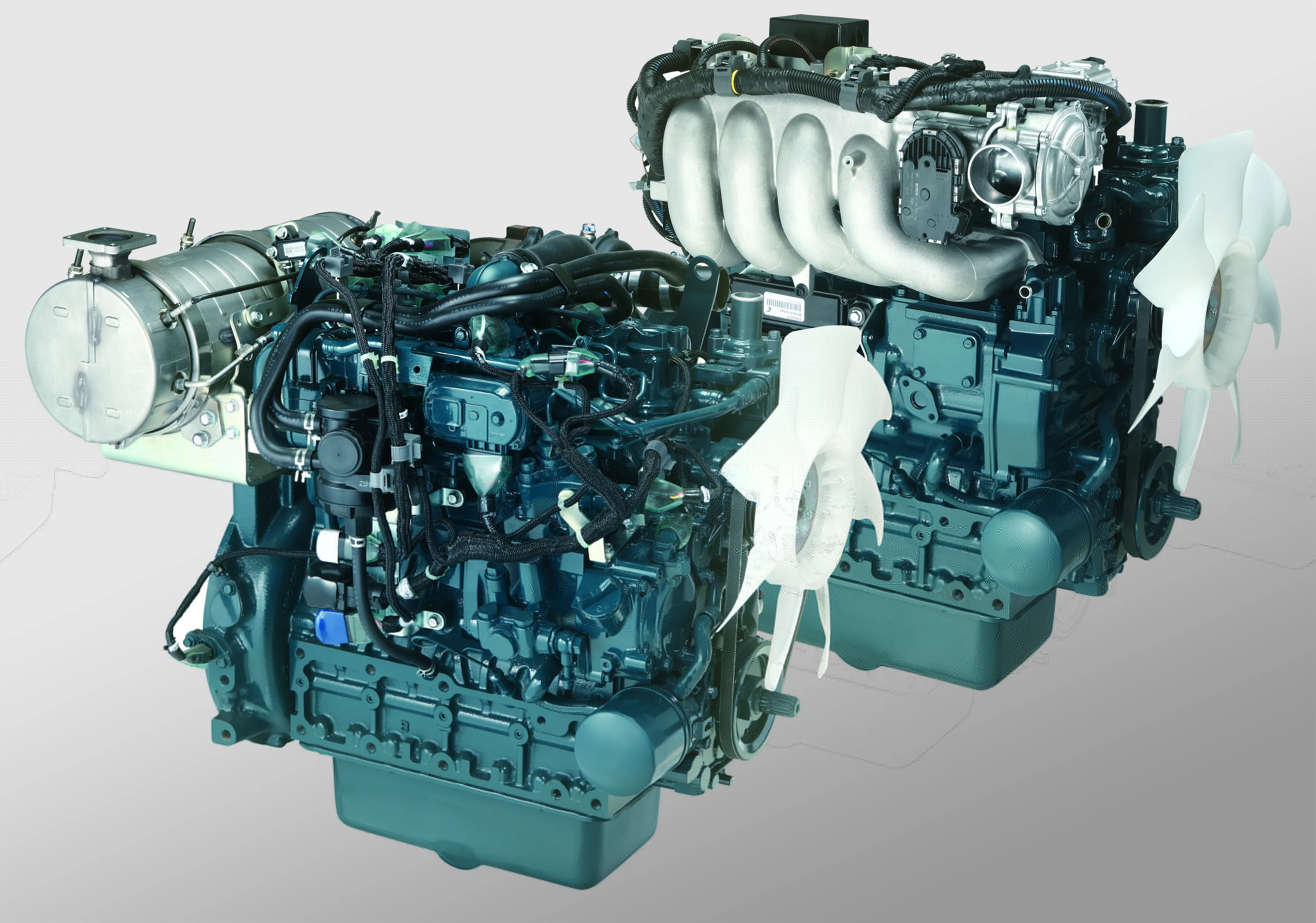

It is not clear yet how IMO rules will impact on bitumen production. Some refineries have already changed to meet the demand for low sulphur fuel oils. This involves switching to lighter, sweeter crudes which do not produce the heavy residues used to make bitumen. Some refineries have upgraded with hydrocracking and coking units in order to produce lighter, more profitable products.

“It may be that rather than produce high sulphur fuel oil, some refineries switch to producing bitumen,” says Weston. It is economics which will make these decisions. Will bitumen prices support these refineries to continue?

Woes for Nynas

The past decade has seen a spate of older refineries closing in northern Europe, a trend that continued last year, because they did not stack up financially. Supply in this region could also be impacted in the short term by the problems that specialist bitumen supplier Nynas is facing.

A joint venture between Neste Oil of Finland and Venezuela’s PdV, Nynas has faced problems due to last year’s US-imposed sanctions on Venezuela. “Nynas has had difficulty getting hold of the Venezuelan crude to produce bitumen,” explains Weston. “Their refineries are set up to use a certain crude slate. Only around 10% of crudes are suitable for bitumen production. As well as the alternatives costing more, they require expensive changes to plant too.”

Having struggled with profitability, Nynas announced last December that it was looking to reorganise the business within a three-month period imposed by administrators. Weston believes that “it seems likely that there will be sales of parts of the business”.

He says that he impact of bitumen pricing’s dislocation from high sulphur fuel oil and any impacts from changes to Nynas’ bitumen production won’t be felt in Europe until the warmer weather and the paving season arrives. Bitumen could simply come to northern Europe from the Mediterranean where Spain, Greece and Italy have been producing more than they need, given their depressed economies.

However, demand for bitumen in the Mediterranean is starting to rise and bitumen produced there has been travelling further afield, as price differences between global regions make viable these long journeys of the product. This is even with the great expense of huge bitumen tankers that need to heat the bitumen during transport. Another possibility could be that Russian bitumen comes to northern Europe - if Russia continues to improve its infrastructure for bitumen. Trader Trafigura exported its first bulk cargo of bitumen in years from Russia to Europe in last October.

As the world emerges from the Covid pandemic and traumatised national economies reboot, changes to bitumen pricing will become more clear.