Kenya’s demand for bitumen products is set to increase with recent budget allocations for construction of new roads, ports and airports and for maintenance of existing transport infrastructure. The country’s economic growth rose from 5.3% in 2014 to 5.5% in 2015 and is projected to hit 6% and 6.4% in 2016 and 2017 respectively according to the

For example, National Treasury Cabinet Secretary Henry Rotich has proposed in the 2017/2018 the construction of 1,138km of low volume seal roads (LVSR) to boost rural connectivity, 1,768km of new paved roads and rehabilitation of a further 224km.

Road construction, rehabilitation and maintenance are expected to consume the highest share of bitumen in Kenya according to speakers at the Road Infrastructure and Investment Congress 2017, held in Nairobi in mid-February by the Bitumen Exchange. This online and live platform connects stakeholders in the bitumen and asphalt industries.

“Demand for bitumen should rise with demand for paving of more roads using the low volume sealed technology,” said Charles Langat, chief executive officer Asphalt Institute of East Africa.

Kenya plans to upgrade up to 3,010km of road using the low volume seal technology which is “cost-effective technology for rural road development” according to the Kenya Roads Board, a State agency which funds, oversees and coordinates the country’s road development, rehabilitation and maintenance.

Langat said research by the Asphalt Institute of East Africa showed that a kilometre of LVSR will require an estimated 21.175tonnes of bitumen. He said for the planned 3,000km, potential bitumen suppliers have an opportunity to supply at least 211,000tonnes of bitumen in five years.

He said pen grades 80/100 in the Kenyan market and the rest of sub Saharan Africa “is becoming a low performer for use.”

There is an emerging trend for the use of pen grades with heavier penetration grades such as 40/50 although Langat said pen grade 60/70 can also be ideal in tropical regions.

Although no figures were immediately available on the latest annual bitumen consumption in Kenya, it has been estimated that East Africa as a region consumed an average of 100,000tonnes annually by 2015.

Construction or expansion of key highways in Kenya is also expected to increase demand for bitumen according to Stanley Kamau, the director of the public private partnership (PPPs) at the National Treasury. The participation of development financial partners and the embracing of the PPP model in road sector development are critical in unlocking financing for the projects which in turn will boost the bitumen market growth.

He said the three-phase 485km Nairobi-Mombasa road is ready for procurement while the 184km Nairobi-Nakuru-Mau Summit road has been moved to procurement phase. Both will be developed under a PPP.

Bitumen Exchange Director Natasha Johnson said PPP projects are catalysts for bitumen market growth but that the manufacturers and suppliers should partner with other road sector stakeholders in Africa.

“For the African bitumen industry to thrive it needs to develop better understanding of what drives inward road investment decisions,” she said.

“Forging new vertical relationships directly with the investor will allow them to make informed decisions on quality and security of the product and spur the industry forward,” said Johnson.

Johnson said the African bitumen industry can only develop if it taps into the development finance institutions which she said: “Significantly improve the bankability of road projects and increase flow of private funding into infrastructure.”

Kenya, just like the rest of East Africa, relies on countries such as Iran, India, Kuwait, Saudi Arabia and the United Arab Emirates for satisfy local demand for bitumen.

With the closure of East Africa’s only and largest refinery, Kenya Petroleum Refineries, Kenya will continue to rely on bitumen imports to meet demand.

Additional demand for bitumen is expected from the ongoing rehabilitation of a number of airports.

However, there are challenges to growth of the bitumen market in Kenya, such as the unregulated nature of the industry.

Participants at the Congress in Nairobi asked the East African governments to ensure taxes are not prohibitive because high taxation increases the price of bitumen and could distort the cost of bitumen and road projects.

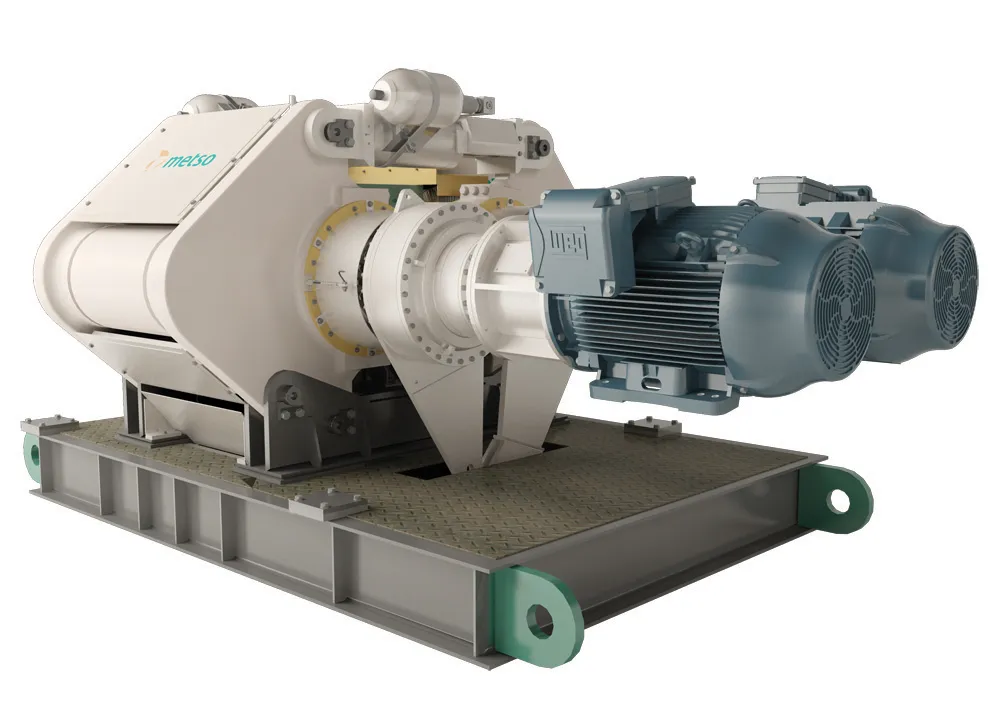

Kenya’s investment opportunities in the bitumen industry include bitu-containers, leasing and hiring of bitumen processing and discharge equipment, supply of emulsion products which are environmentally tolerable and also the establishment of bonded storage reserves especially at the port of Mombasa.