The milling machine market is increasingly competitive - Mike Woof reports

Having been a pioneer of the road milling machine market, it is no surprise that theThe company has faced increasing levels of competition however, with firms such as

In the US, Caterpillar and Roadtec have developed good markets for their machines, while in Europe

He explained that this is a key market segment for the firm and that its current model is the first in the range that was designed and built at the BOMAG factory in Germany. BOMAG is keen to capitalise on demand for milling machines from road repair applications, a market the firm’s 500mm machine is targeted at. However the firm has also been investing in the rest of its milling machine line-up, with the top-of-the-range model being the BM2000/60-2.

This is aimed at high production applications such as highway milling duties. The machine features a 2m wide cutting drum and 168 teeth in standard configuration, although other tooth spacing can be used depending on the application and duty. The BM2000/6-2 can cut to depths from 0-320mm deep and offers cutting advance rates of 0-40m/min, depending on the application, while power comes from a diesel rated at 440kW. Weighing in at 32.5tonnes, the BM2000/60-2 can carry up to 3,300litres of water for minimising dust during its operating cycle.

But the Wirtgen Group is not content to let its competitors reduce its market share in any international territory. Of note is the fact that the firm has recently developed two smaller mills that are specially configured for the needs of Chinese customers.

Built in China at the firm’s plant in Langfang, the W100H and W130H share several features such as a similar chassis design and the 153kW power unit. However the W100H is equipped with a 1m wide drum while the W130H has a 1.3m wide drum. Both machines offer cutting depths from 0-180mm.

Other international companies also manufacture machines in China while others, like Roadtec, have established partnerships with local firms.

Recycling asphalt

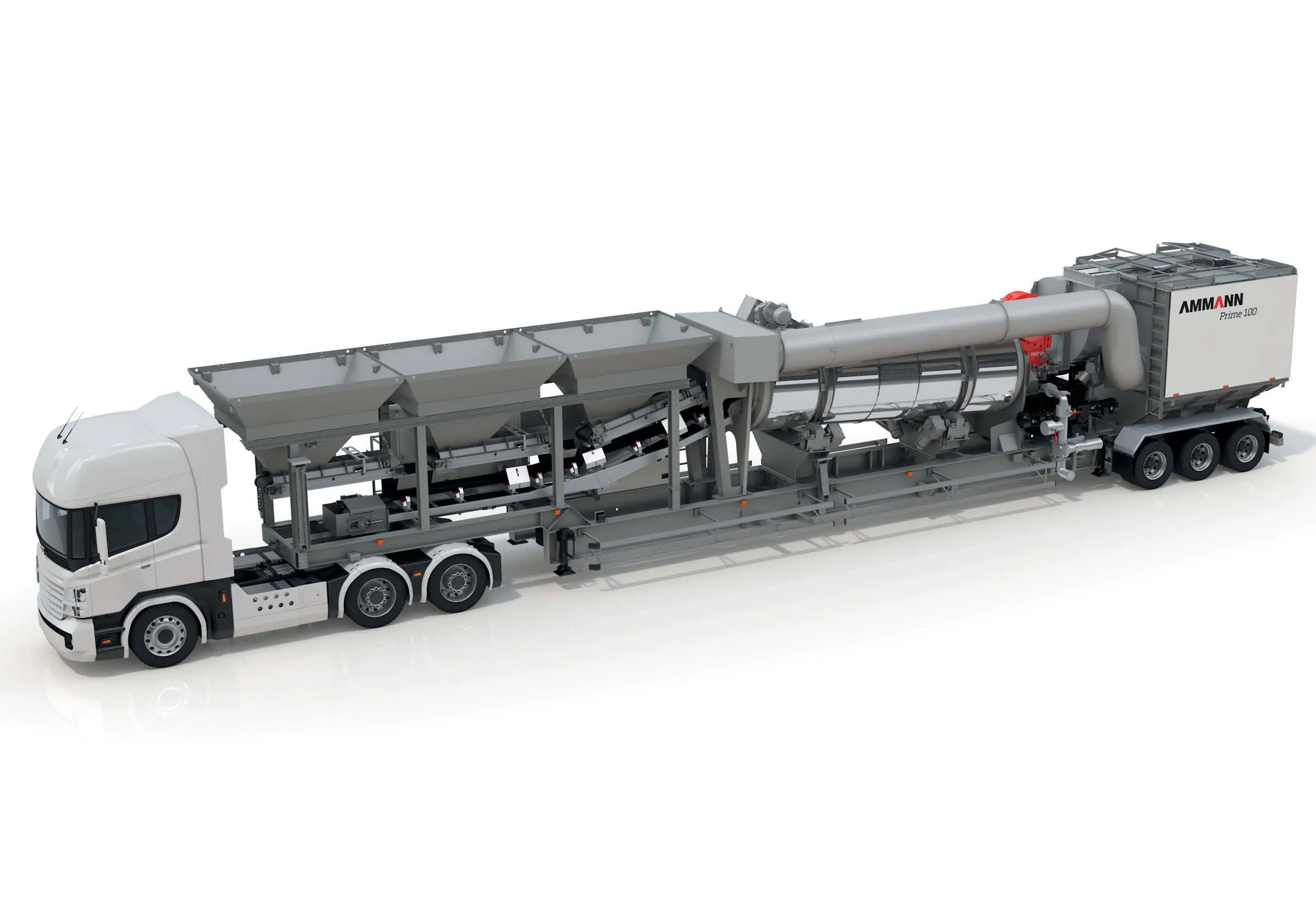

In the UK a specialist contractor, JPCS, is helping Dudley Council reduce paving costs. The firm is now offering a footway recycling solution that avoids costly reconstruction. The process involves removing the existing asphalt and recycling it using a mobile machine.

This new recycled material is laid as a new binder course and then overlaid with a thin surface course. Trials have shown this can reduce costs by 15%, as well as minimising waste and transport needs.

The contractor said that the whole surface of the pavement can be replaced whilst avoiding the costly process of traditional reconstruction, which also means less disruption for residents while improvements are being made.