The

Bonvallet said that Chinese contractors are keen to invest in high quality equipment with better performance and improved working life. The

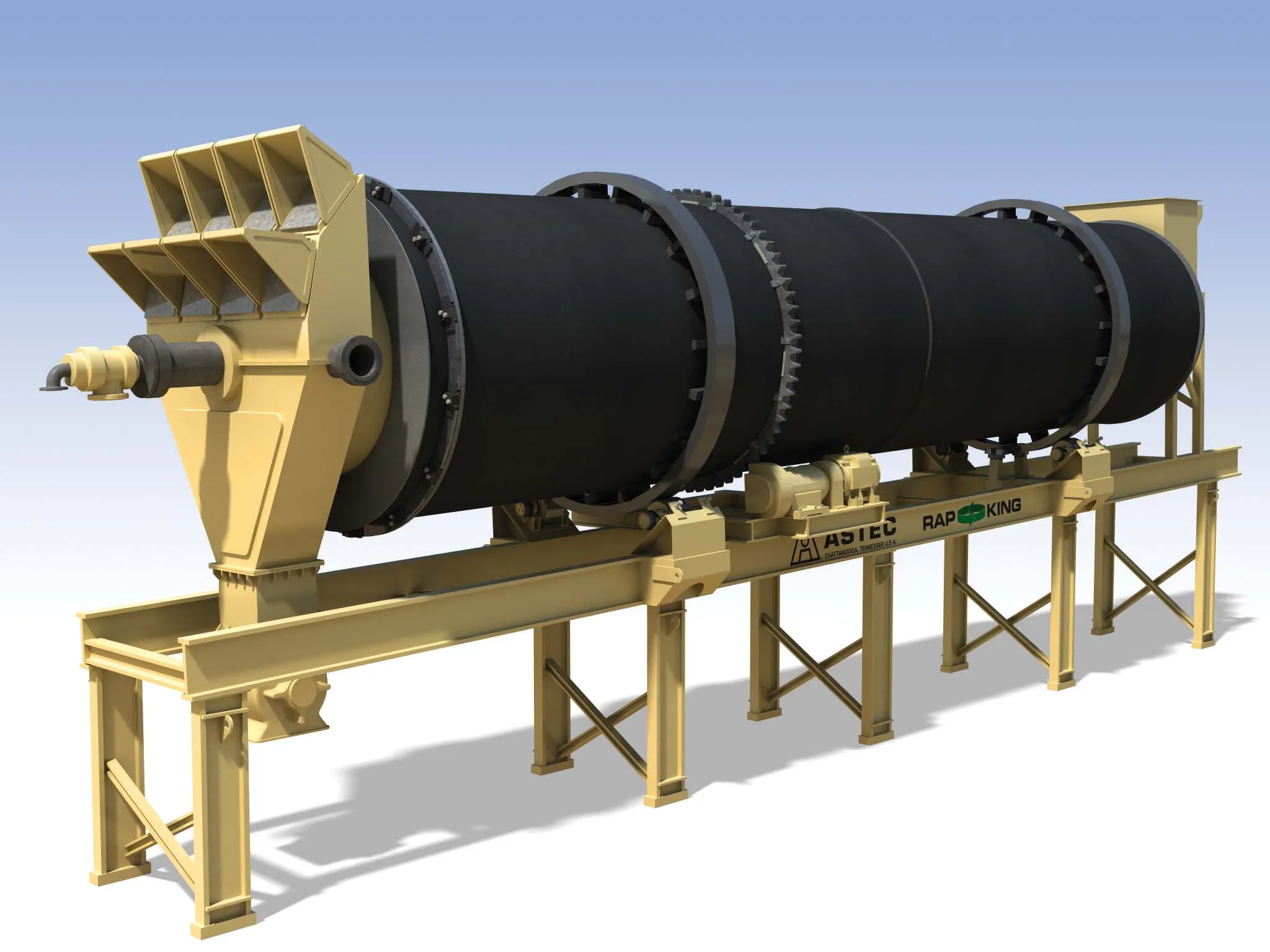

Meanwhile the Chinese Government is also keen to capitalise on developments in asphalt technology, with warm asphalt and recycled asphalt pavement (RAP) systems both now being favoured. The energy savings and the reduction in material wastage have been identified. The Fayat Group is now offering its 6tonne Marini mixer in China for example, as this large unit is well-suited to the longer mix times required for recycled asphalt applications. With RAP stockpiles having reached some 100 million tonnes in China, the authorities identified major cost savings and environmental benefits from using this material in road construction.