SDLG is unveiling a new 5tonne capacity wheeled loader in India. The model launch is significant for SDLG and shows how the firm is keen to capitalise on India’s fast-growing infrastructure sector. “With the Indian Government continuing to invest in infrastructure, the new wheeled loader will be a great fit for heavy-load applications such as material handling, land clearing and general earthmoving,” explained Surat Mehta, head of the SDLG business in India.

The L946 wheeled loader features a 3.5m3 capacity bucket, a maximum 1m dumping distance and is driven by a diesel delivering 129kW. The machine is said to be productive and durable, and is able to offer high capacity in tough working conditions, according to the firm.

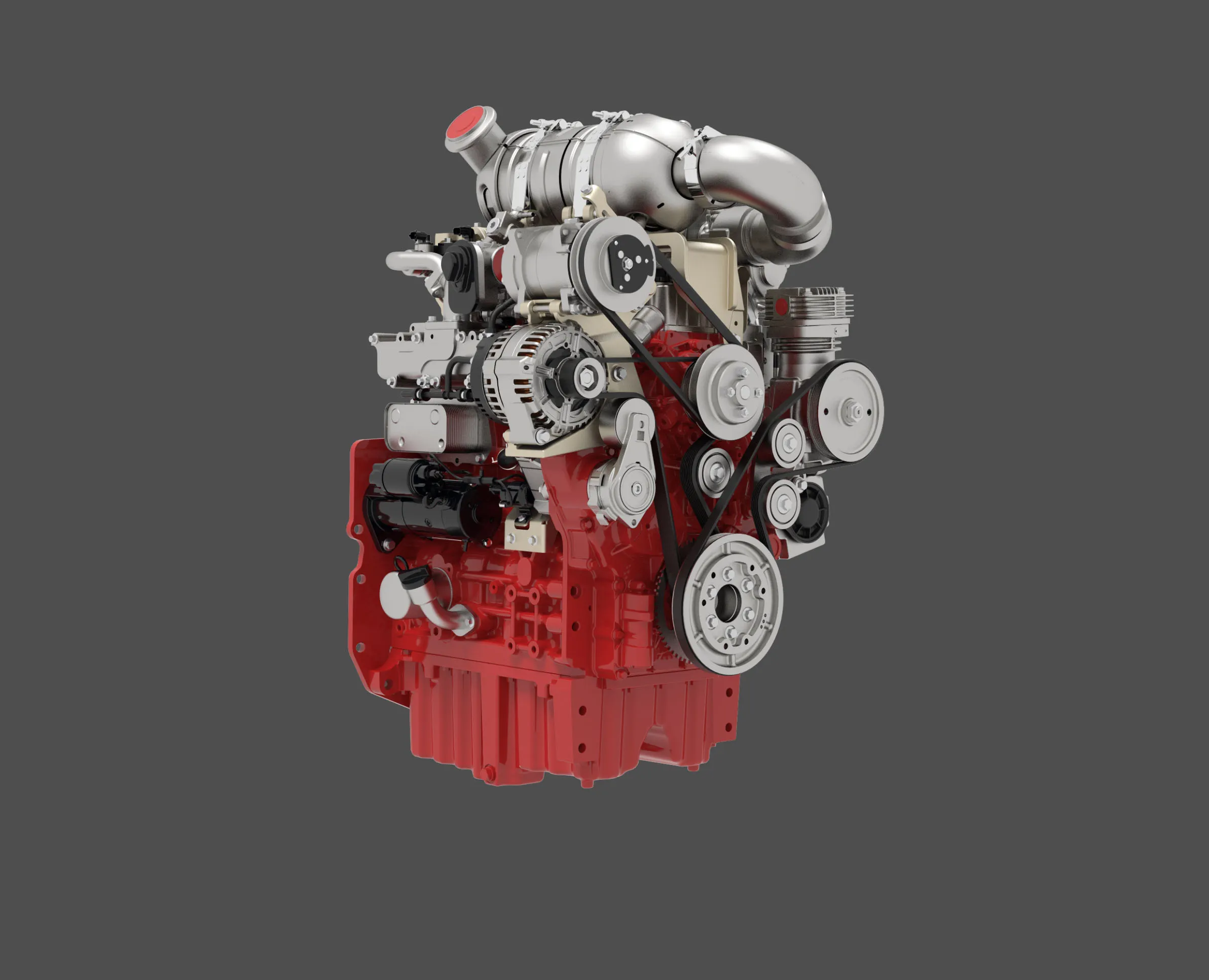

In addition to the new loader, 5316 SDLG is also keen to market its G9138 grader to customers in India. The G9138 is the smaller of two grader models that SDLG offers in the region and suits duties in general construction or for work on smaller municipal roads or rural roads. The G9138 is powered by a 201 Deutz BF4M1013-15T3R/2 engine that has an output of 111kW at 2,100 rpm and can reach a maximum speed of 39km/h forwards and 24km/h in reverse. Since 2015, the construction industry in India has grown. Mehta says he expects the trend to continue. “For wheeled loaders, SDLG has a strong market position in the 3- 5tonne range, and we plan to further strengthen our position,” Mehta said. “For graders, there is potential to grow our customer base as well, with road construction activity levels remaining high in India.”