The machine shares some of the same basic features as the firm’s standard SK140 models. However, it has extra cab protection, uprated hydraulics to utilise high power hydraulic attachments and a number of heavy-duty components.

Despite its smaller size, this machine is borne from 40 years of innovation and development in automotive dismantling and incorporates many of the same features as the larger models.

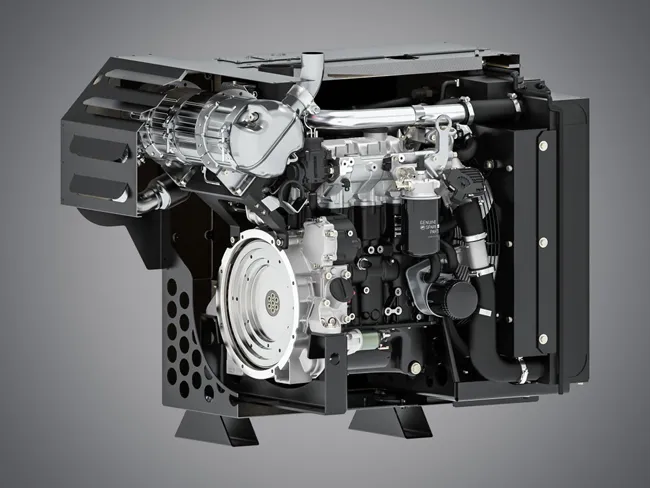

Since launching its first demolitions and recycling machines in Japan in 1979, Kobelco has continued to focus on developing the best possible equipment to for these heavy-duty applications. Kobelco claims that these special machines offer high performance, reliability and efficiency. The firm also says that the all-new Kobelco SK140SRD also promotes lower fuel consumption, lower noise and a significant reduction in CO2 emissions.