Proterra, a supplier of commercial vehicle electrification technology, and Komatsu, will work on the equipment maker’s first battery-electric middle-weight excavator.

The collaboration represents Proterra’s entry into the off-road vehicle market and the company’s first Proterra Powered battery-electric construction equipment, according to Proterra, based in the US state of California.

“Komatsu will use Proterra’s high-performance battery systems for the development of a proof-of-concept electric excavator in 2021 before expected commercial production in 2023 to 2024,” noted Proterra. “The Proterra battery system powering the electric excavator will feature high energy-density and fast-charging technology.”

Proterra battery packs, made in the US, are already fitted within a variety of vehicles, including school buses, coach buses, delivery vans and low-floor cutaway shuttle buses.

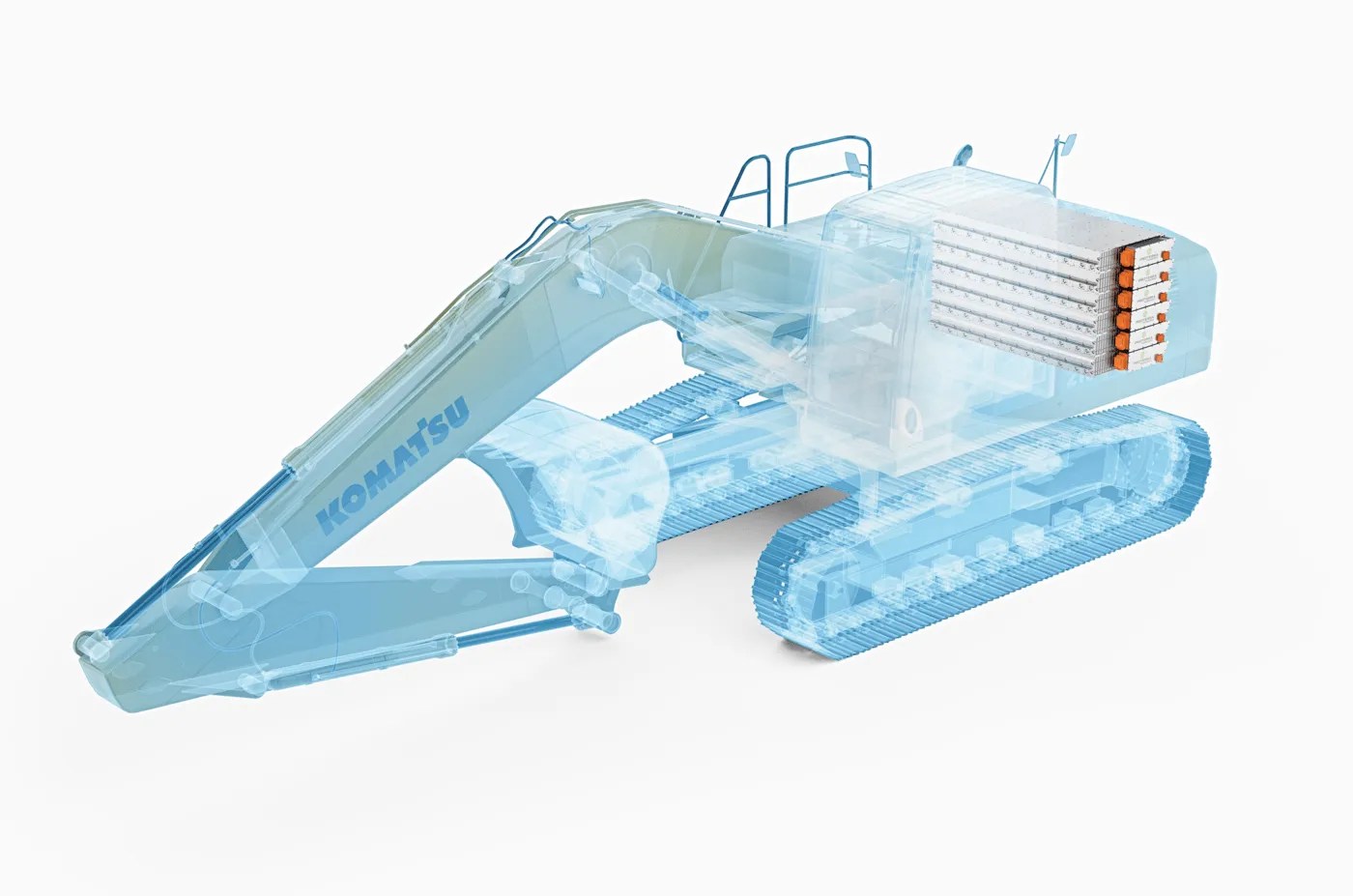

“The packaging flexibility of Proterra’s battery platform will further enable the optimal placement of the batteries within the middle class excavator and replace the need for a normal counterweight used to balance the excavator’s hydraulic arm movements,” said the press release from Proterra.

“Proterra’s best-in-class battery technology has been proven in 16 million miles driven by our fleet of transit vehicles,” said Jack Allen, chief executive of Proterra. “What’s working in our battery-electric transit vehicles on roads across North America can work off-road, too."