The introduction of the latest emissions standards in North America and Europe are requiring major design rethinks for earthmoving machines such as ADTs, Mike Woof reports. With the introduction of the Tier 4 Interim/Stage IIIB emissions legislation, major changes are being made to off-highway machines. One of the machine types most affected by this legislation will be the articulated dump truck (ADT) and designers have faced major challenges in developing solutions that retain what are now seen as key oper

February 14, 2012

Read time: 5 mins

The introduction of the latest emissions standards in North America and Europe are requiring major design rethinks for earthmoving machines such as ADTs, Mike Woof reports

With the introduction of the Tier 4 Interim/Stage IIIB emissions legislation, major changes are being made to off-highway machines. One of the machine types most affected by this legislation will be the articulated dump truck (ADT) and designers have faced major challenges in developing solutions that retain what are now seen as key operating features.In recent years ADT design has focussed on a number of key features, putting operator safety and comfort as high priority issues. Some of the developments from manufacturers, such as improved suspension designs, show continuing refinement with the prospect of more to come. Wishbone suspension systems previously seen on road vehicles only or smart active suspension types have been offered by various manufacturers as standard features or options on a number of models. These allow ADTs a number of benefits such as allowing the machines to cycle faster over rough terrain, provide a smoother ride for the operator, cut material spillage, reduce wear and tear on tyres and drivetrains and boost steering accuracy. Looking ahead it seems these sophisticated suspension features will become more commonplace and perhaps even become standard features in time.

However other market developments in ADT design over the last few years face major challenges. The

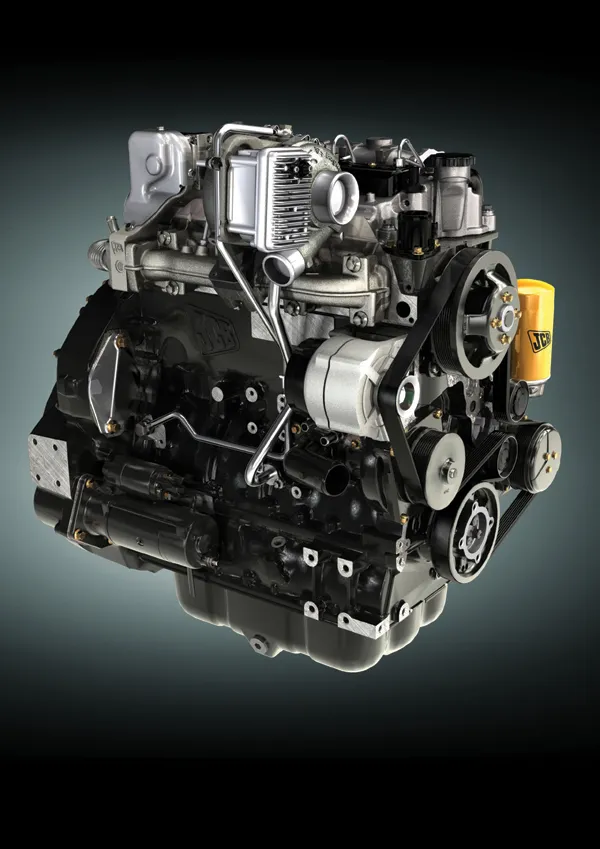

A key feature of the MT36 was its sloping, low profile engine cover. This design could be achieved in part due to the compact nature of the

Other firms offered their own solutions to the issue of forward visibility.

The ADT market has continued to develop in the last 10 years. While the market has been affected by the construction downturn in North America and Europe, the overall trend has been upward. ADTs used to be sold in comparatively few markets such as Northern Europe and South Africa, but their acceptance has grown and other firms, such as

However, Tier 4 Interim/Stage IIIB and the coming Tier 4 Final/Stage IV legislation are forcing changes to ADT design. Firstly, these new generation engines run at higher operating temperatures than previous diesels, as this helps in delivering a more efficient combustion process required by the tougher emissions standards. For this fact alone, radiators have to be larger and cooling fans have to deliver more air across the engines. This has had an impact as designers have had to squeeze greater cooling capacity into compact spaces, without compromising forward visibility with the sloping engine cover. At the same time though, noise emissions have had to be reduced, posing additional challenges given the extra noise generated by the far larger cooling fans required.

For the Tier 4 Interim/Stage IIIB regulations manufacturers also have to install exhaust after-treatment technologies, and these are bulky. The Tier 4 Final/Stage IV legislation to come requires additional particulate filtration, with more units having to be installed. And manufacturers are already preparing for the future, so as not to have to redesign machines again within a short space of time. But these bulky after-treatment packages take up valuable space and have to be installed in such a way as to not spoil the forward visibility that customers have come to expect.

As Caterpillar showed when it unveiled its 336 excavator last year, the after-treatment systems do mean manufacturers have to adapt designs to cope with this additional equipment. The low and uncluttered rear decks of excavators from all manufacturers in recent years are changing, and ADTs will also have to adapt.