Articulated dumptrucks are highly versatile and new developments continue to extend productivity The ADT market has been one of the fastest growing product areas in recent years. In the past ADTs were niche products that sold particularly well in Northern Europe (and Scandinavia and the UK in particular) as well as South Africa for many years, but these have now become popular worldwide. The number of manufacturers in the market has grown too. Just 10-15 years ago the only serious ADT manufacturers building

July 3, 2012

Read time: 7 mins

Articulated dumptrucks are highly versatile and new developments continue to extend productivity

The ADT market has been one of the fastest growing product areas in recent years. In the past ADTs were niche products that sold particularly well in Northern Europe (and Scandinavia and the UK in particular) as well as South Africa for many years, but these have now become popular worldwide. The number of manufacturers in the market has grown too. Just 10-15 years ago the only serious ADT manufacturers building the mass market 23-26tonne capacity classes of machines in any number could be counted quite literally on the fingers of one hand,The growth of the ADT market was one factor in the shrinking sales for scrapers in recent years (along with a change from new highway construction to highway maintenance in the developed nations of North America and Europe).

Technological improvements have brought greater efficiency and productivity as well as lower running costs for the customer. The current machines are faster, more powerful, more productive and more reliable than ever before. Major gains have been made in a disparate array of areas, taking in factors such as product safety, operator comfort and working noise.

If the strength of the ADT has been its versatility due to its all-wheel-drive, its Achilles heel has been the complexity of the driveline. Having numerous gears, driveshafts and universal joints spinning at speed and under heavy load in the unfriendly environment of a construction site for long working hours has inevitably resulted in breakdowns. Early generations of machines were notorious for their frequent breakdowns. Many of these issues have been solved, with the introduction of sealed-in drivelines, computer monitoring of performance parameters, better quality materials and improved manufacturing processes. Designers also have a better understanding of how machines operate in the field while manufacturers carry out far more intensive and rigorous product prototype proving programmes prior to launching new models. But even when some model ranges have been launched on the market in recent times, customers have had to resort to warranty claims to sort out problems with driveline issues proving one of the biggest complaints amongst users.

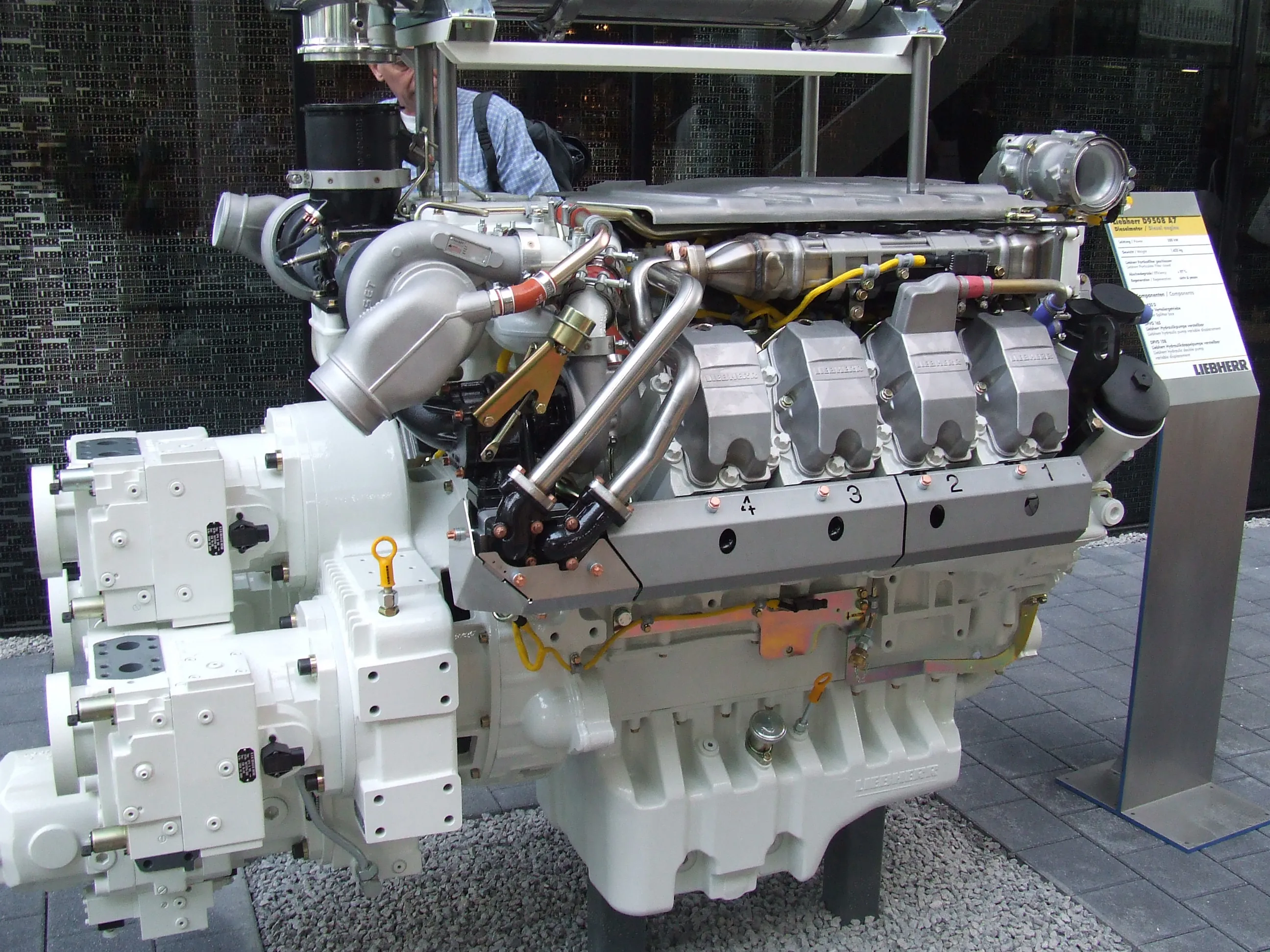

Hydrostatic drivelines have been mooted in the past for ADTs and could avoid some of the issues created by having a large number of moving parts operating in a tough environment. For hydrostatic transmissions there are also benefits in terms of retardation as shutting off the power to the driveline generates a powerful braking effect. The unveiling of a prototype Terex scraper developed at one of its US facilities that featured a high speed hydrostatic transmission some years ago suggested the potential for the ADT sector as well. However long term field trials over several years of at least one ADT design by a major manufacturer have so far been inconclusive and despite widespread awareness of this machine's existence, the company has yet to announce the product's market availability.

The first ADTs mirrored the on-highway vehicles of the period, with drum brakes all round. As dry disc brakes began to become more common in the on-highway automotive sector and the cost of the technology fell, ADT manufacturers followed and switched to fitting these systems. However the working cycle for an ADT in a difficult environment and high dust levels in certain applications exposed the shortcomings of dry disc brakes, particularly for ADTs carrying heavy loads, with comparatively high maintenance needs becoming apparent. As a result ADT builders have since switched to fitting fully enclosed, oil-immersed disc brake systems, which are protected from the working environment and have far lower maintenance needs while offering high retardation capabilities. There have been design issues to address though, with cooling of the oil around the brake system being a particular challenge. With the cooling package on most ADTs situated forward of the articulation hitch, this has required novel design features to carry the oil to the front of the truck from the rear disc brakes. Bell has developed a particularly interesting cooling method, by circulating the oil within the rear axles of the truck and avoiding the need to bring the fluid forward of the hitch joint.

Early ADTs were comparatively crude machines and their suspension systems were basic in the extreme. These machines gave operators a rough ride over bad ground while the incessant jolting and jarring also led to additional stresses for the mechanical components and high wear rates. With this in mind, it is surely no surprise that driveline problems were so frequent. Changes to legislation have highlighted the vibration levels that the human frame has to endure in the working shift and in this respect, old ADTs were poor performers. The latest machines offer a much smoother ride, reducing fatigue for the operator, cutting the exposure to vibration and minimising the risk of long term health problems. The benefits of better suspension are not confined to the operator either, as less jolting means less wear and tear on each machine and a reduced risk of unplanned downtime through unexpected component failure. More visible still is the increased productivity offered by an effective suspension system that allows an ADT to run faster over rough ground and cut cycle times. The most notable gains in this area have come from firms such as Bell, Terex and Volvo. Both Bell and Volvo offer full suspension systems on certain models - as a standard feature on Bell's B50 and as a customer option on Volvo's A40. Terex has developed a fully independent double wishbone system for its TA30 front chassis, in comparison with the strut type front suspensions used by many of its main competitors.

Changes in manufacturing processes have resulted in almost all of the major manufacturers adopting a similar approach in terms of body design: manufacturers have been encouraged to design dumpbodies made from a hard wearing flat plate steel and with a single bolster along the top rail for additional stiffness.

A notable change from the standard tipping type ADT has been pioneered by Caterpillar and while the firm was not first to offer this design, it has refined the concept. The ejector configuration offers safety benefits as there is a reduced risk of the machine rolling over and the machines can also operate under powerlines or other overhead obstacles without danger. In addition ejector trucks can also unload on the move, a useful feature for spreading a layer of material across a specified area.

Some ejector designs from other firms have not been successful but Caterpillar's proven ejector trucks have developed a niche market in certain applications. As a result other firms such as

To date, only Bell and Moxy (recently bought by