In the fast moving world of construction software, major innovations are happening on a continuous basis. All the leading players are making notable contributions to the sector. A new strategic alliance just announced between the management and data handling software giant Pitney Bowes, and design and construction software producer Autodesk, will help create an end to end range of products and tools for rapidly evolving BIM strategies in the industry. In particular in should help develop an integrated suite

June 12, 2012

Read time: 4 mins

An array of innovations are occurring in the software sector – Adrian Greeman writes

In the fast moving world of construction software, major innovations are happening on a continuous basis. All the leading players are making notable contributions to the sector.A new strategic alliance just announced between the management and data handling software giant Pitney Bowes, and design and construction software producer

The BIM ethos has become far more than merely the use of advanced 3D modelling tools within construction. It is an entire method of working and in particular a focus on processes and data transfer during the construction sequence, with the accumulated data from previous stages feeding into the next stages, and in turn this allowing feedback to adjust and modify early decisions.

The integration of the planning design, construction and maintenance chain allows the concept of the whole-life planning and design to become a reality. Savings in maintenance and repair, in rebuilds and upgrades are potentially huge.

Both Pitney Bowes and Autodesk currently make important tools which are used with the whole cycle of infrastructure production.

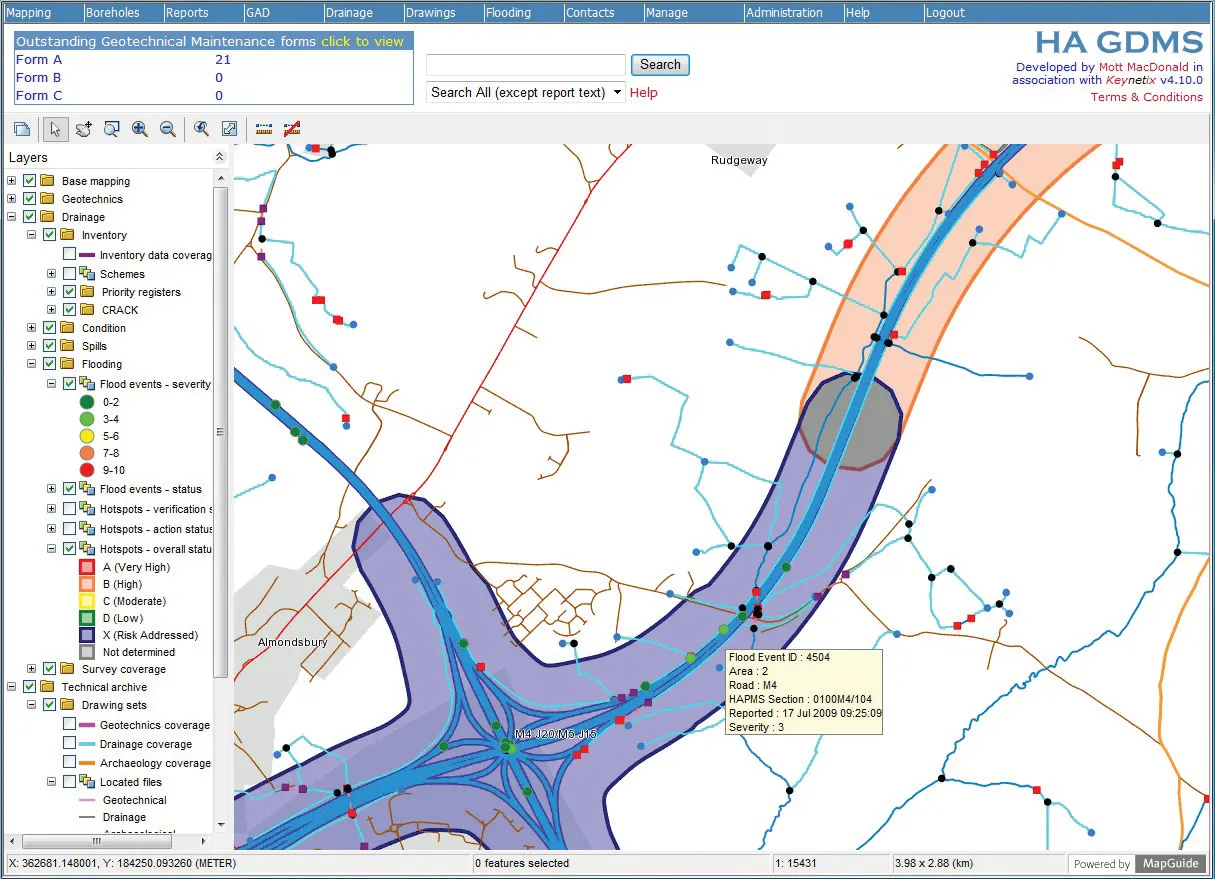

Pitney Bowes has the highly developed and complex suite of GIS mapping, and particularly map analysis tools, from its acquisition of MapInfo combined with large scale geographic data gathering capacities and general business analysis tools. It has lately also bought the detailed and comprehensive road and local authority asset management tools embodied in the Confirm system. Confirm is a complete asset management and planning system with over 125 modules focused around a central database, developed for the wide range of inspection, repair, maintenance, recording and centralised reporting functions needed by local authorities.

Pitney has also recently acquired the traffic microsimulation software house Quadstone Paramics.

"These are important tools at the outer ends of the road and infrastructure cycle," said Richard Humphries at Autodesk "whereas our products are those used in the middle stages, from map and alignment data integration in Autodesk 3D Map to the various powerful design tools built upon core

The two sets of software products are complementary, said Humphries. Pitney's powerful analytic tools in Mapinfo and the microsimulaton are important even before the design begins at all, he says, whereas Autodesk products fill all the intermediate stages. Once data is accumulated and passed on by increasingly organised and disciplined BIM protocols and procedures there is a sophisticated asset management system potentially ready to be fed the information.

The agreement between the two big companies, - Autodesk has a US$2 billion turnover and Pitney Bowes about $500 million in software with an overall $5 billion in business products – will initially involve joint marketing and product sales, but seems likely to involve matching of the products and especially their lines of future development.

"There could be some integration of their software architecture,” said Humphries, "and if the development made it necessary, even some future code transfer, though this would remain to be worked out."

He said the two corporations had a "similar approach" and management attitude which seemed likely to produce a good synergy.

Certainly other companies have been concentrating on building a whole-life strategy, not least

Meanwhile Autodesk's existing range of design, coordination and visualisation tools has been ordered in a significant comprehensive package by major international design-contractor Balfour Beatty in a deal worth $12 million and lasting three years.

The company is one of a number of firms internationally which are integrating the design and construction roles and applying BIM processes across the board to be able to carry through projects from beginning to end. This "whole-life" capacity follows purchase of major US consultant Parsons Brinckerhoff two years ago, and is seeing the company push ahead with BIM technology.

The agreement gives Balfour Beatty access to a range of Autodesk BIM solutions including Autodesk Revit, "intelligent" object-based building design software, AutoCAD Civil 3D, Navisworks software products, AutoCAD itself and 3Ds Max Design the advanced visualisation and photorealistic rendering tool. Part of the package is training, support and strategic consultancy by Autodesk Consulting to

help the company maximise the use of the tools as part of its overall BIM programme.