Wacker Neuson is seeing strong financial performance as demand for construction machines continues to improve. While expanding production worldwide, the company is also making a strong investment in research and development, for refining products and designing new models.

CEO Martin Lehner said: “We want to focus on innovation. This is what drives us forward. There are two main points for us on products, one is zero emissions and another is on digitalisation.”

The company has been heavily reliant on the European market in past years. Lehner said: “The main revenue is coming from Europe, about 74%, but we’re growing fast in America where we had about 23% of turnover last year.”

And he added that with the establishment of a new manufacturing facility in China, the firm is also looking to capitalise on the country’s strong construction market recovery. The new Chinese facility will also allow the firm to boost sales across Asia as a whole. He continued: “Last year was a very good year after years of shrinking revenues. The business climate mood is very positive at the moment.”

The new Chinese facility is at Pinghu, to the south of Shanghai, and is expected to play an increasing role in the firm’s future business. He said: “We saw a doubling of mini excavator sales in China.”

However he cautioned: “The supply chain is stressed and many companies are struggling on ramping up production, while we are facing increased costs from suppliers and there are also limitations on the workforce.”

The company has seen turnover improve steadily, reaching €1.53 billion in 2017 compared with €1.36 billion in 2016. If the market continues to grow at its current rate, the firm predicts that 2018 turnover could range from €1.65 billion to €1.7 billion.

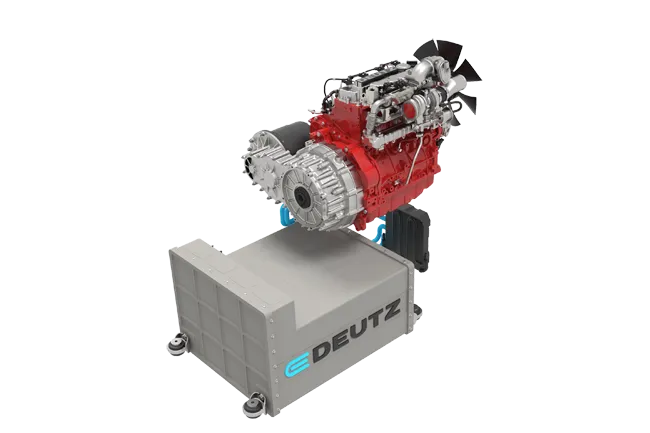

Looking ahead, the electric machines the firm is already offering for the compact wheeled loader, rammer and plate compactor markets are expected to develop an important market segment for the company. And the latest addition to the zero tailpipe range is the new electric mini excavator.

Lehner said that while rental firms were sceptical of these electric units at first, they have quickly begun to appreciate the benefits in terms of lower maintenance costs. He added: “If you look at the products, there are no v-belts or filters or oil to change.” And while the rental market may be ambivalent about the lower emissions performance of the electric units, the firms are very keen on the cost savings these machines offer in terms of lower maintenance needs and better uptime.

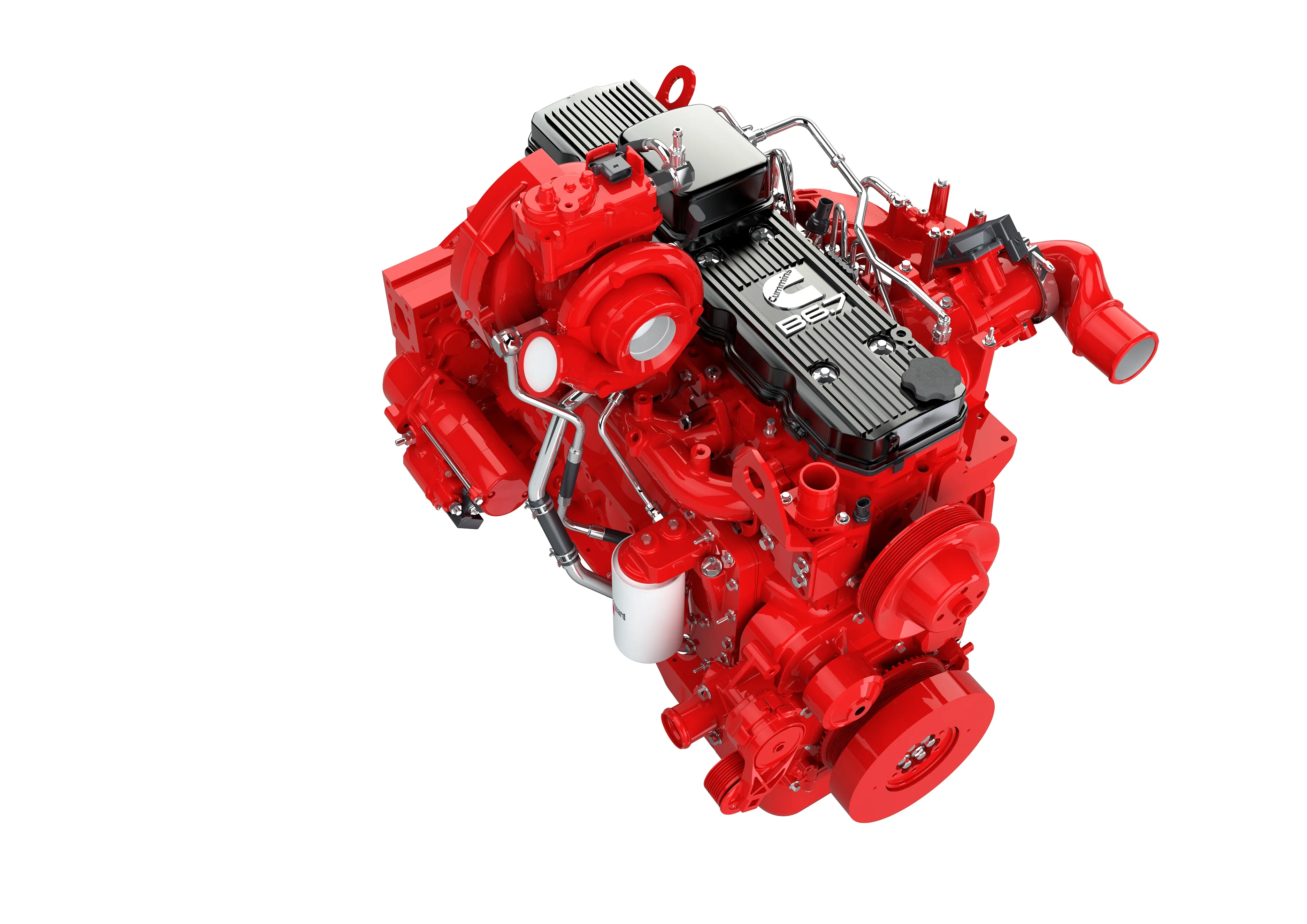

That said, Lehner explained that Wacker Neuson is also continuing to develop new diesel machines and will do so for the forseeable future.