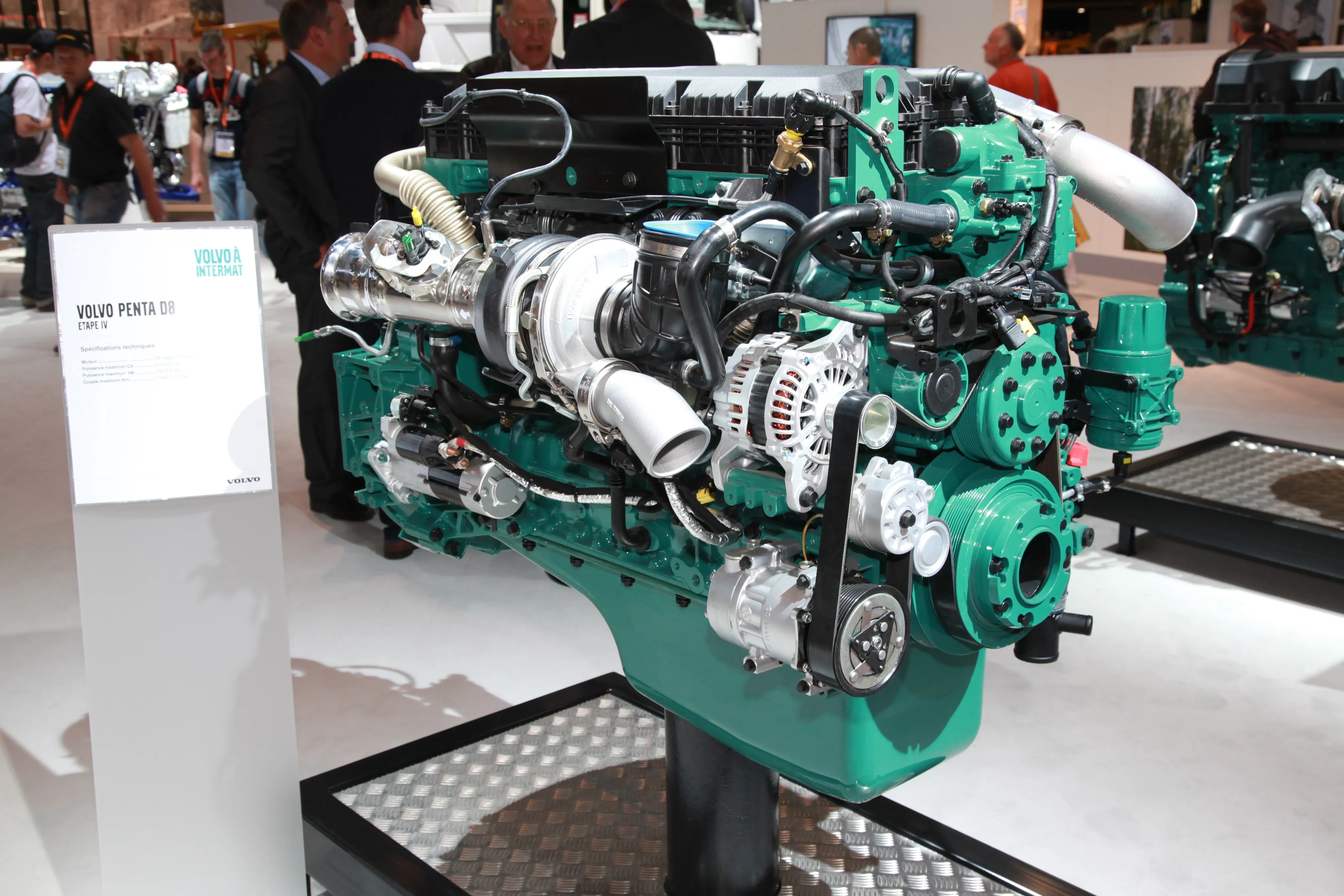

Volvo Penta has reinforced its presence in the construction market at INTERMAT 2015 with the introduction of the 5-litre D5 and the 8-litre D8 engines. As well as being used in sister company Volvo Construction Equipment’s machinery, the engines are increasingly finding favour with a number of OEMs. The latest of these is McCloskey International, which uses the engines in its range of crushers, screens and trommels, and BBA Pumps. The D5 and D8 have a slightly larger displacement than the engines they repla

April 23, 2015

Read time: 2 mins