Wacker Neuson has ambitious plans to continue its double-digit growth which has seen its group sales figures increase from €758m in 2010 to €1,284m in 2014. New product development will be crucial to continued growth, Dieter Freisler, Wacker Neuson Europe’s regional president told a press conference at Intermat 2015, with a focus on developing lower-emission products.

Customers are looking for lower lifetime costs, as well as lower emissions, said Freisler: “Everyone is talking about TCO, total cost of

January 6, 2017

Read time: 2 mins

Customers are looking for lower lifetime costs, as well as lower emissions, said Freisler: “Everyone is talking about TCO, total cost of ownership. It is not only the cost of the product that is important, the whole life cycle cost is important too.”

Underlining that trend, Wacker Neuson has launched several products which meet the energy efficiency and environmentally friendly brief. The 803 dual power mini-excavator, which won a Gold Intermat Innovation Award, can be operated with an external electro-hydraulic power unit or with a diesel engine.

“In our opinion, the future is not to have two machines but to have one machines which has a combination of both diesel and electric power,” said Freisler.

In some applications, however, electric-only power is desirable, for example when working in confined spaces such as car parks or in congested city centre sites. Intermat 2015 also saw Wacker Neuson launch two emission-free vehicles: the DT10e track dumper and the WL20e wheel loader.

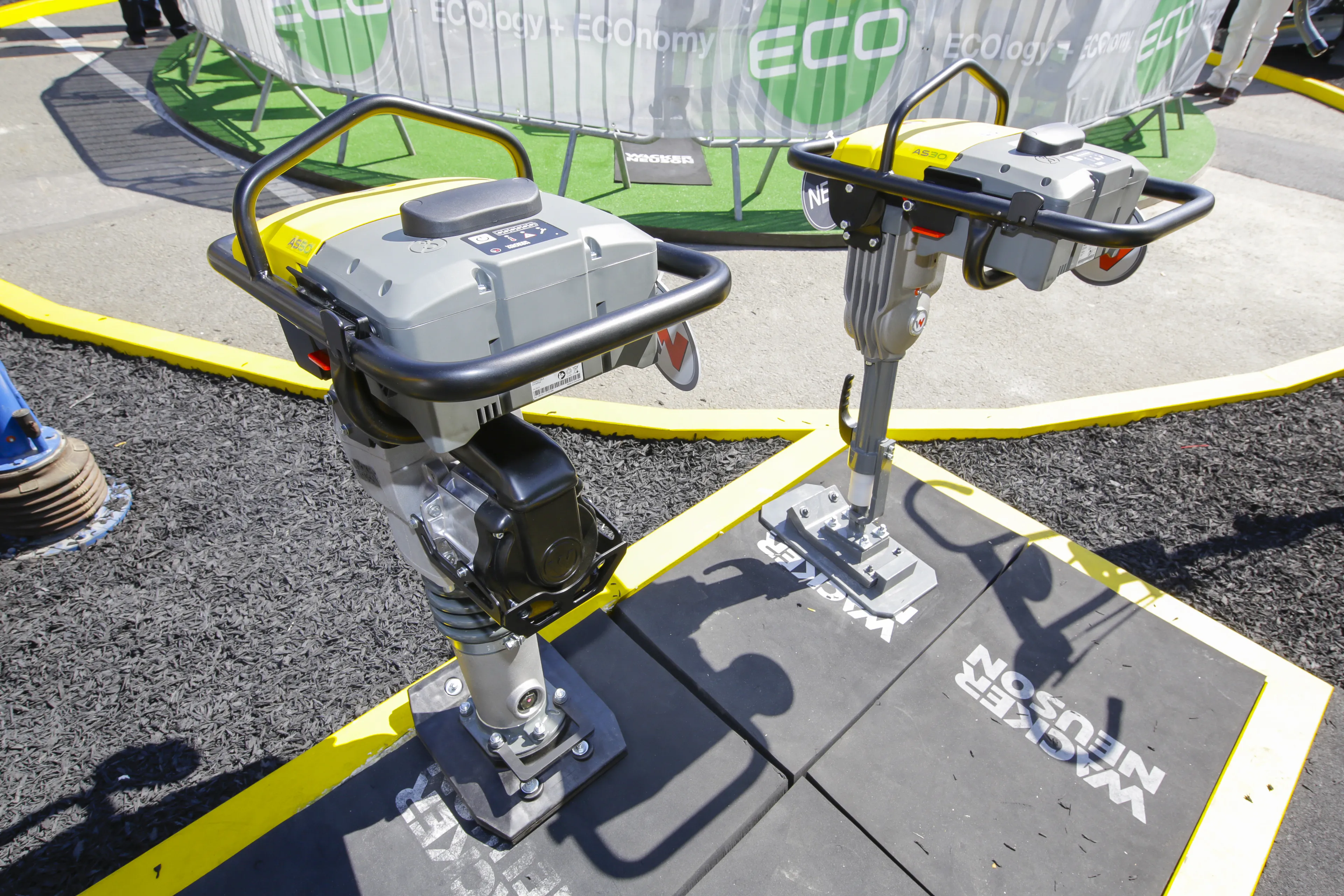

The AS 30 and AS 50 battery-operated rammers, also new for Intermat, are ideally suited to work in confined spaces such as trenches or indoors. As well as removing potentially harmful exhaust emissions, they can save the operator up to 55% in operating costs, according to the group.

Other new products on display at the Wacker Neuson stand include the EW65 mobile excavator, the ET90 track excavator and a re-engineered range of vibratory plates which remove the risk of hand-arm vibration and reduce regulatory burdens for contractors. Group company Kramer also revealed new wheeled loaders from its base and premium ranges.