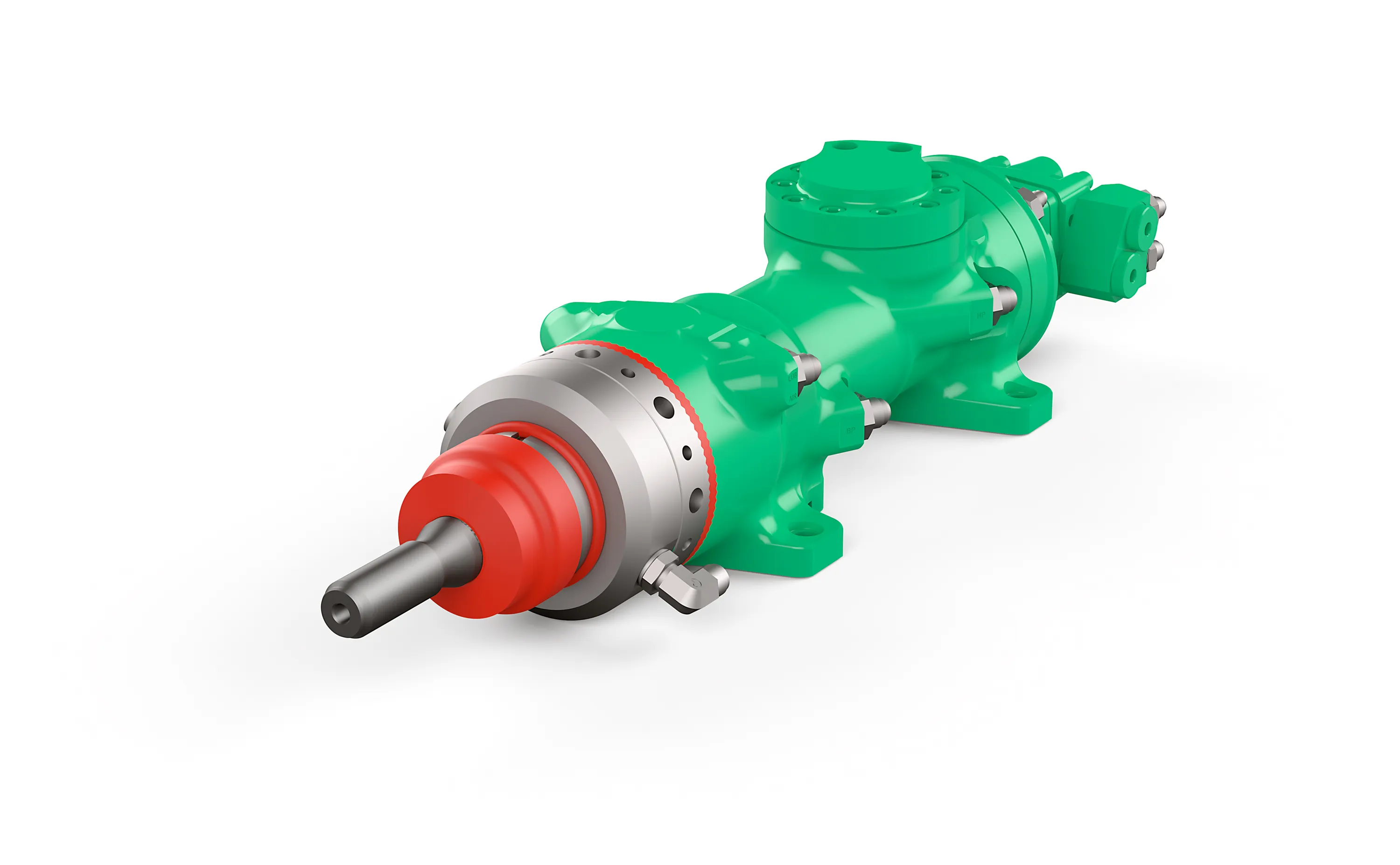

Rockmore International has launched its new ROK 550T drill for the European market. The latest addition to the company’s T Series DTH hammer line, the 127mm class product uses the industry-standard QL5/QL50 bit shank, but with the blow tube/foot valve (plastic tube) removed.

Pejman Eghdami, Rockmore executive vice president, said: “Plastic parts do tend to break in deep hole drilling, causing the hammer to stop leading to costly downtime. Others have tried removing the plastic tube but they lose a lot of performance in penetration rates. We’ve designed uniquely around that [so that performance can be maintained].”

With high performance drilling characteristics rated for drilling 140-152mm diameter holes, the ROK 550T is said to be ideal for blast-hole applications involving, among others, geotechnical and geothermal contractors. It is also well suited to water well drilling work.

Rockmore’s first T Series DTH model was the ROK 600T, a 152mm class model that uses a tubeless QL6/QL60 bit shank. The company then expanded the T Series with the ROK 60T-360T hammers that use the IR 360 bit shank without the blow tube/foot valve.

As with all Rockmore DTH hammers, the new ROK 550T is also said to take advantage of the firm’s patented SonicFlow technology, which optimises airflow by simplifying and streamlining the air paths to minimise back flow and turbulence, delivering more energy to the piston. Field testing of the SonicFlow design was determined to result in faster penetration rates and greater overall DTH hammer efficiency.