The early part of 2012 will see a whole host of new technology coming to market, as manufacturers introduce their latest models and solutions. At the same time, the construction equipment market is also seeing an increase in competition, with Chinese firms making serious inroads into the global supply sector. These new technologies and new competitors will ensure that the construction equipment sector will see major changes during this year. From a technical viewpoint, one of the biggest technical challenge

May 29, 2012

Read time: 3 mins

The early part of 2012 will see a whole host of new technology coming to market, as

manufacturers introduce their latest models and solutions. At the same time, the construction equipment market is also seeing an increase in competition, with Chinese firms making serious inroads into the global supply sector. These new technologies and new competitors will ensure that the construction equipment sector will see major changes during this year.

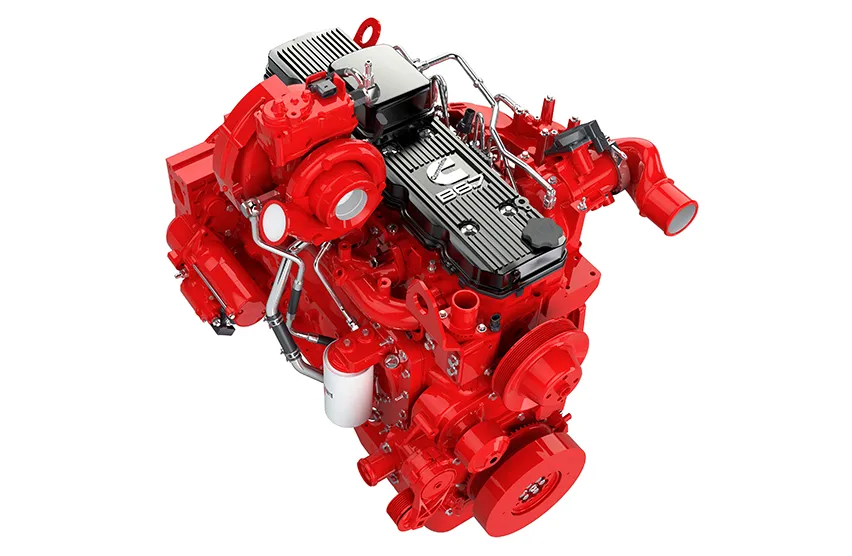

From a technical viewpoint, one of the biggest technical challenges has been meeting the necessary emissions legislation required by the EC nations and North America. This has been an extremely costly process, requiring extensive research and development, with firms offering solutions utilising an array of technologies.

None of the firms have taken exactly the same route to achieving the low emissions performance required as any other, although broadly similar systems are used in many cases. At the same time as delivering the reduced emission levels, companies have also managed to reduce fuel consumption and extend service intervals, helping offset the extra costs of these advanced new engines to customers over the long term.

For most companies, the emissions technology forms an integral part of the engine and cannot be removed at a later stage. This does pose questions in the mid-long term, as the engines require clean, low sulphur fuels. Sales of second-hand machines powered by these engines will not be possible to developing nations where low sulphur fuels are not available. However, at least one manufacturer has developed its emissions control package along modular lines, which could allow the system to be removed at a later stage in its life. And, in theory, this could allow machines with such engines to be traded into developing markets, with less concern over the quality of available fuels.

At the same time as the new low emission engines are being launched, Chinese manufacturers are also introducing new machines worldwide. And rather than relying on exports to developing nations, they are also looking to develop long-term supply chains in the developed markets. Distribution chains have yet to be fully established, but many of the major firms have hired western executives and acquired existing

companies in Europe.1175 Zoomlion bought Italian concrete pumping firm 2203 CIFA and 269 LiuGong recently completed its purchase for the Polish 3420 Dressta bulldozer line. But the biggest acquisition was 1170 Sany’s purchase of German firm Putzmeister, a leading concrete pump brand. Sany will be able to learn how 1259 Putzmeister services and supports its machines, expertise that will likely be rolled out across Sany’s other operations in due course.

If one thing about the construction equipment market is clear, it is that the industry is in a process of transition. While new technologies are being developed, Chinese firms are also using the economic strength to establish a much greater international

presence than ever before. How the industry will look 10 years from now remains to be seen.

manufacturers introduce their latest models and solutions. At the same time, the construction equipment market is also seeing an increase in competition, with Chinese firms making serious inroads into the global supply sector. These new technologies and new competitors will ensure that the construction equipment sector will see major changes during this year.

From a technical viewpoint, one of the biggest technical challenges has been meeting the necessary emissions legislation required by the EC nations and North America. This has been an extremely costly process, requiring extensive research and development, with firms offering solutions utilising an array of technologies.

None of the firms have taken exactly the same route to achieving the low emissions performance required as any other, although broadly similar systems are used in many cases. At the same time as delivering the reduced emission levels, companies have also managed to reduce fuel consumption and extend service intervals, helping offset the extra costs of these advanced new engines to customers over the long term.

For most companies, the emissions technology forms an integral part of the engine and cannot be removed at a later stage. This does pose questions in the mid-long term, as the engines require clean, low sulphur fuels. Sales of second-hand machines powered by these engines will not be possible to developing nations where low sulphur fuels are not available. However, at least one manufacturer has developed its emissions control package along modular lines, which could allow the system to be removed at a later stage in its life. And, in theory, this could allow machines with such engines to be traded into developing markets, with less concern over the quality of available fuels.

At the same time as the new low emission engines are being launched, Chinese manufacturers are also introducing new machines worldwide. And rather than relying on exports to developing nations, they are also looking to develop long-term supply chains in the developed markets. Distribution chains have yet to be fully established, but many of the major firms have hired western executives and acquired existing

companies in Europe.

If one thing about the construction equipment market is clear, it is that the industry is in a process of transition. While new technologies are being developed, Chinese firms are also using the economic strength to establish a much greater international

presence than ever before. How the industry will look 10 years from now remains to be seen.