Taking a world view, the construction equipment market provides a handy guide as to overall construction business activity. Evaluating machine shipments can provide a ready answer to those who ask, “What is happening?”

Major manufacturers such as

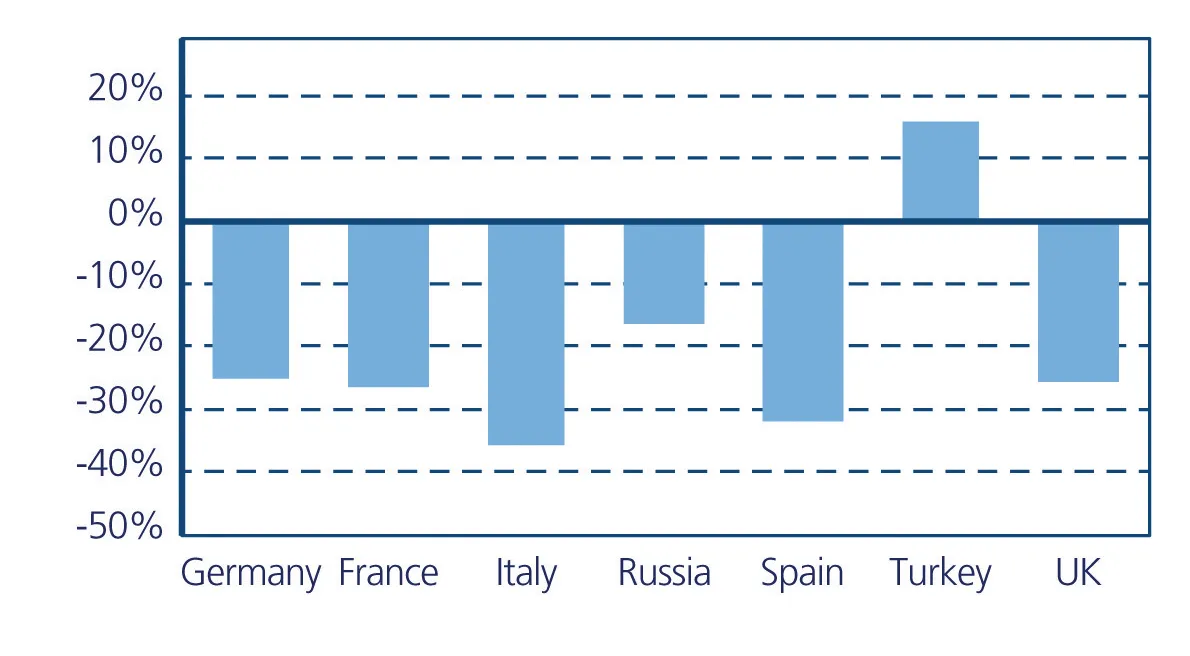

Activity in Australia/Oceania gave particular cause for concern with a drop of 38.6% to $460.7 million, due to a fall in demand for minerals. South America also showed a worrying 33.1% drop in its equipment buying from the US, falling to some $1.28 billion. Parts of Europe remain healthy but overall, US machine exports to Europe dropped 25.4% to $1.02 billion for the first half of 2014, compared with the same period in 2013. Machine sales from the US also dropped to neighbouring Canada, falling 4.6% to $3.51 billion.

The Asian market which has been the powerhouse for construction activity in recent years is also seeing a rather more uncertain outlook. US machine exports to Asia fell by 13.9% to $1.04 billion for the first six months of 2014. In addition, US machines sales to Central America fell 23.7% to $949.3 million.

Not every sector of the construction equipment market is pessimistic though. The

period for the previous year. Wirtgen also said that business activity could have been higher were it

not for the difficult political climate between Russia and the Western nations as a result of the situation in the Ukraine.

The AEM has said there are some markets still seeing growth too, with Africa in particular providing some grounds for optimism. In the first half of 2014 some $682.1 million worth of construction equipment was shipped to Africa, an increase of 4.3%. And it is worth noting that US manufacturers are not the only companies capitalising on sales to Africa as Chinese companies are also seeing strong demand for equipment. Massive infrastructure programmes are being seen across the continent, in North, East, West and Southern Africa and highway construction is playing a key role in development.

Africa’s economic potential is enormous and while it may not be sufficient to offset the drop elsewhere in the world, it certainly offers grounds for optimism.

Route One Publishing New address:

Route One Publishing Ltd,

Waterbridge Court,

50 Spital Street, Dartford, Kent, DA1 2DT, UK

Tel: +44 1322 612055 Fax: +44 161 603 0891