Available in many languages, Owner’s Site and ConSite are introduced for Zaxis-3 and Zaxis-5 medium and large crawler, and wheeled excavators, as well as ZW-5 wheeled loaders.

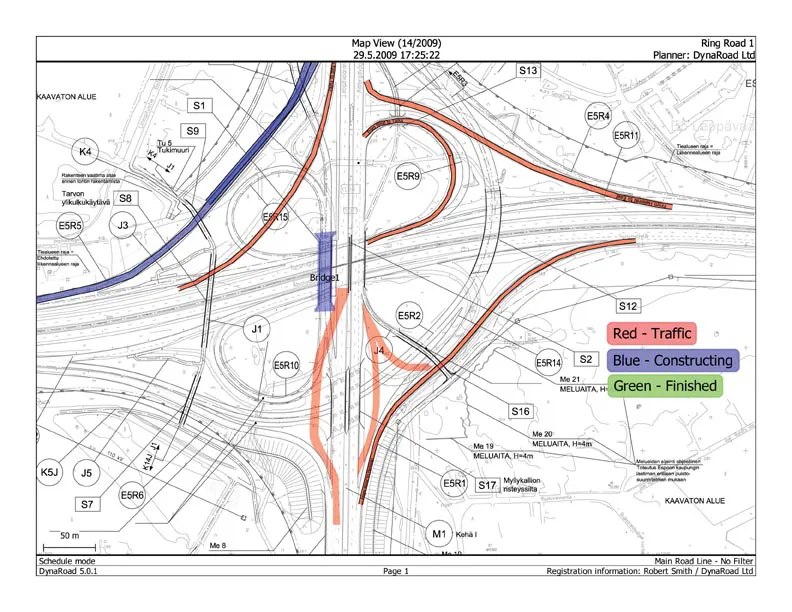

Global e-Service allows owners to monitor their Hitachi construction machinery remotely. Machines send operational data on a daily basis via GPRS or satellite to www.globaleservice.com. This allows immediate access to the new and improved Owner’s Site, and the vital information that is required to support Hitachi machinery and operations on construction job sites.

An automatic service report, ConSite sends a monthly email summarising the information from Global e-Service for each Hitachi machine. This includes a detailed analysis of the operational data, ratios and hours.

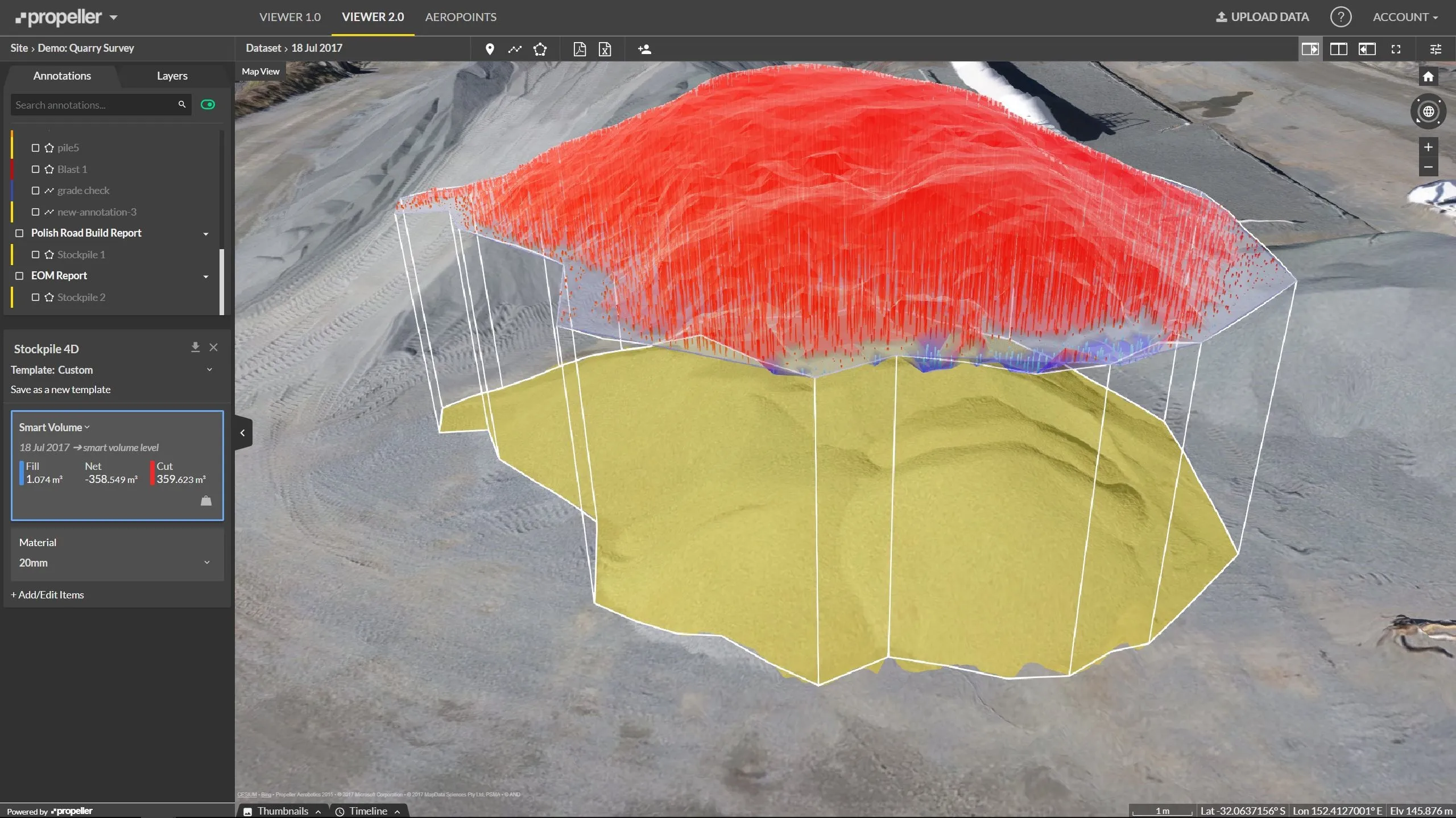

The operational data highlights daily working hours and fuel consumption in a colour-coded calendar format. This gives an insight into how productive and efficient each machine has been in the past month.

In addition, in the event of a fault, an emergency alarm report is sent to the owner and the local authorised Hitachi dealer for immediate action.

“Owner’s Site and ConSite will provide information that they can use to maximise the efficiency, minimise downtime and improve the overall performance of their Hitachi fleets,” says Tom van Wijlandt, HCME’s assistant manager service development.