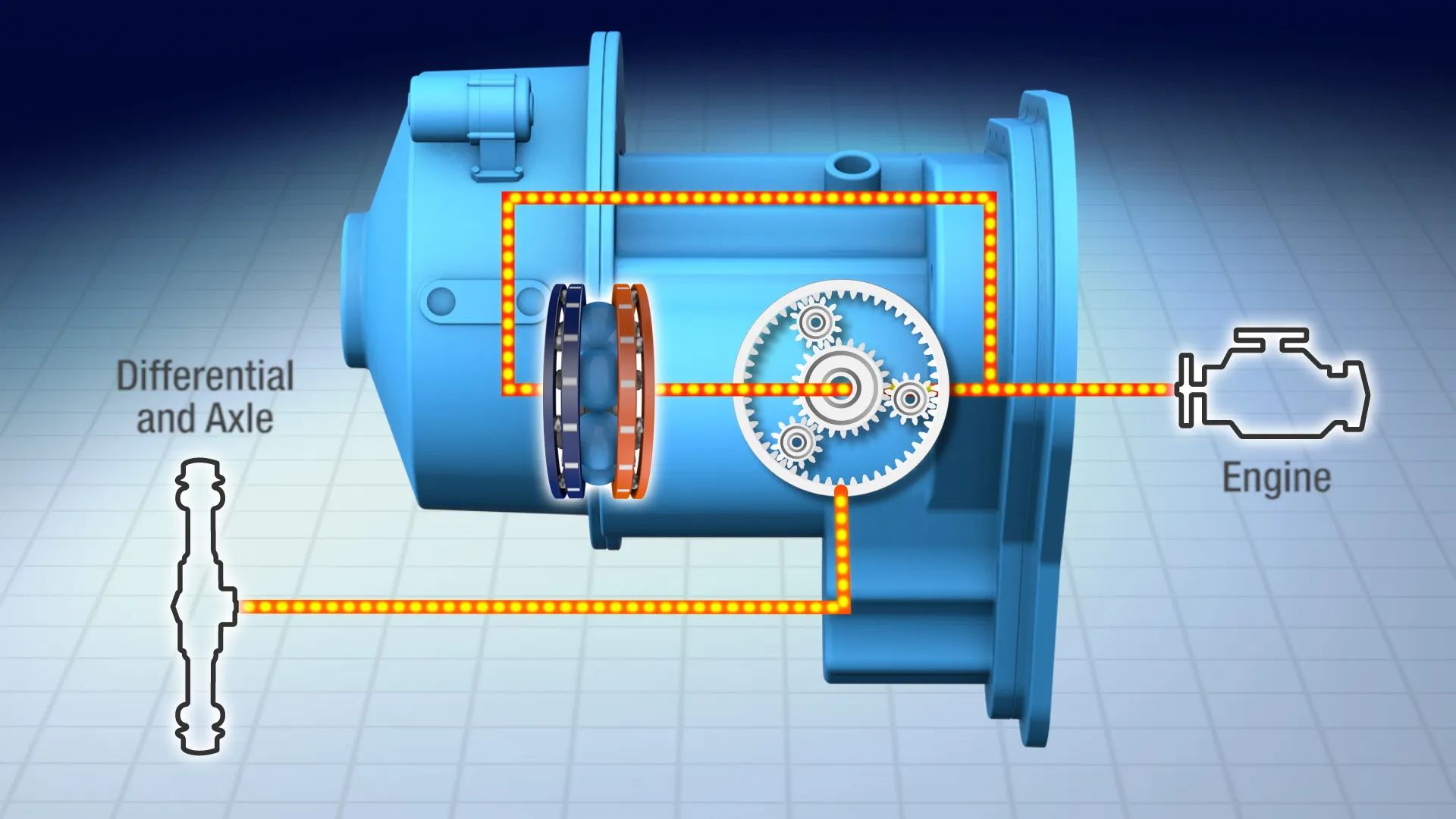

Dana says that its VariGlide technology is “a revolutionary new transmission design that incorporates continuously variable planetary (CVP) technology.” According to the company, its engineers have confirmed performance and positioning improvements following hundreds of hours of functional evaluation and dynamometer testing on a standard-sized 2.2tonne forklift truck equipped with VariGlide technology operating in a typical pick-and-place duty cycle.

January 30, 2015

Read time: 1 min

According to the company, its engineers have confirmed performance and positioning improvements following hundreds of hours of functional evaluation and dynamometer testing on a standard-sized 2.2tonne forklift truck equipped with VariGlide technology operating in a typical pick-and-place duty cycle.

Developed through a strategic licensing relationship with

“Ideal for the rapid acceleration, deceleration, and precise positioning required by material handling applications, it also eliminates the need for forward and reverse clutches while reducing overall engine speeds, allowing the engine to operate at its optimum efficiency level and reduce noise levels,” says the company.

VariGlide technology will be offered as a pre-assembled module providing a standard power split configuration for forklift truck transmissions produced by original equipment manufacturers.