Chinese Construction equipment manufacturers are aiming to raise their game in order to capture a larger share of the global market, in particular that of the US.

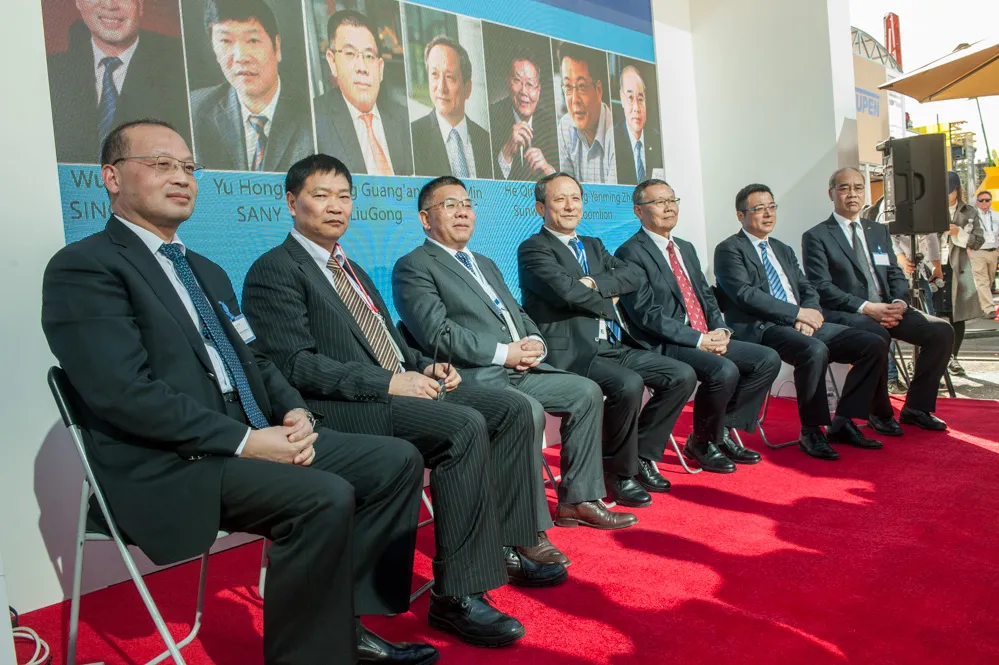

Lessons have been learned, according to several senior executives from major Chinese firms who, as a group, faced the press during a presentation at the CONEXPO-CON/AGG in Las Vegas.

Greater machine durability coupled with improved customer service are central to improved sales, said Wang Min, chairman of

Zeng Guang’an, chairman of

It is a given that “the customer comes first”, said Yu Hongfu, chairman of

Zhang Xiuwen, chairman of

As a group, they understood US president Donald Trump’s desire to see more products made in America by Americans. In today’s global climate, many Chinese manufactures are already moving in the direction of manufacturing in the US rather than reassembling their products.

What will likely push, or lead, Chinese companies to do more manufacturing in the US is the decreasing difference in manufacturing costs between China and other countries, including the Americas, as China becomes more wealthy and urbanised. “This has been going on for 10 years or so,” said Zeng Guang’an of LiuGong. “The manufacturing cost difference is now becoming so small.”

Many components, such as engines are manufactured globally for use in Chinese equipment so a Chinese product is not solely Chinese anymore.

Chinese supply chains are increasingly sophisticated and global.

But, Zeng noted, in order to manufacture in the US, Chinese firms also have to increase sales and market share to ensure it is economically feasible.

In the end, said Wang Min of XCMG, president Trump’s focus on infrastructure is good for the entire equipment manufacturing sector.