British Steel as an entity disappeared with its acquisition first by Corus in 1999 and then Tata in 2007, re-emerging in 2016 as an independent company – having bought back its name for £1.

The company supplies long bars to manufacturers such as Caterpillar to build undercarriages, as well as crane rails, and bucket and cutting-edge profiles to various customers. Forks and masts for forklifts companies such as Toyota is also a growing sector for the company.

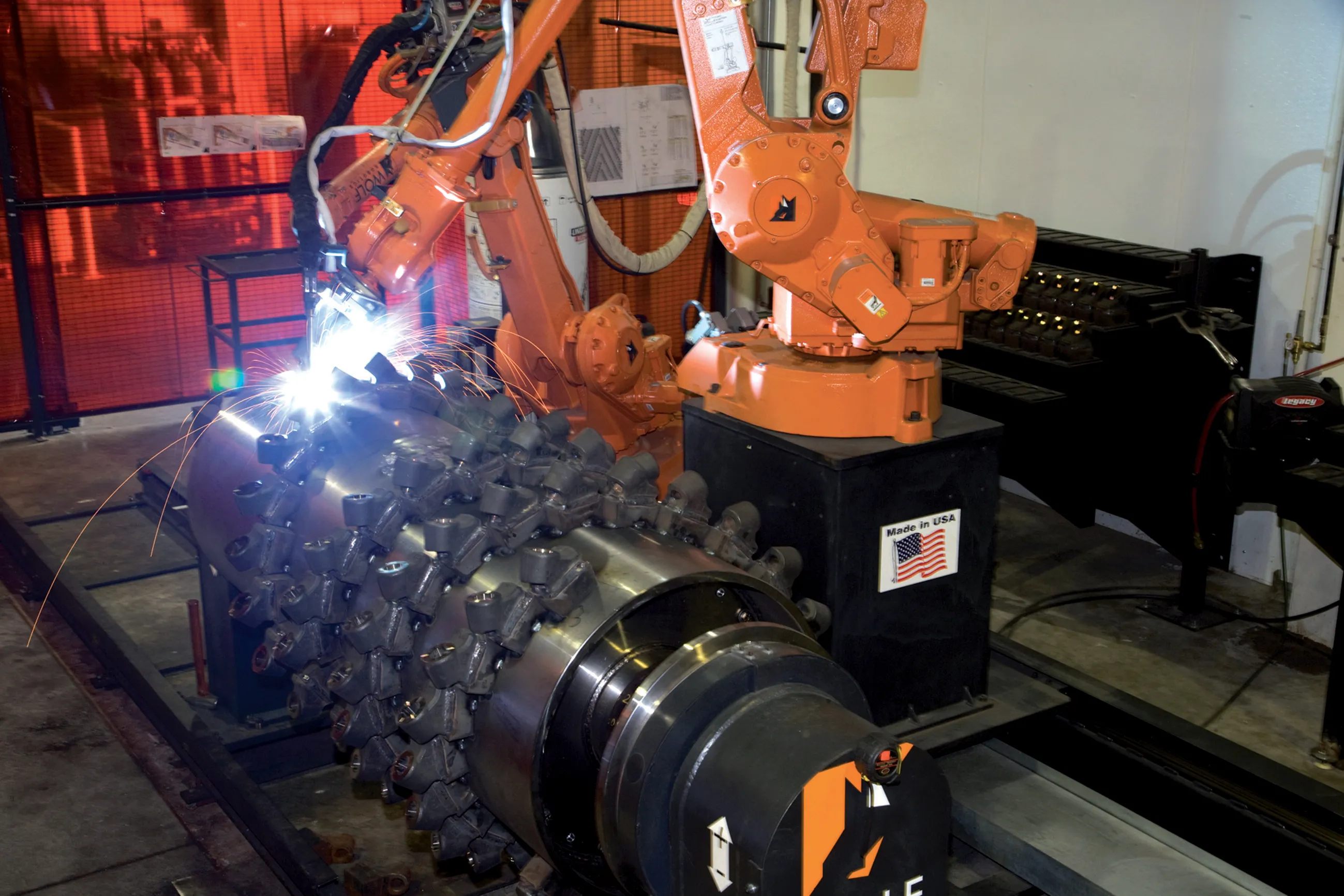

This is an area where surface quality is becoming a critical factor, says Grant McBain, commercial director, special profiles at British Steel, prompting the company to recently invest £2m in developing leading edge surface quality manufacturing capabilities.

Although it has established customer bases already in the US and Europe, the company is capitalising on its previous and current reputation as a reliable global supplier of quality steel to promote itself further in Europe, as well as in Asia and other growth markets, says McBain.

British Steel produces 2.8 million tonnes of steel a year in its blast furnaces in the North of England.

The company has seen a 25% increase in sales over the last 18 months and is anticipating a further increase of 10% over the next 18 months.

The company has recently increased its production from 14 to 16.5 shifts a week to meet demand.