Chinese off-highway machinery major XCMG saw a 33.5% year-on-year increase in overseas sales revenue in the first half of 2023, topping US$2.85 billion.

Meanwhile, total sales revenue for the half-year was worth US$6.98 billion. Sales of energy products in H1 2023 were worth $717.56 million, nearly 175% growth year-on-year.

XCMG’s first-half-year gross profit margin of 22.86% has increased 2.44% year-on-year. Net profit margin on sales reached 7%, up 0.19% year-on-year, with the Q2 2023 performance reaching 7.54%, a 1.77% increase year-on-year.

“XCMG has been advancing steadily to achieve a resilient, high-quality development. In the context of a complex and fast-changing market environment, the new XCMG – with new ideas, new concepts, and new mechanisms – is pushing forward the intelligent and digital transformation following the five strategies of ‘high-end, intelligent, green, service-oriented, and globalisation,’” said Yang Dongsheng, chief executive of XCMG.

The Chinese company has established what it calls a four-in-one international development model of product export, overseas factories, cross-border mergers and acquisitions, and globally collaborative R&D. XCMG now exports to more than 190 countries and regions worldwide, providing not only “advanced and endurable” products, but also integrated services and spare parts support.

XCMG’s overseas revenue of $2.85 billion in H1 2023 accounted for 40.75% of total company revenue, an 11.08% increase year-on-year, with multiple regions and products achieving rapid growth.

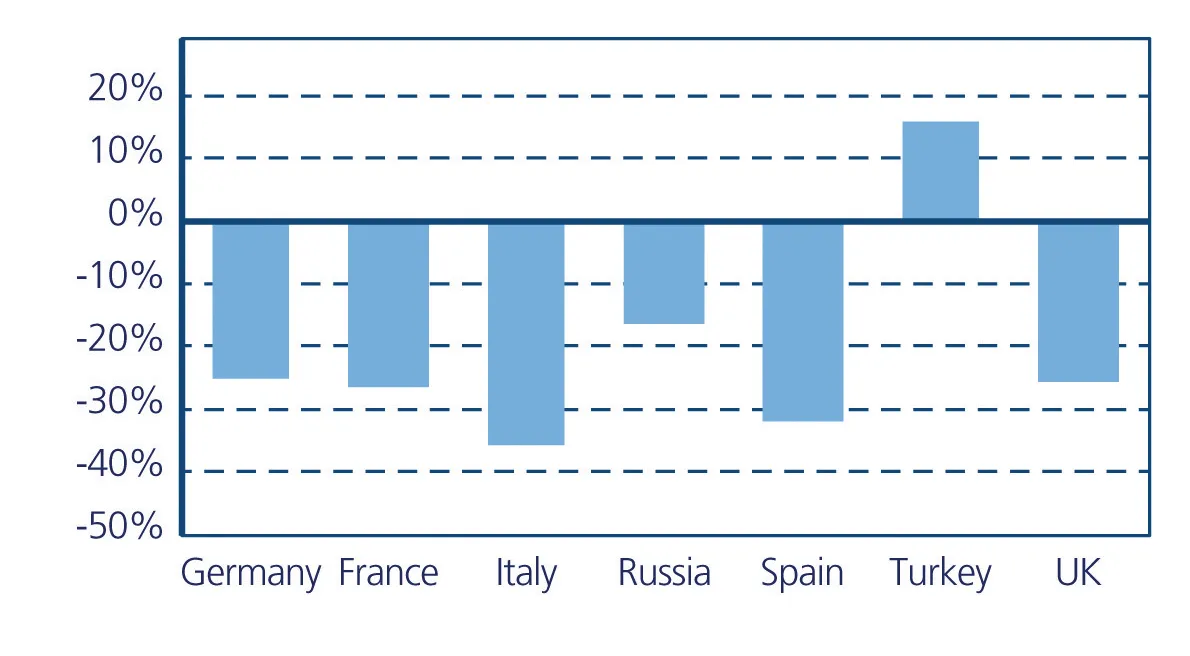

Company revenue in West Asia, North Africa and Central America has risen by over 200%, sales in Europe are up 150% and around 100% revenue growth was achieved in Central Asia and North America.

XCMG has opened sales companies in the UK, Singapore, Saudi Arabia, the United Arab Emirates and Vietnam. More production bases, R&D facilities and spare parts centres are under construction and planning.

“XCMG is navigating through the industry cycles with innovation and internationalisation as the core focuses,” said Yang. “It’s our goal to build a world-class enterprise with leading advantages in products, scale, services, digital and intelligent technologies to achieve strategic transformation and continuous breakthroughs.”