World demand for asphalt will grow by 3.6% annually until 2017, according to Cleveland market research company The Freedonia Group. This follows a decline in demand between 2007 and 2012 in North America and Western Europe, during the global economic crisis. “Gains will be driven by especially strong growth in consumption in China and other developing countries as they work to improve their transportation infrastructures,” said Freedonia analyst Mariel Behnke.

March 4, 2014

Read time: 2 mins

World demand for asphalt will grow by 3.6% annually until 2017, according to Cleveland market research company The 2821 Freedonia Group. This follows a decline in demand between 2007 and 2012 in North America and Western Europe, during the global economic crisis.

“Gains will be driven by especially strong growth in consumption in China and other developing countries as they work to improve their transportation infrastructures,” said Freedonia analyst Mariel Behnke.

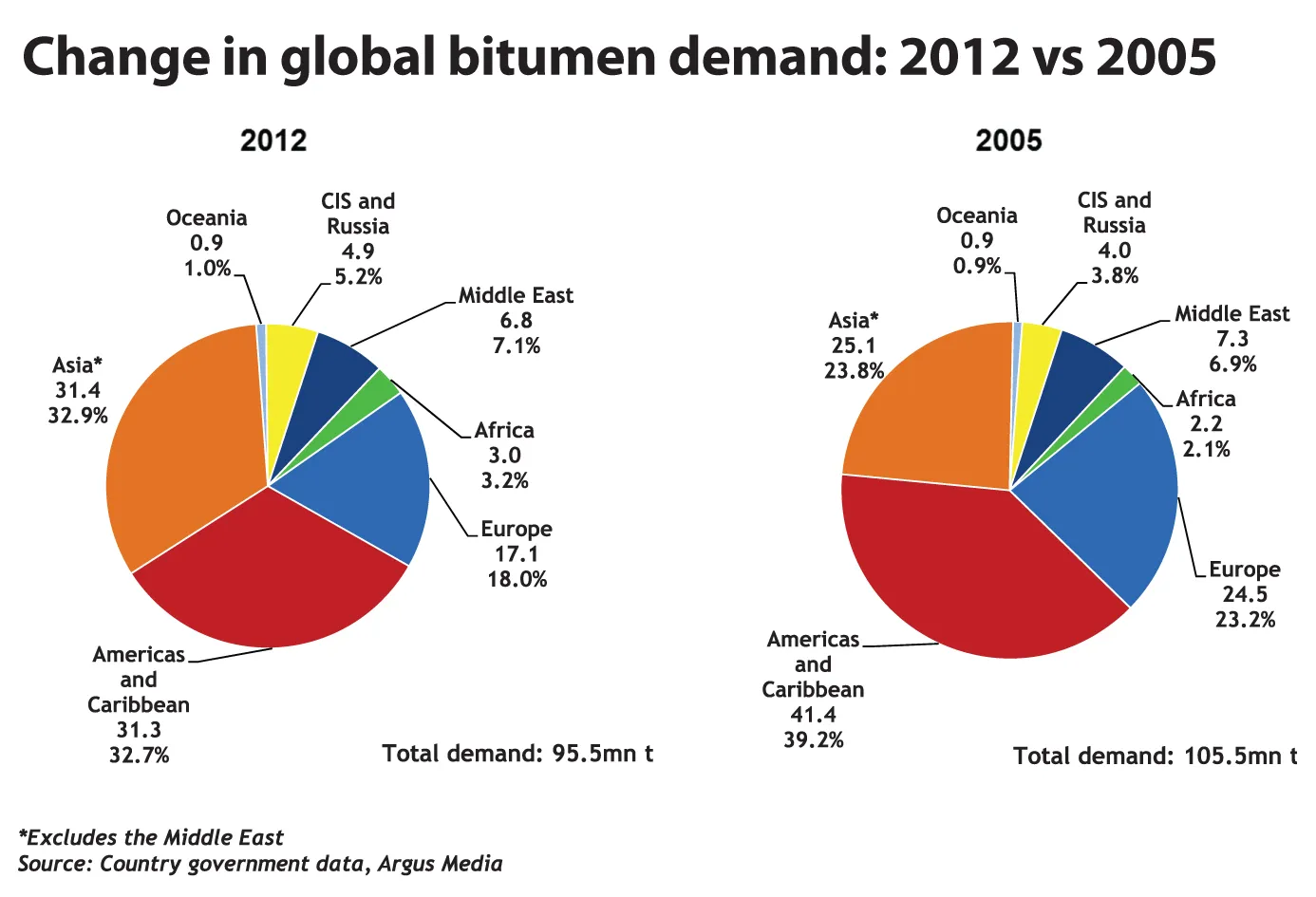

Asphalt demand in North America declined by 5.8% a year between 2007 and 2012. From 2012 to 2017, Freedonia forecasts annual growth of 3.6%. Asia-Pacific continued to grow between 2012 and 2017, with a 5.8% annual growth, a rate which is forecast to slow to 4.7% up to 2017.

Maintenance of North America’s massive regional network of roads and highways will drive demand in that region. And in many parts of Western Europe there is a huge backlog of maintenance work to tackle.

The Asia-Pacific region has overtaken North America as the world’s largest market for asphalt, driven mainly by China and India, according to Freedonia’s report ‘World Asphalt’ which was published as Conexpo got underway. China uses over 20% of the world’s asphalt, and is set to become the world’s biggest asphalt user by 17%, a position currently occupied by the US.

Though China is still building roads now, growth will slow as its national infrastructure programmes come to an end and the country moves to smaller road construction jobs and maintenance of its existing networks. Demand in India and other developing Asian countries will grow, predicted Freedonia, as they push on with large public works projects.

%$Linker:2 Asset <?xml version="1.0" encoding="utf-16"?><dictionary /> 2 43686 0 oLinkExternal www.freedoniagroup.com Visit Freedonia Group Website false /EasySiteWeb/GatewayLink.aspx?alId=43686 false false %>

“Gains will be driven by especially strong growth in consumption in China and other developing countries as they work to improve their transportation infrastructures,” said Freedonia analyst Mariel Behnke.

Asphalt demand in North America declined by 5.8% a year between 2007 and 2012. From 2012 to 2017, Freedonia forecasts annual growth of 3.6%. Asia-Pacific continued to grow between 2012 and 2017, with a 5.8% annual growth, a rate which is forecast to slow to 4.7% up to 2017.

Maintenance of North America’s massive regional network of roads and highways will drive demand in that region. And in many parts of Western Europe there is a huge backlog of maintenance work to tackle.

The Asia-Pacific region has overtaken North America as the world’s largest market for asphalt, driven mainly by China and India, according to Freedonia’s report ‘World Asphalt’ which was published as Conexpo got underway. China uses over 20% of the world’s asphalt, and is set to become the world’s biggest asphalt user by 17%, a position currently occupied by the US.

Though China is still building roads now, growth will slow as its national infrastructure programmes come to an end and the country moves to smaller road construction jobs and maintenance of its existing networks. Demand in India and other developing Asian countries will grow, predicted Freedonia, as they push on with large public works projects.

%$Linker: