“This strong start to the year sees us continue the dynamic pace of growth from the fourth quarter of 2018. Demand for our products and services is high and this has helped us gain market shares in many countries,” explained Martin Lehner, CEO of Wacker Neuson SE. “Throughout the whole of 2018, we had to contend with major bottlenecks in the global supply chain. Although the situation has not been fully resolved, it has improved significantly in 2019,” he added.

The company says that its rise in revenue was fuelled by double-digit growth in all three reporting regions. Revenue for Europe, which accounts for around three quarters of revenue, rose 18.3% to €316.7 million, compared with €267.8 million for the same period in 2018. Revenue grew rapidly in a number of countries, including the UK, where the Group reported particularly strong sales of excavators and dumpers together with an increase in market shares.

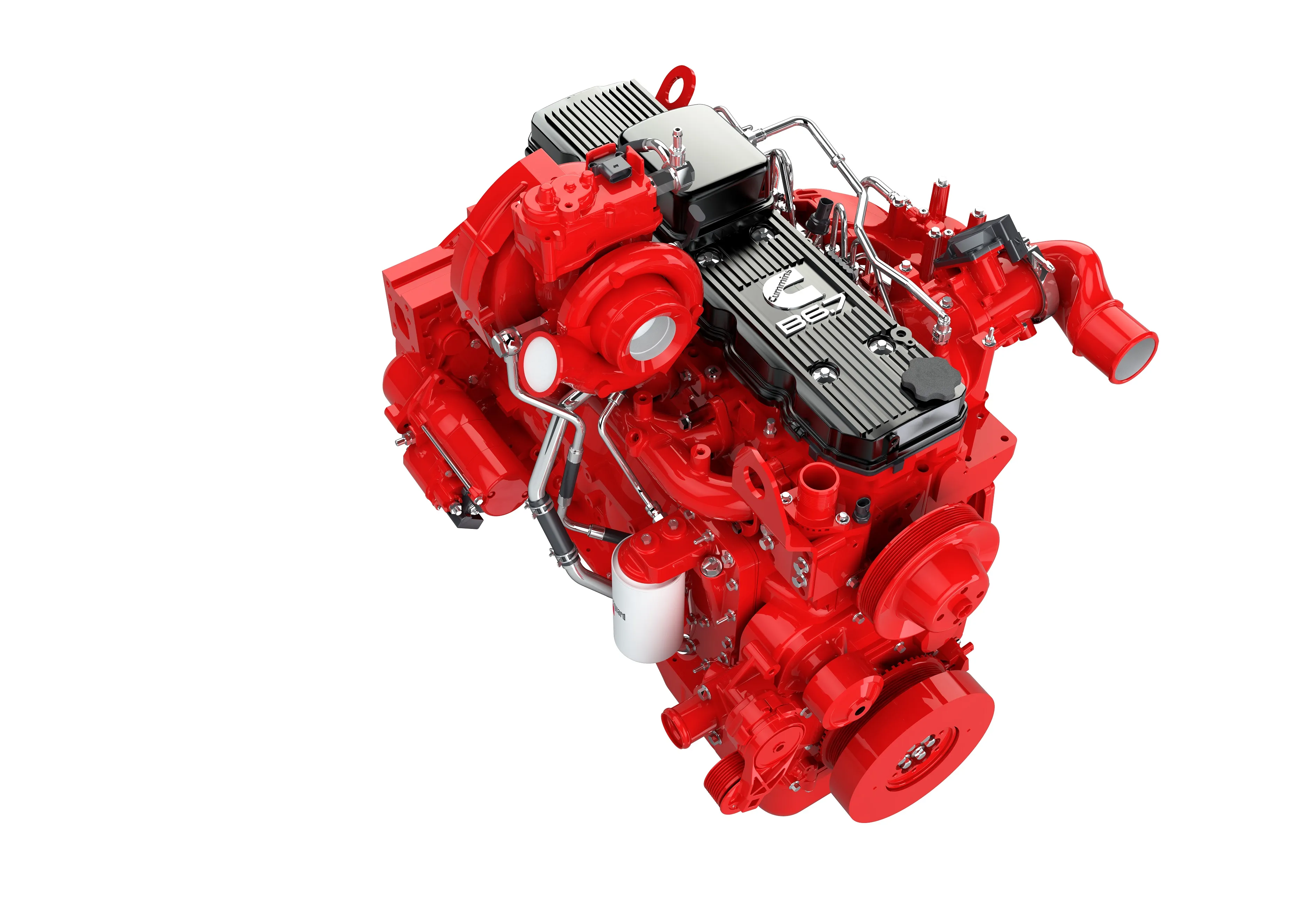

In the Americas, revenue rose 14% to €104.5 million, compared with €91.7 million for the same period in 2018. Adjusted for currency effects, revenue increased by 6.7%. While the Group reported significant gains in the US, demand in Canada was dampened by the tightening of emissions legislation, which came into effect on January 1, 2019. This had resulted in pre-buy effects in the fourth quarter of 2018. The more favorable currency situation had a positive impact on earnings. Restructuring measures at the plant in Wisconsin, USA, are continuing as planned.

Cash flow was impacted by a temporary increase in net working capital and the expansion of the dealer network in North America however. “Due to the positive market and order situation, we built up more inventory in recent months than in previous years. Stocks will return to normal levels over the course of the fiscal year as revenue increases during the summer months and we gradually start to decrease our stock of pre-buy engines. We also expect receivables to decrease during the course of the year, which will have a positive impact on the development of cash flow,” said Lehner.

The firm saw strong interest for its new machine unveiled at the bauma 2019 event, held in Munich at the start of April. “The talks we held at the show once again confirmed that we are on the right track to consolidate and expand the success of the Wacker Neuson Group in the long term,” added Lehner. The Group confirmed its guidance for fiscal 2019, which it issued back in March.

Buoyed by the strong start to the year, its well filled order books and the very positive feedback from customers at Bauma, the Executive Board expects revenue to lie in the upper half of its projected range of €1.775 to €1.85 billion. The EBIT margin is expected to come in at between 9.5% to 10.2%.