A report from the German construction and building equipment manufacturer’s association, the

“This forecast is, however, based on several different backgrounds,” said Sebastian Popp, the VDMA’s expert on economics explains the situation. He explained that with construction equipment, the amount of incoming orders has seen an increase of 9%. Demand in earth moving and road construction machinery is much stronger than for building construction machines.

With regard to building material machinery, the amount of incoming orders is currently about 30 per cent lower than last year’s. Popp knows, “This can be seen mainly as a statistical effect.” In the cement segment, the figures climbed impressively in 2013 due to a number of large orders.

In the first five months of this year, manufacturers in Germany sold nearly 14% more construction equipment than at the same time last year. However, this growth is likely to slow down and should be around 5% by the end of the year according to Popp.

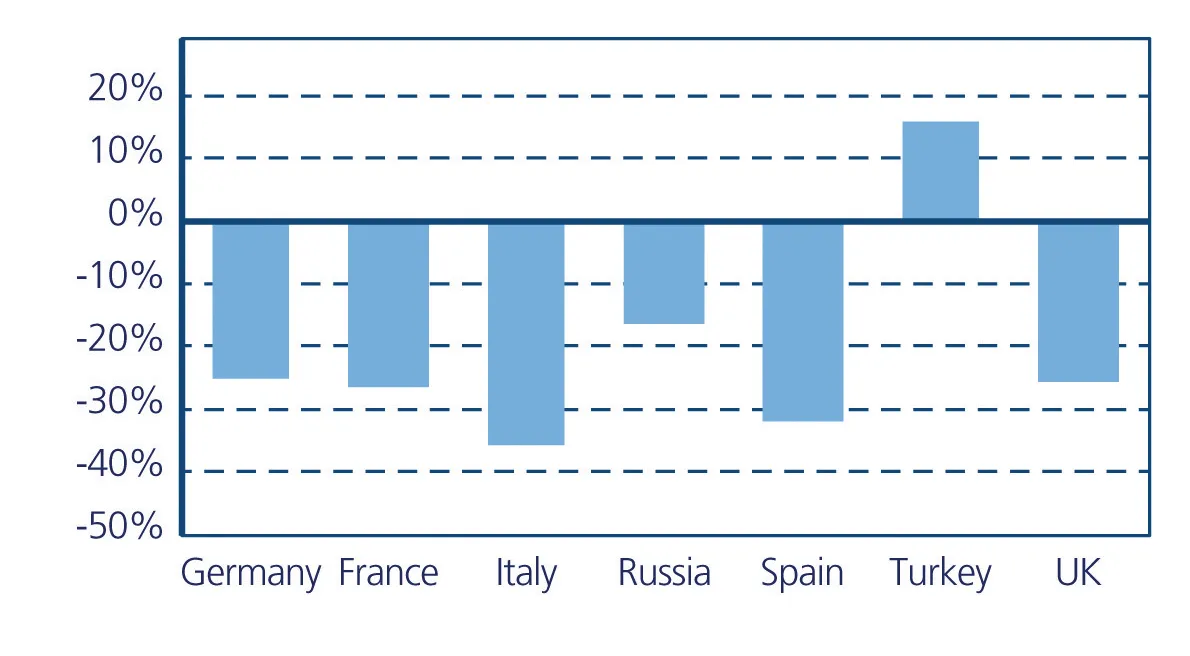

For the first time in a number of years the European market is likely to grow again, which should also help to weaken the extreme discrepancy between the North and the South. Of all high volume markets, the UK is currently seeing the most significant growth.

German manufacturers are noticing a strong decline in Russia, which can only in part be explained by the currently difficult political situation. German manufacturers are also seeing a trend towards a lower cost units that is benefiting South Korean and Chinese manufacturers.

Again this year, China does not qualify as a market of growth. Since 2011, turnover in construction machinery has gone down by more than 40%. “This year, it will probably go down even further,” Popp commented. The main reasons are the enormous excess capacities and young machine fleets in the market, as well as difficulties with financing projects and machinery. The Indian market is remaining weak at the moment. With a new government now having been established, all hopes of the industry focus on 2015 and 2016. South East Asian markets are presenting themselves as mainly stable. In the Middle East, the construction equipment and building material market is still growing immensely. It is Saudi Arabia that is currently particularly convincing. The Northern American market is very likely to recover further this year. But the countries in Latin America are not fulfilling expectations.

VDMA reports increase in German equipment sector

A report from the German construction and building equipment manufacturer’s association, the VDMA, reveals steady sales for 2014. According to the report, German manufacturers of construction equipment are expecting to see a growth of 5% throughout 2014. In 2013, sales for the entire industry reached €11.7 billion.

“This forecast is, however, based on several different backgrounds,” said Sebastian Popp, the VDMA’s expert on economics explains the situation. He explained that with construction equipment, th

July 22, 2014

Read time: 3 mins